Are you tangled in the web of financial management and bookkeeping? If you’re using QuickBooks, you’re likely familiar with the pivotal roles of customers and vendors in your accounting system.

But do you truly understand the distinction between these two crucial entities? Knowing how each functions can significantly enhance your efficiency and accuracy in managing your finances. Dive into this article to unlock the secrets behind Customer Vs Vendor in QuickBooks, and discover how mastering these concepts can transform the way you handle your business transactions.

Whether you’re a seasoned user or just starting out, grasping these insights can empower you to make informed decisions and streamline your accounting processes. Ready to take control of your financial management? Keep reading to uncover the nuances that can elevate your QuickBooks experience.

👉👉 Recommended: QuickBooks – The #1 Accounting Software for Small Business Owners

Roles In Quickbooks

Understanding the roles in QuickBooks is crucial for efficiently managing your business finances. QuickBooks offers distinct roles for customers and vendors, each with specific functions and benefits. Knowing these roles helps you keep track of transactions and maintain healthy business relationships.

Customer Role

The customer role in QuickBooks is designed to manage individuals or companies who purchase your products or services. You can create detailed profiles for each customer, including contact information, payment terms, and transaction history. This helps you track sales and outstanding invoices with ease.

QuickBooks lets you generate invoices, send payment reminders, and offer discounts. Imagine how much time you save by automating these tasks rather than doing them manually. If you’ve ever forgotten to send an invoice on time, you’ll appreciate how QuickBooks ensures you never miss another payment.

Have you ever wondered how to maintain a strong cash flow? Keeping your customer profiles updated and monitoring their transaction activities can provide valuable insights. It can help you identify your top customers and nurture those relationships.

Vendor Role

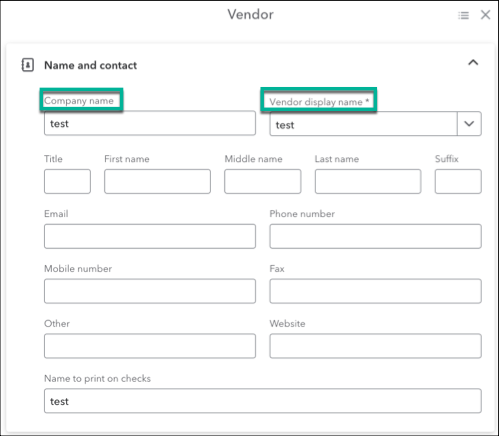

The vendor role is all about managing the entities from whom you purchase goods or services. QuickBooks allows you to create profiles for each vendor, complete with essential details like payment terms, contact information, and purchase history. This organization simplifies managing your accounts payable.

QuickBooks makes it easy to track and pay your bills on time. You can set up reminders and automate payments, reducing the risk of late fees and improving your vendor relationships. Think about the stress relief of never missing a payment deadline again.

Efficient vendor management can also help you negotiate better terms and discounts. When you know which vendors are crucial to your operations, you can focus on building strong partnerships. Is your current vendor management strategy giving you the best value?

Both the customer and vendor roles in QuickBooks are vital for maintaining an organized and efficient financial process. By fully utilizing these roles, you can enhance your business operations and support growth. Which role do you think needs more attention in your current setup?

Financial Transactions

QuickBooks simplifies managing financial transactions for both customers and vendors. Customers can easily track expenses and manage invoices. Vendors benefit from streamlined billing and payment processes. This tool enhances efficiency and accuracy in financial management.

Understanding financial transactions in QuickBooks is essential for both customers and vendors. QuickBooks simplifies the process of managing these transactions, ensuring accuracy and efficiency. Whether you’re invoicing clients or tracking your expenses, mastering these features can save time and reduce errors.

###

Invoicing And Sales

Invoicing is a crucial part of managing customer relationships. QuickBooks allows you to create professional invoices in just a few clicks. You can customize these invoices with your brand logo and payment terms.

Imagine sending an invoice to a client and getting paid within days. QuickBooks lets you track these invoices and see who has paid and who hasn’t. This visibility ensures you stay on top of your cash flow.

