Are you finding yourself tangled in the web of accounting terms and unsure about when to use a sales receipt or an invoice in QuickBooks? You’re not alone.

Understanding the differences between these two can empower you to streamline your financial processes, boost your business credibility, and improve your cash flow. Imagine the clarity and confidence that comes with mastering these tools – you’ll feel like you’ve unlocked a new level of control over your finances.

You’ll discover the key distinctions between QuickBooks sales receipts and invoices, helping you make informed decisions that can save you time and enhance your business operations. Ready to transform your accounting experience? Let’s dive in and unravel these concepts together!

Credit: www.youtube.com

Sales Receipt Features

QuickBooks offers two distinct ways to handle transactions: sales receipts and invoices. Sales receipts are ideal for immediate payments. They simplify the transaction process. Customers receive instant confirmation. This builds trust and satisfaction. Let’s explore the features that make sales receipts effective and efficient.

Instant Payment Confirmation

Sales receipts provide instant payment confirmation. This reassures customers immediately. They know their payment is processed. It reduces uncertainty. It saves time for both parties. Customers appreciate this feature. It enhances their overall experience.

Customer Interaction

Sales receipts facilitate customer interaction. They offer a chance to engage directly. Customers see a clear breakdown of their purchase. This transparency fosters trust. It invites questions and feedback. Business owners can use this opportunity. It helps refine services and products. A personal touch goes a long way.

Credit: quickbooks.intuit.com

Invoice Advantages

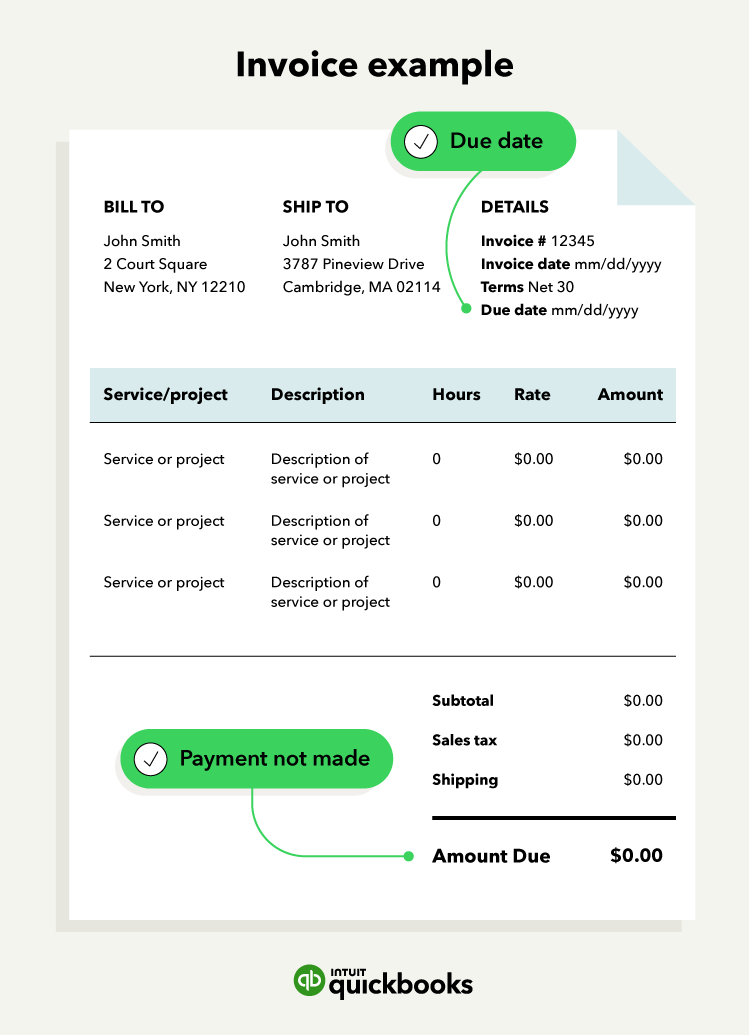

Invoices offer several advantages in managing business transactions with clients. They help businesses maintain organized records and ensure timely payments. With QuickBooks, creating and sending invoices becomes seamless. This tool enhances efficiency and improves cash flow. Understanding invoice benefits can help businesses choose the right option for their needs. Let’s explore the key advantages of using invoices in QuickBooks.

Payment Flexibility

Invoices provide payment flexibility for both businesses and clients. Clients can pay using various methods, such as credit cards or bank transfers. This flexibility simplifies the payment process and encourages prompt payments. Businesses can also set due dates that align with their cash flow needs. This ensures a steady income stream and reduces financial stress.

Tracking Outstanding Payments

Tracking outstanding payments becomes easier with invoices. QuickBooks allows businesses to monitor unpaid invoices at a glance. This feature helps identify overdue payments quickly. Businesses can then send reminders to clients for prompt payment. Keeping track of unpaid invoices ensures better financial management. It also helps maintain healthy client relationships.

Choosing Between Receipt And Invoice

Deciding between QuickBooks sales receipt and invoice depends on your business needs. Sales receipts are for immediate payment, useful for small transactions. Invoices allow for payment later, ideal for larger orders. Understanding the difference helps manage your business finances efficiently.

