Are you struggling to choose between SAP and QuickBooks for your business needs? You’re not alone.

Many business owners find themselves caught in the dilemma of selecting the right accounting software that aligns with their unique requirements. You want a solution that not only simplifies your financial tasks but also scales with your growth. We’ll explore the key differences between SAP and QuickBooks, helping you to make an informed decision.

Imagine the peace of mind knowing you’ve chosen the perfect software that boosts your productivity and streamlines your operations. Dive in and discover which option is best suited to propel your business forward.

Comparison Overview

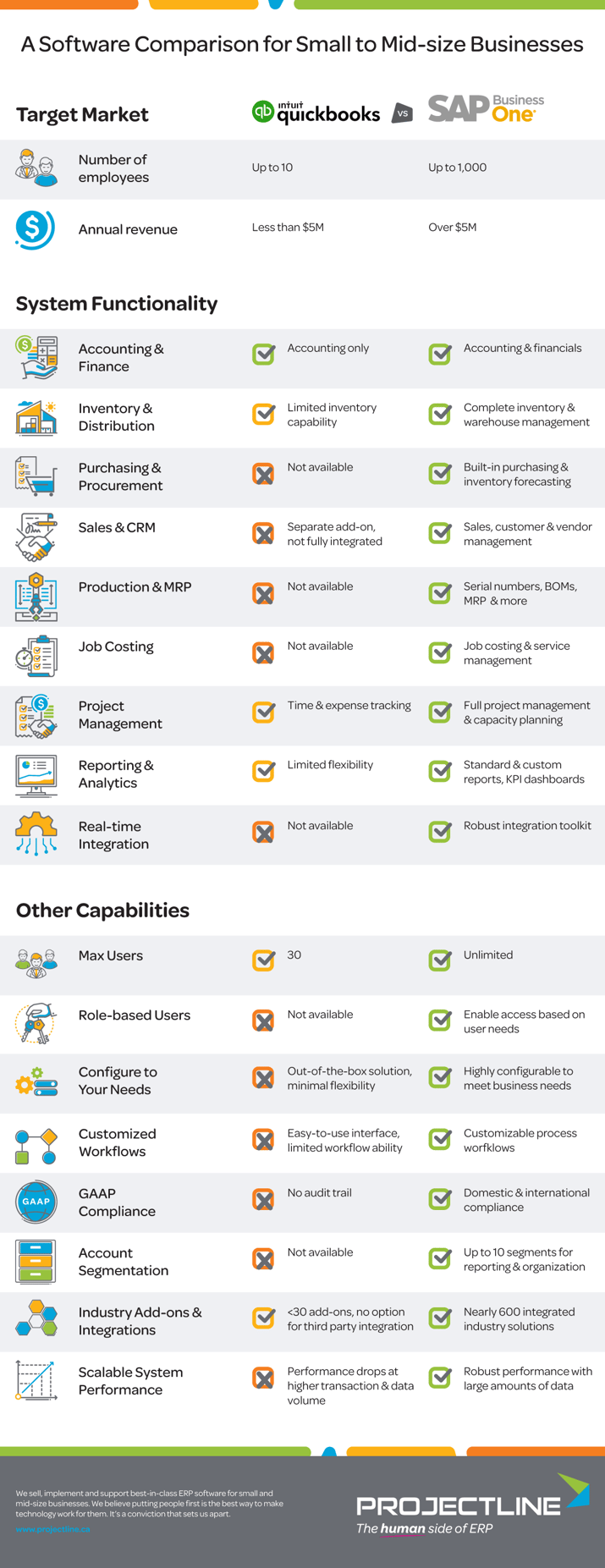

Choosing the right accounting software can feel like a daunting task. Whether you’re a small business owner or managing a large enterprise, you need a solution that fits your unique needs. Let’s take a closer look at how SAP and QuickBooks stack up against each other.

User Interface

SAP offers a robust and comprehensive interface packed with features. However, it can be overwhelming for new users. QuickBooks, on the other hand, is known for its user-friendly design, making it ideal for beginners.

