We’ve all been there — staring at a pile of receipts, feeling overwhelmed as tax season looms closer. Small business owners know the pain of trying to keep track of every expense, every write-off, and every rule without losing sleep.

It’s frustrating and stressful. But what if managing your taxes didn’t have to be so hard? Choosing the right tools can make all the difference. The right books, logs, and guides can simplify your daily tasks and help you save money legally.

Imagine feeling confident and organized when tax time arrives, knowing you’ve captured every possible deduction. In this article, we’ll share some of the best small business tools designed to ease your tax worries. Keep reading to discover products that can turn your tax frustrations into smooth, manageable steps.

The Only Book You’ll Ever Need On Small Business Taxes

The ideal customer for The Only Book You’ll Ever Need On Small Business Taxes is a small business owner or entrepreneur looking to gain a comprehensive understanding of tax strategies, legal loopholes, and deductions to save money. This book is also perfect for beginners who want to improve their bookkeeping and accounting skills to better manage their finances and stay compliant with tax laws.

Pros:

- Clear explanations of complex tax concepts tailored for small businesses

- Includes practical tips on legal loopholes and deductions to maximize savings

- Comprehensive coverage of bookkeeping and accounting basics for beginners

- Up-to-date information reflecting the latest tax laws as of 2024

- Compact and easy-to-read format with 153 pages

Cons:

- May not cover highly specialized tax situations for large businesses

- Limited depth on advanced accounting techniques

This book offers a well-rounded approach to managing small business taxes by combining tax-saving secrets with foundational knowledge in bookkeeping and accounting. Its concise format makes it accessible for readers who may feel overwhelmed by more technical tax literature. By focusing on practical advice and legal strategies, users can confidently reduce their tax liabilities and avoid common pitfalls.

With a publication date in 2024, the content is current and aligned with the latest tax regulations, ensuring that small business owners are informed about recent changes. The step-by-step guidance empowers readers to take control of their financial record-keeping and tax preparation, ultimately leading to better financial health and peace of mind.

The Ultimate Small Business Taxes Blueprint

Ideal for small business owners, entrepreneurs, and freelancers seeking to maximize their tax savings while minimizing liabilities, THE ULTIMATE SMALL BUSINESS TAXES BLUEPRINT provides the latest strategies tailored for LLCs, S-Corps, and sole proprietors. This guide is perfect for those who want to understand complex tax rules and leverage write-offs to improve their bottom line.

Pros:

- Comprehensive coverage of latest tax write-off strategies applicable in 2024

- Clear insights into different business structures including LLC, S-Corp, and sole proprietorship

- Practical tips designed to maximize profit and minimize tax liability

- Easy-to-understand language suitable for both beginners and experienced business owners

- Detailed guidance across 256 pages, ensuring thorough explanations and examples

Cons:

- Focuses primarily on U.S. tax laws, limiting relevance for international readers

- Some sections may require additional accounting knowledge for deeper understanding

- Updates needed as tax laws evolve beyond 2024

THE ULTIMATE SMALL BUSINESS TAXES BLUEPRINT is packed with detailed features that help business owners identify all possible deductions and tax credits. The book explains how different business entities like LLCs, S-Corps, and sole proprietorships affect tax liabilities, allowing readers to choose the best structure for their financial goals. With a publication date of March 2024, the content includes the most recent tax code changes, making it a reliable resource for current tax planning.

Readers benefit from actionable insights into bookkeeping, expense tracking, and strategic tax planning that can significantly reduce tax burdens. The guide also demystifies complex tax jargon, enabling small business owners to confidently manage their taxes and avoid costly mistakes. This comprehensive approach ensures users not only save money but also maintain compliance and peace of mind throughout the year.

Llc & Taxes Explained For Beginners

The book LLC & Taxes Explained for Beginners is ideal for aspiring entrepreneurs, small business owners, and individuals looking to establish a limited liability company while ensuring they stay compliant with IRS regulations. If you want a clear, step-by-step guide to starting a business, filing taxes correctly, and maximizing deductions, this comprehensive resource is tailored specifically for you.

Pros:

- Provides a detailed, easy-to-understand explanation of LLC formation and tax filing processes.

- Includes practical tips to maximize tax deductions and save money.

- Written in a beginner-friendly style with step-by-step instructions.

- Compact and portable with dimensions 9.0 x 0.4 x 6.0 inches and weighing less than half a pound.

- Recent publication date (February 2025) ensures up-to-date IRS compliance information.