Choosing between QuickBooks sales receipts and invoices can be tricky. Both serve distinct purposes and cater to different business needs. Understanding the differences helps in making informed decisions. Sales receipts confirm immediate payment, while invoices request payment later. Each has its place in business transactions.Business Needs Assessment

Assessing your business needs is crucial. Do you sell products or services instantly? Sales receipts are ideal for immediate transactions. They confirm payment right away. Invoices are better for delayed payments. They help manage accounts receivable. Understand your cash flow. Determine if you need immediate funds or can wait. The choice influences your financial management.Customer Preferences

Consider your customers’ preferences too. Some customers prefer immediate proof of purchase. Sales receipts offer this. Others need time to review and pay later. Invoices provide flexibility. Knowing your customers’ habits helps in choosing the right option. Customer satisfaction can be linked to your choice. Choose wisely to enhance their experience.

Credit: quickbooks.intuit.com

Integration With Quickbooks

Integrating QuickBooks into your business streamlines financial management. It connects sales receipts and invoices seamlessly. This integration simplifies tracking and managing transactions. Both sales receipts and invoices have distinct roles in QuickBooks. Understanding their integration benefits your billing process and overall business efficiency.

Automated Billing Processes

Automated billing saves time and reduces errors. QuickBooks lets you automate sales receipts and invoices. This ensures accurate billing for every transaction. It also means timely updates to your accounting records. Automation minimizes manual entry, leading to fewer mistakes. This efficiency boosts productivity and accuracy.

Synchronization Benefits

Synchronization keeps your financial data current. QuickBooks syncs sales receipts and invoices with other data. This ensures consistency across all records. Real-time updates make financial reporting more reliable. Synced data helps in making informed business decisions. It also aids in maintaining accurate cash flow tracking.

Common Misconceptions

In the world of business accounting, understanding terms is crucial. Many confuse QuickBooks sales receipts with invoices. This confusion leads to errors in financial records. Both serve unique purposes and aren’t interchangeable. It’s important to clarify these common misconceptions.

Usage Scenarios

Sales receipts and invoices serve different functions. A sales receipt is immediate proof of payment. It’s used for transactions completed on the spot. Think of it as a store purchase. You pay, and you get a receipt instantly.

An invoice requests payment. It’s used for credit transactions. A business sends an invoice after delivering products or services. The customer then pays later, as per agreed terms. Misunderstanding these uses can affect cash flow management.

Legal Implications

Sales receipts and invoices have legal differences. A sales receipt confirms a transaction is complete. It acts as evidence for both buyer and seller. This is important for returns or disputes.

An invoice, however, represents a promise to pay. It’s a legal document outlining payment terms. Failure to pay an invoice can lead to legal action. Recognizing these differences can prevent legal complications.

Tips For Simplifying Billing

In the world of business, handling billing efficiently is crucial. Quickbooks offers tools that can simplify this process, especially when choosing between sales receipts and invoices. While both serve to document transactions, understanding their distinct roles can help you streamline your billing process. Here are some tips to make billing simpler and more effective.

Streamlining Processes

Efficiency is key in billing. You want to avoid unnecessary steps that can slow down your workflow. Start by examining your current process. Are there tasks that seem redundant? Cutting out these extra steps can save time and reduce errors. Consider how Quickbooks can help you do this.

One way to streamline is by setting up automatic reminders for unpaid invoices. This can ensure you’re not spending extra time chasing payments. Additionally, customize your templates. Having a consistent format can reduce confusion and make transactions smoother.

Utilizing Quickbooks Tools

Quickbooks offers a variety of tools that can make billing easier. Use the software to its full potential by taking advantage of features like batch invoicing. This allows you to send multiple invoices at once, saving time and effort. Imagine reducing the hours spent on individual billing tasks!

Another feature to explore is the mobile app. You can manage sales receipts and invoices on the go, making it easier to keep track of transactions outside the office. Think about how much more productive you could be if you could handle billing while waiting for your coffee.

Quickbooks also provides reports that offer insights into your billing practices. Regularly reviewing these reports can help you spot trends and identify areas for improvement. What changes could you make to enhance your billing efficiency?

By focusing on simplifying billing, you can free up time to focus on what matters most—growing your business. Consider these tips and make Quickbooks your ally in achieving streamlined and effective billing processes.

Frequently Asked Questions

What Is The Difference Between A Sales Receipt And Invoice In Quickbooks?

A sales receipt records immediate payment, while an invoice requests payment later. In QuickBooks, sales receipts streamline cash sales, invoices track credit transactions. Both help manage finances efficiently.

When Should You Use A Sales Receipt In Quickbooks?

Use a sales receipt in QuickBooks for immediate payments at the time of sale. It records transactions where customers pay instantly, avoiding invoicing. This is ideal for cash sales, credit card payments, or checks received on the spot. It ensures accurate financial tracking and efficient bookkeeping.

How Do I Change A Sales Receipt To An Invoice In Quickbooks?

Open QuickBooks, select the sales receipt, click “More,” then “Copy to Invoice” to convert it into an invoice.

Conclusion

Choosing between QuickBooks Sales Receipts and Invoices is important. Sales Receipts work best for immediate payments. Invoices fit delayed payments or installment plans. Both serve different needs in business transactions. Consider your cash flow and customer preferences. Each option offers unique advantages.

Understanding their uses helps manage finances better. The right choice simplifies bookkeeping and ensures smooth operations. Evaluate your business needs carefully. Make informed decisions. Accurate records lead to financial success. QuickBooks provides tools to support your business journey.