Imagine logging into your software and feeling at ease because everything is where you expect it to be. That’s the ease QuickBooks aims to provide. With SAP, the learning curve is steeper, but the payoff is powerful capabilities for those who master it.

Features And Functionalities

SAP is renowned for its extensive features suitable for large enterprises. It offers everything from financial management to supply chain oversight. QuickBooks is more streamlined, focusing on core financial tasks like invoicing and payroll.

Think about what your business needs most. Do you require extensive features or just the basics? SAP can handle complex tasks, while QuickBooks keeps it simple yet effective.

Scalability

As your business grows, your software should, too. SAP is designed to scale with your business, making it a favorite among large companies. QuickBooks caters to small to medium businesses, offering scalability but within limits.

Have you considered where your business will be in five years? If expansion is in your plans, SAP might offer the growth potential you need. For steady businesses, QuickBooks provides a snug fit.

Cost

Budget is a key factor in any decision. SAP’s pricing reflects its enterprise-level capabilities, often requiring a significant investment. QuickBooks offers a more affordable entry point, especially for small businesses.

Weighing the cost against the features is crucial. Are you prepared to invest in a comprehensive solution, or does a budget-friendly option suffice? Your decision could impact your bottom line.

Support And Training

Software is only as good as the support behind it. SAP offers extensive training and support options, crucial for its complexity. QuickBooks provides accessible support, catering to users who prefer a straightforward approach.

Have you ever felt stuck and needed immediate help? The right support can make or break your software experience. Consider which platform offers the assistance you might need.

When choosing between SAP and QuickBooks, think about your current needs and future goals. Which software aligns with your vision? Your choice today will shape your business tomorrow.

Key Features

Choosing the right accounting software for your business is crucial. Two popular options are SAP and QuickBooks. Each offers unique features tailored to different business needs. Understanding these features helps make an informed decision. Let’s dive into the key features of both SAP and QuickBooks.

Sap Features

SAP provides powerful tools for large enterprises. It integrates with various business functions seamlessly. This includes finance, sales, HR, and supply chain management. SAP’s real-time analytics enhance decision-making processes. It supports multi-currency and multi-language operations. This is ideal for global businesses. Customization options allow businesses to tailor the software. This ensures it meets specific requirements.

SAP also excels in data security. It offers robust protection for sensitive business information. Automated processes reduce manual errors and increase efficiency. SAP’s scalability supports growing businesses. It adapts to changing business sizes and needs. Its comprehensive support system aids in smooth operations. 24/7 customer service ensures immediate assistance.

Quickbooks Features

QuickBooks is user-friendly and perfect for small to medium businesses. It simplifies bookkeeping tasks with its intuitive interface. QuickBooks offers invoicing, expense tracking, and payroll management. These features streamline daily financial operations. It provides real-time financial reporting. This helps businesses stay updated on their finances.

Cloud-based access allows users to work from anywhere. This flexibility is crucial for remote work scenarios. QuickBooks also offers integration with third-party apps. This enhances its functionality significantly. It is cost-effective, making it suitable for budget-conscious businesses. QuickBooks supports multiple users, promoting collaborative work environments. Its comprehensive tutorials and community support ease the learning curve.

Pricing Structure

Choosing the right accounting software often boils down to understanding the pricing structure. It’s not just about the upfront cost but what you get for your money. Whether you’re a small business owner or managing a large enterprise, knowing how SAP and QuickBooks price their offerings can significantly impact your decision. Let’s dive into what each has to offer.

Sap Pricing

SAP’s pricing can seem complex at first glance. It typically caters to large businesses with specific needs. The cost often includes licensing fees, maintenance, and support services. This can be a significant investment, but for many, the robust features and scalability justify the expense.

One unique aspect of SAP pricing is its modular structure. You pay for what you need, which can be beneficial if you’re only interested in certain functionalities. However, this requires a clear understanding of your business requirements to avoid overspending on unnecessary modules.

Have you ever wondered if a higher price means better value? With SAP, the answer often lies in its customization capabilities. While it may not be the cheapest option, it offers tailored solutions that can align perfectly with your business goals.

