Are you wondering if the tools you buy for your business can save you money come tax time? The good news is—yes, you can often write off those tools.

But it’s not as simple as just keeping the receipt. Knowing what qualifies, how much you can deduct, and when you should claim it can make a big difference in your tax savings. If you want to keep more of your hard-earned cash and avoid common mistakes, this guide will walk you through everything you need to know about writing off tools for your business.

Ready to make your tools work harder for you? Let’s dive in.

:max_bytes(150000):strip_icc()/write-off-4186686-c574fff265d64d35a80330a2ae1ccac0.png)

Credit: www.investopedia.com

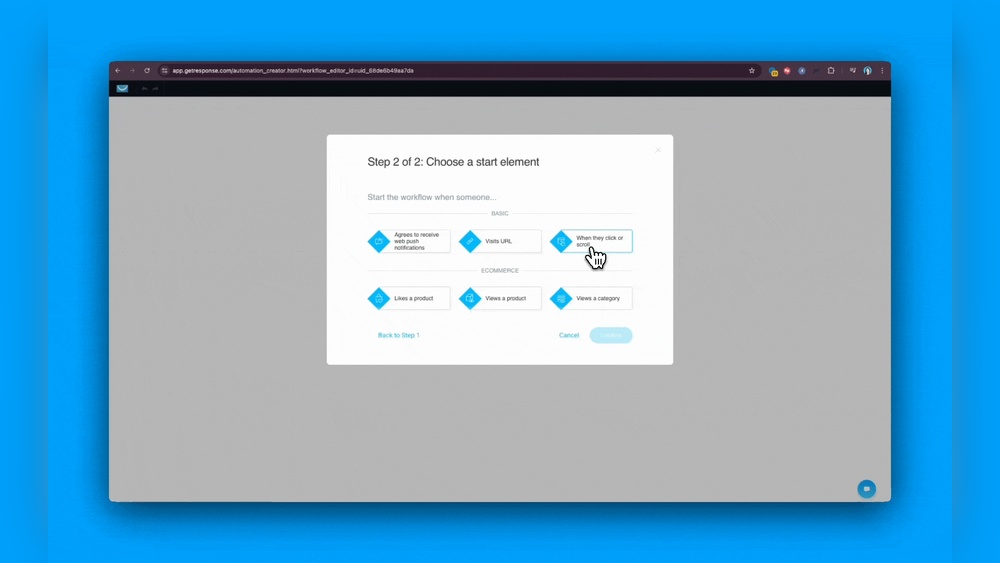

Eligibility For Tool Deductions

Determining eligibility for tool deductions is key for small business owners. The IRS allows deductions for tools if they meet specific rules. Understanding these rules helps you claim the right expenses and save money on taxes.

Business Use Requirements

Tools must be used for your business activities. Personal use tools do not qualify. The IRS looks for tools that are ordinary and necessary for your trade. Ordinary means common in your field. Necessary means helpful and appropriate. Keep records to prove the business use of your tools.

Exclusive Tool Usage

Tools should be used exclusively for business. Mixed-use tools may limit the deduction amount. If you use a tool partly for personal reasons, only the business portion is deductible. Clear separation of usage helps avoid IRS issues. Document how and when you use your tools for business only.

Deducting Small Tools

Deducting small tools for your business can save you money on taxes. Small tools often have a short life and low cost. You can usually deduct their full price in the year you buy them. This helps reduce your taxable income quickly. Understanding the rules for small tool deductions is important for accurate tax filing.

Tools With Short Lifespan

Small tools that last less than one year qualify for full deduction. Examples include hand tools like hammers, screwdrivers, and pliers. These tools wear out fast or break easily. You can claim the entire cost as a business expense right away. This avoids the need to track the tool’s value over several years.

Tools with a short lifespan do not require depreciation. They are simple to deduct and record. Keep your receipts and note the business use. This supports your deduction if the IRS asks for proof.

Immediate Expense Deductions

Tools that cost below a certain amount can be deducted immediately. The IRS allows small purchases to be fully expensed in the purchase year. This rule helps avoid complex depreciation methods for low-cost items.

For example, if a tool costs under $2,500, you may deduct it right away. Check the current IRS limits as they can change. Immediate deductions improve cash flow and reduce paperwork. Always keep clear records of your tool purchases and their business purpose.

Handling Expensive Tools

Handling expensive tools in your business requires understanding the right way to claim deductions. High-cost tools usually cannot be fully deducted in the year of purchase. Instead, they need special tax treatment to match their value and lifespan.

Knowing how to handle these tools saves money and keeps your accounting clear. The IRS expects you to spread out the cost over time, reflecting how long the tool will last in your business.

Capitalizing High-cost Tools

Capitalizing means recording the tool as an asset on your balance sheet. This happens when the tool’s cost is above a set limit, usually a few hundred dollars. You do not write off the full cost immediately. Instead, you add it to your business assets.

This approach shows the tool’s value over several years. It matches expenses to the time the tool is used. Capitalizing helps you keep accurate financial records and follow tax rules.

Using Depreciation Methods

Depreciation lets you deduct parts of the tool’s cost each year. It spreads the expense over the tool’s useful life. This life is often set by the IRS, commonly seven years for tools.

There are different methods to calculate depreciation. The most common are straight-line and accelerated depreciation. Straight-line spreads the cost evenly. Accelerated allows bigger deductions earlier.

Choosing the right method depends on your business needs. Depreciation reduces taxable income gradually. It reflects the tool’s loss in value as you use it.

