As a business owner, you’re always looking for ways to save money. You may be wondering if you can write off software for your business. The answer is maybe.

It depends on a few factors, such as the type of software, how you use it, and what type of business you have.If you use software to run your business, such as accounting or inventory software, you can usually write it off as a business expense. This is because these types of software are considered necessary for running your business.

However, if you use software for personal use, such as a word processing program or a game, you can’t write it off as a business expense. This is because the IRS considers these types of software to be personal expenses.So, can you write off software for your business?

It depends on the type of software and how you use it. If you use it for business purposes, you can usually write it off as a business expense. However, if you use it for personal use, you can’t write it off as a business expense.

- Determine which software is no longer being used by your business

- This could be because it is outdated, no longer supported, or you have switched to a different program

- Research the depreciation rates for software

- This will vary depending on the type of software and the country you are located in

- Write off the software by taking the depreciation rate and multiplying it by the cost of the software

- This can be done in the year the software is purchased or over the course of several years

- Keep track of the software write-offs for tax purposes

- This will ensure you are able to deduct the correct amount from your taxes

14 Biggest Tax Write Offs for Small Businesses! [What the Top 1% Write-Off]

Can I deduct tax software as a business expense?

If you’re like most people, tax season is a time of stress and anxiety. But it doesn’t have to be! One way to ease the burden of tax season is to use tax software.

And the good news is, you can deduct the cost of tax software as a business expense!There are a few things to keep in mind when deducting tax software as a business expense. First, you can only deduct the cost of the software itself – not any associated costs like installation or training.

Second, you can only deduct the cost of tax software that you use for business purposes – not personal use.Using tax software can save you time and money, and now you know that you can deduct the cost as a business expense. So why not give it a try this tax season?

Does software count as a business expense?

When it comes to business expenses, there is often a lot of confusion about what can and cannot be deducted. This is especially true when it comes to something like software, which can be an essential part of running a business but isn’t always easy to classify. So, does software count as a business expense?

Generally speaking, software can be classified as a business expense if it is necessary for the operation of your business. This could include things like accounting software, design software, or even specific applications that you use for your business. If the software is something that you would not be able to do without, then it is likely that it can be classified as a business expense.

Of course, it is important to keep in mind that not all software will be considered a business expense. For example, if you purchase a video game for your personal entertainment, this would not be considered a business expense. The same is true for any software that is not essential to the operation of your business.

In order to deduct software as a business expense, you will need to keep good records of your expenses. This means keeping receipts and documentation of why the software was purchased. This will help to ensure that you are only deducting expenses that are truly business-related.

Overall, software can be a deductible business expense if it is necessary for the operation of your business. Be sure to keep good records of your expenses so that you can deduct them correctly.

Is software licensing deductible?