Cons:

- Focused primarily on LLCs, so may not cover other business structures in depth.

- Limited to 160 pages, which might restrict coverage of highly specialized tax scenarios.

This guide, published by Pantheon Global Publishing LLC, offers a perfect balance between comprehensive information and concise presentation. With 160 pages of expert content, it covers everything from the basics of LLC formation to detailed tax strategies, making it an invaluable asset for those new to business ownership. The emphasis on maximizing deductions and staying IRS-compliant helps users avoid costly mistakes and optimize their financial outcomes.

Beyond just theoretical knowledge, the book delivers actionable advice that entrepreneurs can implement immediately. Its step-by-step format breaks down complex tax concepts into manageable tasks, empowering readers to confidently navigate the often confusing world of business taxes. Whether you are launching your first LLC or seeking to improve your tax filing process, this resource provides clarity and practical guidance tailored to your needs.

The Tax And Legal Playbook

The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions is ideal for small business owners, entrepreneurs, and startup founders who seek clear, practical guidance on navigating the complexities of tax and legal issues. If you want to protect your business, avoid costly mistakes, and make informed decisions without getting overwhelmed by jargon, this book is tailored for you.

Pros:

- Provides straightforward, actionable advice on tax and legal matters.

- Written by Entrepreneur Press, ensuring credibility and expertise.

- Comprehensive coverage in 368 pages, including updated information from the 2nd edition.

- Helps small business owners minimize risks and maximize financial benefits.

- Easy-to-understand language suitable for readers without legal or tax background.

Cons:

- Published in 2019, some tax laws may have changed since then.

- Primarily focused on U.S. tax and legal systems, less relevant for international readers.

- May be too detailed for those looking for a quick overview rather than an in-depth guide.

This book offers a comprehensive approach to handling the tax and legal challenges faced by small businesses. The 2nd edition brings updated insights that reflect recent changes in regulations, helping readers stay current. With its 368 pages, the book thoroughly addresses common questions and scenarios, empowering entrepreneurs to confidently tackle issues such as business formation, tax deductions, compliance, and contracts.

By breaking down complex topics into manageable sections, the Tax and Legal Playbook delivers practical benefits like reducing the risk of audits, avoiding costly penalties, and streamlining business operations. Readers gain a strategic advantage, making it easier to focus on growth while ensuring their business is legally sound. Its clear explanations and real-world examples make it a valuable resource for those committed to long-term success.

They Call Me The Refund Man

They Call Me The Refund Man: How You Can Start a Successful Tax Business is ideal for aspiring entrepreneurs and individuals interested in launching a profitable tax preparation service. If you are looking to enter the tax industry with practical guidance and a clear roadmap, this book by Absolute Author Publishing House offers valuable insights tailored for beginners and those seeking to expand their financial services.

Pros:

- Concise and easy-to-understand content with only 60 pages

- Provides step-by-step instructions for starting a tax business

- Published recently in 2023, ensuring up-to-date information

- Compact dimensions (9.0 x 6.0 inches) make it easy to carry and reference

- Focuses on practical business strategies and real-world applications

Cons:

- Limited depth due to brevity; may not cover advanced tax topics extensively

- Primarily focused on U.S. tax business, which might limit international applicability

This book stands out by offering a streamlined approach to entering the tax preparation industry. Its compact size and lightweight design make it highly portable, perfect for busy professionals who need quick access to essential information. The publication date in 2023 ensures that readers receive current insights relevant to today’s tax environment, which is critical in a constantly evolving financial landscape.

By focusing on the fundamentals of starting and managing a successful tax business, readers benefit from clear, actionable advice that can help reduce the learning curve. Whether you are a first-time entrepreneur or looking to enhance your existing services, this guide equips you with the knowledge to build a sustainable and profitable tax business.

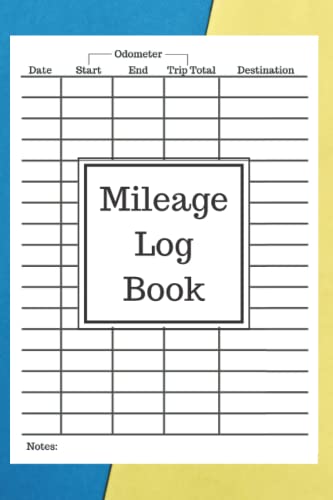

Mileage Log Book

The Mileage Log Book: For Taxes; Small Business Owners; and Company Expense Reports is ideal for anyone who needs to keep accurate records of their vehicle mileage for tax deductions, business expenses, or reimbursement purposes. This product is especially useful for small business owners, freelancers, and employees who travel frequently for work and want to maintain organized and detailed mileage logs.