As a vendor, you can also record sales transactions efficiently. QuickBooks offers reports that help you understand your sales trends. This data can guide your business decisions, ensuring you’re focusing on the right products or services.

###

Purchasing And Expenses

Managing expenses can be a daunting task, but QuickBooks makes it simpler. You can record all your purchases directly in the system. This ensures you have a clear picture of your spending habits.

Do you often forget to track small expenses? QuickBooks allows you to capture receipts using your smartphone. This feature is a lifesaver for those small, yet important, deductions.

QuickBooks also helps you manage vendor relationships. You can enter bills from vendors and track when payments are due. This ensures you maintain good relationships by paying on time, avoiding late fees or strained partnerships.

Financial transactions are at the heart of your business operations. How effectively you manage them can make all the difference. Are you using QuickBooks to its full potential?

Data Management

Effective data management is crucial for businesses that want to maintain a smooth workflow and make informed decisions. Whether you’re dealing with customers or vendors, QuickBooks offers robust solutions for organizing and accessing your data. By understanding how to efficiently track customer data and record vendor information, you can streamline your operations and enhance your business relationships.

Customer Data Tracking

Imagine knowing every detail about your customers at a glance. QuickBooks makes this possible by allowing you to track customer data efficiently. You can store contact information, transaction history, and even specific preferences.

How does this benefit you? It enables personalized service, leading to increased customer satisfaction. You can quickly pull up past interactions to tailor your offerings, making customers feel valued and understood.

Furthermore, accurate customer data tracking aids in strategic planning. You can analyze purchasing patterns to refine your marketing strategies. This actionable insight can significantly boost your sales and customer loyalty.

Vendor Information Recording

On the vendor side, QuickBooks provides a streamlined method for recording vendor information. You can keep track of contact details, payment terms, and past transactions. This organized approach prevents errors and ensures timely payments.

Having detailed records at your fingertips can simplify negotiations and improve vendor relationships. You can easily access previous agreements to make informed decisions about future contracts.

Consider how efficient vendor management can impact your bottom line. Timely payments can lead to favorable terms, potentially reducing costs. Are you fully leveraging your vendor data to maximize business efficiency?

By mastering customer data tracking and vendor information recording, you position your business for success. QuickBooks not only simplifies these processes but also provides a competitive edge in data management. Are you ready to take your data management to the next level?

Credit: quickbooks.intuit.com

Reporting Features

Explore QuickBooks’ reporting features that compare customer and vendor data effectively. Gain insights into transactions, expenses, and revenues with tailored reports. Enhance your decision-making process by analyzing detailed financial interactions between customers and vendors.

Understanding the reporting features in QuickBooks can significantly enhance how you manage your business’s financial data. Whether you’re tracking customer purchases or managing vendor payments, QuickBooks offers robust reporting tools to help you make informed decisions. These reports are designed to provide clarity and insights tailored to either customer or vendor interactions.

###

Customer Reports

Customer reports in QuickBooks help you keep a close eye on sales trends and customer behaviors. These reports allow you to assess which products are popular, which customers are the most valuable, and identify opportunities to improve your sales strategy.

Imagine knowing exactly when a customer might need a reorder based on their past purchase patterns. QuickBooks enables you to generate detailed sales reports, open invoice reports, and even customer balance summaries. You can customize these reports to focus on specific data points that matter most to your business.

Have you ever wondered which customers contribute most to your revenue? With the reporting features, you can quickly pinpoint your top customers and tailor your marketing efforts accordingly. This focus can lead to better customer retention and increased sales.

###

Vendor Reports

Vendor reports provide insights into your spending patterns, helping you manage your expenses more effectively. These reports can reveal which vendors you rely on most, enabling you to negotiate better terms or discounts.

Accessing reports like unpaid bills, vendor contact lists, or purchase volumes can make a significant difference in your cash flow management. These reports can highlight overdue payments and help you prioritize which bills to settle first.