Credit: www.taxslayer.com

Depreciation Explained

Depreciation is a key concept for business owners buying tools. It helps spread the cost of tools over several years. This method matches the expense with the time the tools are useful in your business. Depreciation reduces your taxable income each year, lowering your tax bill.

Not all tools qualify for immediate full deduction. Some must be depreciated over time. Understanding how depreciation works ensures you claim the correct write-off. It also keeps your accounting accurate and compliant with tax rules.

Useful Life Of Tools

Useful life means how long a tool lasts in your business. Most tools have a lifespan longer than one year. This period guides how you deduct the tool’s cost. For example, a drill may last five years before needing replacement. You divide the cost across those years to claim depreciation.

Tools that break or wear out quickly may have a shorter useful life. You can expense these tools fully in the year of purchase. The IRS sets guidelines on useful life for different types of tools. Knowing your tool’s useful life helps you handle depreciation properly.

Seven-year Recovery Period

The IRS often assigns a seven-year recovery period for many business tools. This means you spread the tool’s cost over seven years. Each year, you claim a portion of the total cost as an expense. This reduces your taxable income gradually, not all at once.

Seven years is a common timeframe for tools that last longer. It balances tax savings with the tool’s actual use. Some tools may have shorter or longer periods based on their nature. Following this recovery period ensures your deductions comply with tax laws.

Record Keeping Tips

Keeping clear records is vital for writing off tools on your taxes. Good record keeping proves the tools are for business use. It helps you track expenses and prepare accurate tax returns. Organized records can prevent problems with tax audits. Follow simple tips to keep your records in order and avoid confusion.

Maintaining Receipts

Save every receipt for tools you buy. Receipts show the purchase date, price, and seller. Store receipts in a safe place, like a folder or digital app. Scan paper receipts to keep a backup copy. Label each receipt with the tool’s purpose. This helps prove the expense is business-related.

Keep receipts for at least three years. This is the usual time the IRS may check your records. Without receipts, you may lose the chance to deduct the tool cost.

Inventory Management

Track all tools used in your business. Create a list with each tool’s name, purchase date, and cost. Update the list when you buy or sell tools. This helps you see what tools belong to your business.

Use simple software or a spreadsheet to manage your inventory. Note if tools are new or used. Record any repairs or maintenance on your tools. This shows you care for your business property and keeps values clear.

Maximizing Tax Savings

Maximizing tax savings means finding the best ways to reduce your taxable income. Writing off tools for your business can lower the amount you owe. It requires careful planning and understanding of tax rules. Knowing which deduction methods apply helps you keep more money in your pocket. Proper strategies ensure you claim all eligible expenses without mistakes.

Choosing Deduction Strategies

Select the deduction method that fits your tools and business type. Small tools with short lifespans can often be deducted fully in the purchase year. For expensive tools, consider depreciation to spread the cost over several years. Use the Section 179 deduction if available, which lets you expense some or all of the tool’s cost immediately. Track the purchase date and usage carefully for each tool. This keeps your records clear and supports your claims during audits.

Consulting Tax Professionals

Tax professionals can guide you through complex rules and limits. They help identify which tools qualify for deductions under current tax laws. A CPA or tax advisor ensures you use the best strategies for your situation. They also keep you updated on any changes in tax codes. Regular consultations reduce errors and increase your chances of maximizing savings. Their expertise is valuable for avoiding penalties and audits.

Common Mistakes To Avoid

Writing off tools for your business can save money, but mistakes cost you more. Avoiding common errors helps keep your deductions safe. Understanding these mistakes improves your tax filing and prevents audits.

Mixing Personal And Business Use

Using tools for both personal and business purposes complicates write-offs. Only the business portion qualifies for deduction. You must separate how much you use the tool for work. Estimating the business use percentage protects your claim. Personal use expenses are not deductible and can trigger tax issues.

Neglecting Documentation

Failing to keep receipts and records is a big risk. The IRS requires proof of purchase and business use. Save invoices, payment records, and notes about the tool’s purpose. Without documentation, deductions may be denied. Organized records make tax time easier and safer. Always track when and how tools are used in your business.

Credit: www.startupdaily.net

Frequently Asked Questions

How Do You Write Off Tools For Business?

Deduct business tools if used exclusively and necessary. Expense low-cost or short-life tools fully in purchase year. Depreciate expensive tools over their useful life. Keep detailed records and receipts to support deductions. Consult a tax professional for the best strategy.

Are Tools 100% Tax Deductible?

Tools are tax deductible if used exclusively for business and necessary for your trade. Small tools can be fully deducted in the purchase year. Expensive tools must be depreciated over their useful life. Keep detailed records to support deductions and consult a tax professional for guidance.

What Items Are 100% Tax Deductible?

Tools and items used exclusively for business, costing under the IRS threshold or with a short lifespan, are 100% tax deductible. Keep receipts and records to support deductions. Expensive tools may require depreciation over their useful life. Always consult a tax professional for precise guidance.

How Much Tools Can I Write Off?

You can write off tools used exclusively for your business. Small tools costing less than the threshold can be fully deducted immediately. Expensive tools are depreciated over their useful life, usually seven years. Keep detailed records and receipts to support your deductions.

Consult a tax professional for guidance.

Conclusion

Writing off tools for your business can save you money on taxes. Keep receipts and records to prove business use. Deduct small tools fully in the year you buy them. For expensive tools, spread the cost over several years. Always check IRS rules to avoid mistakes.

A tax professional can guide you through the process. Careful planning helps you get the right deductions. Use tools only for work to qualify for write-offs. Staying organized makes tax time easier and stress-free.