Quickbooks Pricing

QuickBooks, on the other hand, is known for its straightforward pricing. It’s designed with small to medium-sized businesses in mind. You pay a monthly subscription fee, which can be quite affordable, making it accessible for startups or businesses looking to manage costs.

QuickBooks offers various pricing tiers, each with different features. This allows you to choose a plan that fits your budget and needs. For example, the basic plan is great for freelancers, while the advanced plan offers more comprehensive tools for larger operations.

Have you ever tried predicting your monthly expenses? QuickBooks’ transparent pricing can help. With clearly defined costs, you can easily incorporate this into your budget without hidden surprises.

Ultimately, the choice between SAP and QuickBooks depends on your business size, needs, and budget. What features are essential for your operations? Understanding this can lead you to the best investment for your accounting software.

Credit: www.cogniscient.in

User Experience

Choosing between SAP and QuickBooks depends on your business size. SAP offers robust solutions for larger enterprises. QuickBooks provides simpler tools for small businesses. User experience varies with complexity and features.

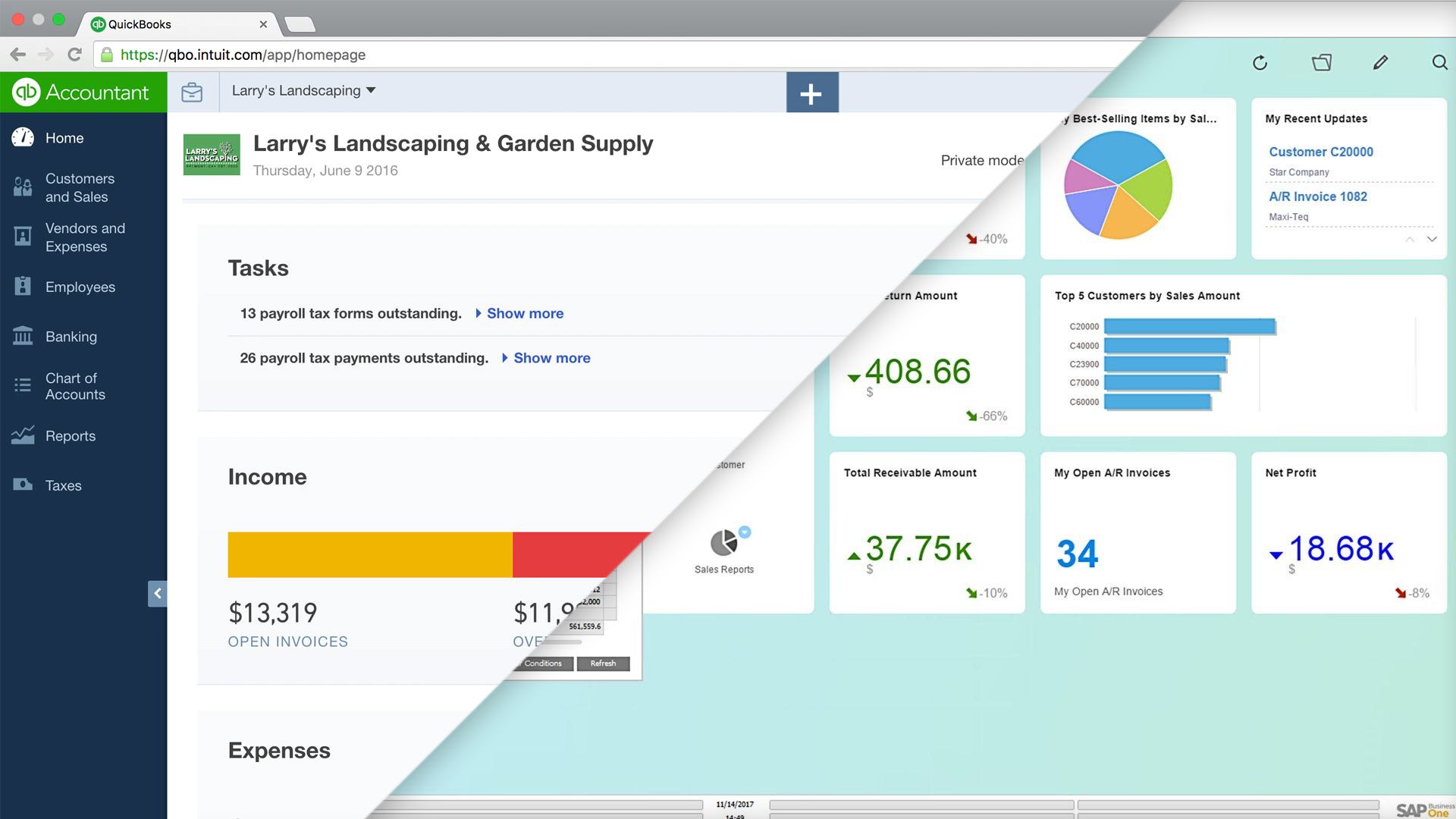

When choosing between SAP and QuickBooks, the user experience can be a significant deciding factor. Both platforms offer robust features, but how they present these features to you, the user, can make a world of difference. Let’s explore the user experience of each software, focusing on how they design their interfaces and how easy they are to use.Interface Design

SAP’s interface is designed with large enterprises in mind. It offers a comprehensive and detailed layout. This can be both a blessing and a curse, depending on your needs. If you require in-depth data analysis, SAP’s interface might be perfect for you. However, its complexity can be overwhelming if you’re used to simpler layouts. QuickBooks, on the other hand, is known for its clean and straightforward interface. It prioritizes ease of navigation. Many users appreciate its organized dashboard, which makes it easy to find what you need at a glance. If you value simplicity and clarity, QuickBooks might have the edge here.Ease Of Use