Are you frequently missing early payment discounts? With vendor reports, you can track payment histories and ensure you never miss out on potential savings. This proactive approach can improve your financial health and vendor relationships.

By utilizing these reporting features, you can transform how you handle customer and vendor relations. Dive into the data, and let QuickBooks guide you in making smarter business decisions. How will you leverage these reports to boost your business’s performance?

Integration And Syncing

Integration and syncing in QuickBooks play a crucial role. They simplify business operations for both customers and vendors. The process ensures seamless data flow between different systems. This results in better accuracy and efficiency. Let’s delve deeper into how QuickBooks handles integration and syncing.

Third-party Integrations

QuickBooks supports various third-party integrations. These integrations enhance functionality. They allow users to connect with other tools. This connection streamlines tasks like payment processing and inventory management. Users find it easy to plug in software that suits their needs. The integration process is straightforward, saving time and effort.

Data Synchronization

Data synchronization is vital for accurate record-keeping. QuickBooks ensures data is consistently updated across platforms. This prevents errors and discrepancies. Users can rely on real-time data updates. Synchronization keeps information current and reliable. It supports better decision-making with accurate data insights.

User Permissions

User Permissions in QuickBooks are essential for maintaining data integrity. They help control who can access specific information. This ensures both security and efficiency. By setting permissions, businesses can protect sensitive data. It also streamlines workflow by allowing specific roles to access necessary information. Understanding these permissions is crucial. Let’s dive into the access levels for both customers and vendors.

Access Levels For Customers

Customers in QuickBooks typically have limited access. They can view their transactions and invoices. This helps them manage their own accounts effectively. They don’t see other customers’ data. This ensures privacy and security. Businesses can customize these permissions. This customization enhances customer experience by providing relevant information. It’s important to regularly review customer access levels.

Access Levels For Vendors

Vendors require different access levels. They often need to see purchase orders and invoices. This helps them stay informed about payments. Vendors can’t access customer data. This separation maintains confidentiality. Businesses can adjust vendor permissions as needed. This flexibility supports various business relationships. Regular updates to vendor access ensure current information is available.

Common Challenges

QuickBooks is a popular tool for managing financial data. Yet, users often face challenges with customer and vendor management. These challenges can disrupt workflow and cause frustration.

Managing Customer Records

Keeping customer records up-to-date is crucial. Errors can lead to billing mistakes. Duplicate entries are another common issue. They complicate tracking and reporting. Users need to ensure data accuracy. Regular audits of customer information help. Training staff on data entry is beneficial.

Handling Vendor Transactions

Vendor transactions require careful attention. Payment errors can damage relationships. Incorrect data entry is a frequent problem. It affects inventory and budget planning. Users should establish a verification process. Double-checking entries minimizes mistakes. Understanding vendor terms is essential. This ensures timely and accurate payments.

Credit: quickbooks.intuit.com

Credit: quickbooks.intuit.com

Frequently Asked Questions

What Is The Difference Between Customer And Vendor In Quickbooks?

In QuickBooks, a customer buys goods or services, while a vendor provides goods or services to your business. Customers generate revenue, and vendors incur expenses.

What Is The Difference Between A Vendor And A Customer?

A vendor sells goods or services. A customer buys and uses those goods or services. Vendors supply, customers consume.

Can You Switch A Customer To A Vendor In Quickbooks?

QuickBooks doesn’t allow directly switching a customer to a vendor. Create a new vendor profile instead. Manually transfer relevant information and transactions to maintain accurate records. This approach ensures data consistency and compliance within QuickBooks.

Conclusion

Choosing between customer and vendor features in QuickBooks is crucial. Both play vital roles in managing finances. Customers drive revenue. Vendors ensure smooth operations. Balancing both is key for business success. QuickBooks offers tools for each side. Understanding these tools helps in better decision-making.

Keep exploring the software’s features. This knowledge enhances efficiency and accuracy. Remember, a well-organized system saves time. It also reduces errors. Stay informed about updates and new features. This will keep your business ahead. With QuickBooks, managing customers and vendors becomes simpler.

Focus on what suits your business best.