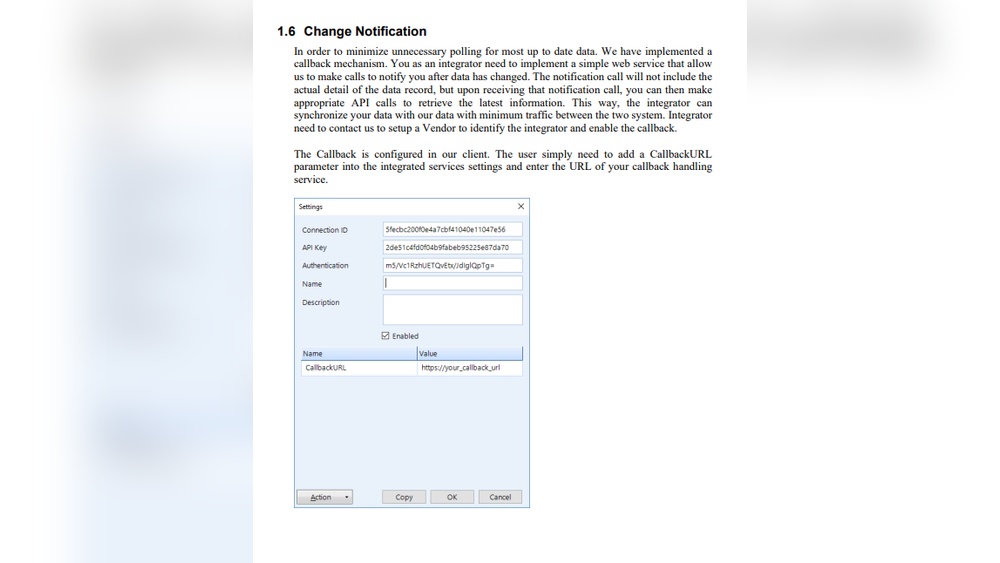

Most businesses incur some type of software expense, so it’s important to know if these costs are deductible. Software is generally considered to be a capital expense, which means it’s not currently deductible. However, there are some depreciation deductions available for software costs.

To qualify for depreciation, the software must be an integral part of your business and used in your business on a regular basis. The IRS requires that you capitalize, or add to the basis of your property, the costs of software that you develop or purchase for your business.The basis is the cost of the software plus any other costs associated with acquiring and installing it, such as the cost of training employees to use it.

You can depreciate the basis of your software over a period of three to five years.The amount of your deduction will depend on the depreciation method and schedule you choose. The IRS offers several methods for calculating depreciation, so you’ll need to consult with a tax professional to determine which method is best for your business.

In general, however, the depreciation deduction for software is a valuable tax break for businesses. By taking advantage of this deduction, you can lower your taxable income and reduce your tax liability.

Can I claim software on my taxes?

There are a few different types of software that you can claim on your taxes, but it really depends on what type of business you have and what type of software you’re using. If you’re using software for your business, then you can usually deduct it as a business expense. This includes things like accounting software, project management software, and even things like virus protection software.

However, if you’re using software for personal use, then you can’t usually deduct it on your taxes. This includes things like video games, music editing software, and even things like office productivity software.

Credit: howtostartanllc.com

Can i write off tools for my business

If you’re a tradesperson or run a business that involves the use of tools, you may be wondering if you can write them off as business expenses. The answer is yes! You can write off the cost of tools that are used for work, as well as any repairs or maintenance costs.

If you’re self-employed, you can claim a deduction for the cost of tools and equipment that you use for work, as well as any repairs or maintenance costs. The deduction can be claimed in the year that the costs are incurred.To claim the deduction, you’ll need to keep records of all your tool-related expenses, including receipts, invoices, and any other documentation.

Make sure to keep track of how the tools are used for business purposes.If you’re an employee, you can’t claim a deduction for the cost of tools that you use for work, as your employer is likely to have already included this in your salary. However, you may be able to claim a deduction for the cost of tools that you purchase yourself and use for work, as well as any repairs or maintenance costs.

As with any business expense, make sure that you keep good records and receipts in order to claim the deduction. If you have any questions about whether or not you can claim a particular expense, it’s always best to speak to a qualified accountant or tax advisor.

Where to enter software expenses in turbotax

If you’re like most people, you use accounting software to keep track of your business expenses. But what happens when it’s time to file your taxes? Do you know where to enter your software expenses in TurboTax?

Here’s a quick guide to help you out:1. Log into your TurboTax account and select the “Business Taxes” tab.2. Select the “Self-Employed” option.

3. Click on the “Deductions & Credits” tab.4. Scroll down to the “Business Expenses” section and click on the “Start/Edit” button.5. Enter your software expenses in the appropriate fields.

6. Be sure to click on the “Save” button when you’re done.That’s all there is to it! By following these simple steps, you can ensure that your software expenses are properly entered into TurboTax.

Can i write off a computer for my small business

Yes, you can write off a computer for your small business. Here’s how:The IRS allows businesses to deduct the cost of equipment, including computers, that is used for business purposes.

This deduction is called an “equipment expense deduction.”To qualify for the deduction, the computer must be used predominantly (more than 50%) for business purposes. So, if you use your computer for both business and personal purposes, you can only deduct a portion of the cost.