SAP can present a steep learning curve, especially for beginners. Its myriad of options and functions requires time and training to master. This can be a challenge if you need to get up and running quickly. However, once you get the hang of it, the depth of functionality can be quite rewarding. QuickBooks is often praised for its user-friendly approach. Its setup process is quick and intuitive. Even if you’re not tech-savvy, QuickBooks offers a helping hand with its guided tutorials and support. This can save you time and frustration. Consider your own experience with software. Do you prefer detailed control or straightforward simplicity? If you’ve ever felt lost navigating a complex system, QuickBooks might ease your journey. On the other hand, if you thrive on detail and depth, SAP’s challenging interface might just be your playground.Integration Capabilities

Integration capabilities can transform how businesses manage their operations. Both SAP and QuickBooks offer unique integration features. These features help streamline processes and improve data accuracy. Understanding these capabilities can guide businesses in making informed decisions.

Sap Integrations

SAP is known for its robust integration capabilities. It connects seamlessly with various enterprise systems. This includes CRM, SCM, and HR solutions. Businesses can integrate SAP with third-party applications. This ensures a smooth workflow across departments. SAP’s integration tools support real-time data exchange. This leads to enhanced operational efficiency. Its flexibility allows customization to meet specific needs. SAP also supports integration with cloud-based services. This provides scalability and adaptability for businesses.

Quickbooks Integrations

QuickBooks offers integrations that cater to small and medium businesses. It connects with popular e-commerce platforms. This helps in managing sales and inventory efficiently. QuickBooks integrates with payment gateways for seamless transactions. It also supports connection with CRM tools. This improves customer relationship management. QuickBooks allows integration with various third-party apps. Users can automate tasks and reduce manual errors. Its simple interface makes integrations easy to manage. QuickBooks Online provides cloud-based integration options. This ensures accessibility and collaboration from anywhere.

Scalability

SAP offers robust scalability for growing businesses, adapting to complex needs. QuickBooks suits small businesses better, providing simpler scalability options.