Pros:

- Compact size (9.0 x 6.0 inches) making it easy to carry in a glove compartment or briefcase

- 108 pages providing ample space for long-term tracking

- Published by Majosta, ensuring quality and reliability

- Designed specifically for tax and expense report purposes, streamlining record-keeping

- Lightweight at 0.48 pounds, enhancing portability

Cons:

- Physical book format may be less convenient for those who prefer digital logging

- Limited to mileage tracking only, no space for other expense types

This mileage log book features a straightforward layout that allows users to easily record dates, starting and ending odometer readings, and trip purposes. This clear structure benefits users by simplifying the process of maintaining accurate and IRS-compliant mileage records, which can maximize tax deductions and reimbursements. The durable size and weight make it practical for daily use without adding bulk.

With its 108 pages, this log book offers long-term use, reducing the need to frequently purchase new ones. Its independent publication by Majosta ensures attention to detail and a focus on the needs of small business owners and professionals who value organized financial documentation. Overall, this log book is a reliable tool that helps users stay compliant and efficient in managing their mileage records for taxes and business expenses.

Mileage Log Book

The Mileage Log Book: Car Tracker for Business Auto Driving Record Books for Business Taxes Vehicle Expense for Self-Employed is ideal for self-employed individuals, freelancers, and small business owners who need to accurately track their vehicle mileage for tax deductions and business expense reporting. If you drive frequently for work purposes and want to keep detailed records in a simple and organized way, this log book is a perfect companion.

Pros:

- Compact and portable size: 9.0 inches by 6.0 inches, easy to carry in your vehicle.

- Contains 99 pages, providing ample space for long-term mileage tracking.

- Helps ensure compliance with IRS requirements for mileage deduction documentation.

- Independently published by Majosta, offering specialized focus on business mileage needs.

- Clear layout designed specifically for business auto driving records and tax purposes.

Cons:

- Limited to physical record-keeping; no digital or app integration.

- May require manual entry, which can be time-consuming for very frequent drivers.

The Mileage Log Book features a well-organized format to capture essential details such as date, purpose of trip, starting and ending mileage, and total miles driven. This meticulous structure helps users maintain accurate and thorough records, which is vital for maximizing business tax deductions and avoiding audits. With its 99 pages, it offers enough capacity for several months or even a year of mileage tracking, making it suitable for regular business drivers.

Additionally, the book’s compact dimensions make it easy to store in your glove compartment or vehicle console, ensuring that you can log trips promptly without hassle. The focus on business auto driving record books specifically tailored for self-employed individuals simplifies the process of managing vehicle expenses. This can ultimately save time and reduce stress during tax season, providing peace of mind that your mileage is well documented and ready for submission.

It’s Not Common Cent$: A 30-day Personal Finance Crash Course For College Students And Young Adults

The book “It’s Not Common Cent$: A 30-Day Personal Finance Crash Course for College Students and Young Adults” is ideal for individuals who are just starting their financial journey, especially college students and young adults. If you want to learn practical strategies to manage money, save money quickly, pay off debt, and even invest in the stock market, this guide is tailored to help you build a strong financial foundation early in life.

Pros:

- Comprehensive 30-day step-by-step crash course designed for beginners.

- Covers essential topics like money management, saving techniques, debt repayment, and investing.

- Written specifically for college students and young adults, addressing their unique financial challenges.

- Contains 278 pages of practical advice and actionable tips.

- Published recently in 2021, ensuring up-to-date information and strategies.

Cons:

- Some readers may find the 30-day format too fast-paced depending on their schedule.

- Focused primarily on beginners; advanced investors might find limited new insights.

This book is a well-structured guide that breaks down complex financial concepts into manageable daily lessons, making it easier for young adults to grasp and apply these principles. The focus on practical money management and saving strategies helps readers develop habits that can lead to financial stability and independence. With clear instructions on how to pay off debt and start investing, it empowers readers to take control of their financial future confidently.

Additionally, the inclusion of investing basics tailored for beginners is a standout feature, setting this book apart from many personal finance guides targeted at this demographic. By following the course, readers can expect to improve their financial literacy significantly, build a solid savings foundation, and lay the groundwork for wealth creation through smart investments early on.