The deduction can be taken in the year that the computer is purchased or leased. If you purchase a computer, you can deduct the full cost in the year of purchase. If you lease a computer, you can deduct the lease payments as business expenses in the year they are made.

To take the deduction, you must itemize your deductions on your tax return. This means that you can’t take the standard deduction; you must itemize each deduction you’re claiming.The equipment expense deduction is just one of many deductions available to small businesses.

To maximize your deductions, be sure to talk to your accountant or tax advisor about all the deductions you may be eligible for.

Is software an office expense

If you’ve ever wondered whether software is an office expense, the answer is yes. Software can be a significant expense for any business, and it’s important to make sure that it’s accounted for in your budget.There are a few different ways that businesses can incur expenses related to software.

The most common is to purchase licenses for software that will be used by employees. This can be a one-time expense or an ongoing expense, depending on the software.Another way that businesses can incur expenses related to software is by paying for maintenance and support.

This can be an ongoing expense, and it’s important to make sure that it’s included in your budget.Finally, businesses may also incur expenses related to software when they need to upgrade or update their existing software. This can also be an ongoing expense, and it’s important to make sure that it’s accounted for in your budget.

Software can be a significant expense for any business, but it’s important to make sure that it’s included in your budget. By doing so, you can ensure that your business has the resources it needs to properly maintain and support its software.

Can you write off microsoft office

If you use Microsoft Office for business purposes, you can deduct the cost of the software as a business expense. The cost of the software can be deducted as an advertising or business promotion expense, or as a business expense if it is necessary for the operation of your business.

Off-the-shelf software depreciation

When it comes to business and technology, nothing ever stays the same for long. Just when you’ve become comfortable with a certain process or system, something new comes along to disrupt the status quo. This is especially true when it comes to software.

New versions of existing software are released on a regular basis, and new software products are constantly hitting the market.This can make it difficult (and expensive) to keep up with the latest and greatest. But it’s important to keep in mind that not all software needs to be kept up-to-date.

In fact, there’s a good chance that some of the software your business is using is already outdated and no longer supported by the manufacturer.This software is referred to as “off-the-shelf” software, and it can be difficult to determine when it’s time to let go. Here’s a look at some factors to consider when trying to decide if off-the-shelf software has reached the end of its useful life.

How old is the software?One of the first things to consider is the age of the software. Obviously, the older the software, the more likely it is to be outdated.

But that’s not always the case. Some software products have a very long lifespan and can be used for many years without becoming obsolete.Other software products have a much shorter lifespan and become outdated more quickly.

What type of expense is software subscription

When you subscribe to software, you’re essentially renting it from the company. You’re paying a set amount each month or year to have access to the software. This type of subscription is different from a cloud subscription, which gives you access to software that’s hosted on the company’s servers.

With a software subscription, you typically download the software to your own computer.

Software amortization life

The software amortization life is the number of years over which the cost of a software asset is spread for accounting purposes. This can be useful information for businesses to know when making decisions about software purchases and upgrades.The concept of software amortization life comes from the world of accounting.

In accounting, amortization is the process of spreading the cost of an asset over its useful life. This is done by taking the cost of the asset and dividing it by the number of years the asset is expected to be used.For example, let’s say a company buys a software program for $10,000.

The software has a useful life of five years. The company would amortize the cost of the software by spreading it out over those five years. This would mean that the company would record $2,000 of expense each year for the software on its financial statements.

The software amortization life is important for businesses to understand because it can impact decision-making around software purchases and upgrades. If a company knows that it will only be able to use a software program for three years, then it may not be worth paying $10,000 for that program. On the other hand, if a company knows that a software program will have a long life, then it may be worth paying a higher up-front cost.

businesses can use the software amortization life to make informed decisions about software purchases and upgrades.

Conclusion

Yes, you can write off software for your business as long as it is used for business purposes. The software must be used to generate income or to save on costs in order to be considered a business expense. You can deduct the cost of the software from your taxes as long as you keep track of all your expenses.