Scalability is a crucial factor when choosing financial software for your business. As your company grows, so do your financial management needs. You need a system that can handle increased complexity without bogging down your operations. Let’s explore how SAP and QuickBooks stack up when it comes to scaling alongside your business.Growing Business Needs

Every business aims to grow, but not all software can grow with you. QuickBooks is great for small businesses and startups due to its simplicity and ease of use. However, as your business expands, its limitations become apparent. Can QuickBooks handle the increased volume of transactions and more complex reporting needs? Many businesses find they need to upgrade to more robust solutions as they scale, which can be both time-consuming and costly. In contrast, SAP is designed with scalability in mind. It’s capable of managing large volumes of data and supports complex, customizable reporting. This makes it suitable for companies planning to expand rapidly or those already operating at a large scale.Enterprise Solutions

When your business reaches the enterprise level, the demands on your financial software increase exponentially. QuickBooks offers enterprise solutions, but they might not meet the needs of a large, multi-faceted organization. SAP offers a comprehensive suite of enterprise solutions that cater to various industries and business sizes. It provides advanced features like real-time data processing and in-depth analytics, crucial for making informed decisions at the enterprise level. If you’re managing multiple locations or dealing with international operations, SAP’s global capabilities are a game-changer. It supports multiple currencies and languages, unlike QuickBooks, which has more limited international capabilities. Consider your business’s growth trajectory. Is your current software equipped to grow with you? Choosing the right financial software now can save you from headaches and expenses down the line.Industry Applications

Choosing the right software is crucial for business operations. Industry applications of SAP and QuickBooks cater to different business needs. While SAP targets large enterprises, QuickBooks is tailored for small businesses. Understanding their specific applications can help make an informed decision.

Sap For Large Enterprises

SAP offers extensive solutions for large enterprises. It supports complex business processes with ease. Companies benefit from its integrated modules. These modules cover finance, supply chain, and human resources. SAP enables seamless data flow across departments. This integration helps in making data-driven decisions. Global companies prefer SAP for its scalability. It handles large volumes of transactions efficiently. SAP’s robust analytics tools provide valuable insights.

Quickbooks For Small Businesses

QuickBooks is designed for small business operations. It offers user-friendly accounting solutions. Small businesses find it cost-effective and easy to use. QuickBooks helps manage invoices, expenses, and payroll. Its intuitive interface requires minimal training. Business owners can track their finances effortlessly. QuickBooks offers cloud-based services for remote access. This feature ensures businesses stay connected anywhere. Its customizable reports provide clear financial overviews.

Credit: www.projectline.ca

Customer Support

When choosing between SAP and QuickBooks, one crucial aspect to consider is customer support. Your business depends on software that not only delivers but also offers reliable assistance when needed. Knowing how each platform supports its users can help you make an informed decision. Let’s dive into the details.

Support Channels

SAP offers a variety of support channels to cater to different needs. You can access their online portal for resources, including guides and FAQs. Additionally, they provide phone support for more personalized assistance.

QuickBooks, on the other hand, has a more streamlined approach. Their support includes chat and phone options, making it easy to connect with a real person quickly. They also have an extensive community forum where users share solutions.

Response Times

In terms of response times, SAP might feel a bit slower due to its vast user base. However, they prioritize issues based on urgency, so critical problems are addressed promptly.

QuickBooks generally boasts quicker response times, especially through live chat. Their team is known for resolving issues swiftly, which can be a lifesaver during peak business hours.

Have you ever been stuck waiting for support during a busy day? Quick resolution can make all the difference in maintaining productivity.

Ultimately, the choice between SAP and QuickBooks might boil down to how much support you anticipate needing. Consider your team’s familiarity with the software and the complexity of your business processes.

Which support style matches your business needs best? Do you prefer a comprehensive portal or the immediacy of live chat?

Security Measures

SAP provides advanced security features suitable for large enterprises, ensuring data integrity and protection. QuickBooks focuses on basic security measures, ideal for small businesses seeking simple yet effective solutions. Both systems prioritize safeguarding sensitive information from unauthorized access.