Reseller Expense Logbook

The Reseller Expense Logbook is ideal for small business owners, independent resellers, and entrepreneurs who need a reliable and organized way to track their monthly sourcing expenses, vehicle mileage, and tax deductions throughout the year. This logbook is perfect for those who want to simplify their financial record-keeping and ensure they are well-prepared for tax season without the hassle of complicated software.

Pros:

- Comprehensive all-in-one ledger for expenses, mileage, and tax deductions

- Undated format allows flexible start time

- Compact size (10 x 8 inches) for portability

- 99 pages provide ample space for year-round tracking

- Helps improve financial organization and tax preparation

Cons:

- Physical logbook may not appeal to users preferring digital tracking

- Limited to manual entry, requiring consistent user diligence

The Reseller Expense Logbook by Majosta is thoughtfully designed with clear sections to help users record expenses related to sourcing products, track vehicle mileage for business trips, and calculate tax deductions efficiently. Its undated pages mean you can start using it anytime during the year without wasting any pages. The size and weight make it easy to carry around, allowing resellers to update records on the go.

By maintaining detailed and organized records in this logbook, users can streamline their bookkeeping process, reduce errors, and confidently provide documentation during tax season. The physical format encourages regular updates, which can lead to better financial insights and smarter business decisions. Overall, this logbook offers a practical solution for resellers aiming to enhance their expense management and optimize their tax benefits.

Tax Deduction Notebook

The Tax Deduction Notebook: Consolidate and Organize Tax Time Deductions – Blue Wood is ideal for individuals who want to simplify their tax filing process by keeping all their deduction information in one place. Whether you are a freelancer, small business owner, or anyone who tracks multiple expenses, this notebook helps you stay organized and prepared for tax season.

Pros:

- Compact and lightweight design measuring 11.0 x 8.5 inches for easy portability

- Contains 117 pages dedicated to detailed tax deduction tracking

- Attractive blue wood cover for a professional appearance

- Published by Majosta, ensuring quality and reliability

- Helps consolidate all tax-related expenses, reducing stress during tax time

Cons:

- Limited to physical note-taking, which may not suit those preferring digital tools

- May require manual updating and organization by the user

- Spine width of 0.27 inches might not accommodate extensive entries over multiple years

The Tax Deduction Notebook features a thoughtfully designed layout that allows users to systematically record and categorize their tax deductions. This organization aids in quickly accessing relevant information during tax preparation, helping to avoid missed deductions and potential errors. Its sturdy construction and professional blue cover make it suitable for use both at home and on the go.

Additionally, the notebook’s size and weight make it easy to carry along with other essential documents. With 117 pages, there is ample space for detailed record-keeping throughout the year. This notebook not only saves time but also helps users maximize their tax savings by keeping all deduction details in one accessible location.

Frequently Asked Questions

What Are The Best Tools For Small Business Tax Write-offs?

Top tools include bookkeeping guides, mileage logbooks, and expense trackers. These help maximize deductions and keep records organized for tax time.

How Can I Maximize Tax Deductions For My Llc?

Use specialized books like LLC tax guides. They explain filing correctly, legal deductions, and IRS compliance to reduce tax liability.

Why Track Mileage For Small Business Taxes?

Mileage logbooks document business travel expenses. Accurate records increase deductible amounts and support claims during IRS audits.

What Bookkeeping Tools Help Beginners With Small Business Taxes?

Books covering bookkeeping basics and tax secrets are ideal. They simplify accounting and highlight legal write-offs to save money.

How Do I Stay Irs-compliant With Small Business Taxes?

Follow guides focused on tax rules and legal requirements. Keep detailed records and regularly update your bookkeeping to avoid penalties.

Can A Tax Business Help With Small Business Write-offs?

Yes, a tax business expert offers advice on deductions and filing strategies. They help optimize profits and minimize tax liabilities.

Conclusion

Choosing the right tools can make small business tax write-offs easier and more effective. Books and logbooks help you track expenses and understand deductions clearly. They guide you through complex rules step-by-step, so you avoid costly mistakes. Using these resources saves time and reduces stress during tax season.

Keeping good records with mileage and expense logs ensures you claim all eligible deductions. Learning from beginner-friendly guides helps even new business owners stay IRS-compliant. With organized information, you can focus more on growing your business. Remember, simple tracking and smart planning lead to better savings.

These tools support your financial health and give peace of mind. Start using them today to keep your taxes under control and your profits higher.