When choosing between SAP and QuickBooks for your business, understanding security measures is crucial. Data breaches can cost businesses millions, not to mention the loss of trust with customers. It’s essential to know how these platforms protect your sensitive information.Data Protection

SAP prioritizes data protection with robust encryption protocols. Your information is safeguarded both during transmission and while stored in their systems. This ensures that unauthorized individuals cannot access your data. QuickBooks also takes data protection seriously. They offer advanced security features, including automatic data backups and secure access controls. This means your financial data is continuously protected against potential threats. Are you confident that your current system offers these levels of protection? Knowing your data is secure allows you to focus on growing your business without constant worry.Compliance Standards

SAP adheres to strict compliance standards, including GDPR, ensuring that your data handling meets international regulations. This compliance is crucial if you operate in multiple countries and need to adhere to various legal requirements. QuickBooks ensures compliance with standard financial regulations, such as PCI DSS. This is particularly important for businesses handling payment information, as it reduces the risk of penalties due to non-compliance. Have you checked if your current platform meets necessary compliance standards? Understanding these standards can prevent legal issues and promote customer confidence. Choosing the right software involves more than just features and price. Security measures should be a top priority. Assessing how SAP and QuickBooks handle data protection and compliance can guide you in making an informed decision.Market Presence

SAP holds a strong market presence for large businesses needing complex solutions. QuickBooks is preferred by small to medium enterprises for its simplicity. Both cater to different needs, ensuring their relevance in various business environments.

Understanding the market presence of software tools is crucial for any business decision. When comparing SAP and QuickBooks, it’s essential to explore their influence and reach in the global market. These aspects can help you decide which platform aligns with your business goals. It’s not just about numbers; it’s about where these tools fit into your business landscape.Global Reach

SAP has established itself as a giant in the enterprise software market. Its presence spans across more than 180 countries, making it a truly global player. With offices in major cities worldwide, SAP offers localized solutions that cater to specific market needs. QuickBooks, on the other hand, primarily targets small to medium-sized businesses. Its reach is more concentrated in North America, but it’s expanding into other regions. QuickBooks Online is gaining traction globally, offering cloud-based solutions that appeal to businesses looking for flexibility. The question to ponder is: Does global presence matter to your business? If you operate internationally, SAP’s extensive reach might be advantageous. For localized operations, QuickBooks might offer just what you need without the complexities of a global software.User Base

SAP’s user base consists of large enterprises and corporations. With millions of users worldwide, it caters to industries ranging from manufacturing to retail. Its comprehensive suite of tools is designed for complex business processes. QuickBooks has a different story. Its user base primarily includes small business owners and freelancers. With millions of users, it’s known for its simplicity and ease of use. QuickBooks provides essential accounting features without overwhelming its users with complexity. Think about your business size and needs. Are you looking for intricate solutions for a large team? Or do you need straightforward accounting software for a small business? Both SAP and QuickBooks have their strengths, but their user bases reflect their targeted markets. When deciding between SAP and QuickBooks, consider how their market presence aligns with your business strategy. The right choice is not only about features but also about fitting into your business environment seamlessly.

Credit: www.consultare.net

Frequently Asked Questions

What Is The Difference Between Quickbooks And Sap?

QuickBooks is ideal for small businesses, offering easy accounting solutions. SAP suits large enterprises, providing comprehensive ERP tools. QuickBooks focuses on finance management, while SAP handles complex business processes. QuickBooks is user-friendly; SAP offers advanced customization. Both serve different business sizes and needs efficiently.

Who Is The Biggest Competitor Of Quickbooks?

Xero is the biggest competitor of QuickBooks. It offers cloud-based accounting software for small and medium-sized businesses. Xero provides features like invoicing, bank reconciliation, and expense tracking. Its user-friendly interface and scalability attract many businesses. Xero’s competitive pricing and integration capabilities make it a strong alternative to QuickBooks.

Is Sap A Good Accounting System?

SAP is a robust accounting system offering comprehensive financial management solutions. It supports efficient data processing and reporting. Businesses benefit from its scalability and integration features. Its user-friendly interface ensures easy navigation. SAP is widely trusted for enhancing financial accuracy and transparency.

Conclusion

Choosing between SAP and QuickBooks depends on your business needs. SAP suits larger enterprises with complex requirements. QuickBooks is ideal for small to medium businesses. Consider your budget, scalability, and features. Both offer unique benefits tailored to different business scales.

Evaluate your specific needs carefully. Remember, the right software can enhance productivity. Efficient financial management is crucial for success. Choose wisely to support your growth. Both options provide valuable solutions. Make an informed decision to streamline operations. Your business deserves the best fit.