To create a accounting software in excel, first open a new workbook in excel. Then, create a new sheet by clicking on the sheet tab at the bottom of the workbook. In the new sheet, enter the labels “Date”, “Description”, “Debit”, and “Credit” in the first four cells of the sheet.

These labels will be the headers for the accounting software.

- Open a new workbook in Excel

- Enter your company’s name, address, and other contact information in the first few cells

- Create a column for each type of income and expense you want to track

- Enter your income and expense data in the appropriate columns

- Use Excel’s formulas and functions to calculate totals for each column

- Use conditional formatting to highlight cells that represent unusual income or expenses

- Save your workbook regularly

How to create an Accounting System IN EXCEL 🎁FREE DOWNLOAD🎁 ** GUARANTEED ** [PART 1/2]

Can we use Excel as accounting software?

Yes, you can use Excel as accounting software. In fact, many businesses use Excel for their accounting needs. Excel has all the features that you need to manage your finances, including the ability to track income and expenses, create invoices and bills, and generate financial reports.

There are a few things to keep in mind if you’re using Excel for accounting purposes. First, make sure to use a separate spreadsheet for each year. This will help you keep track of your finances and avoid any confusion.

Second, be sure to enter all of your transactions accurately. Any mistakes could lead to inaccurate financial reports.Overall, using Excel as accounting software is a great option for small businesses.

It’s affordable and easy to use, and it has all the features you need to manage your finances.

How do I create a new accounting software?

If you’re starting a business or switching to a new accounting software, the process may seem daunting. But with a little research and preparation, you can make the transition quickly and easily.To find the right accounting software for your business, first decide which features you need.

Do you need software that can track inventory or accept online payments? Would you like to be able to generate reports or create invoices? Once you know what features you need, you can narrow down your choices and select a software that meets your specific needs.

Once you’ve selected your software, it’s time to install it and set up your account. This process will vary depending on the software you choose, but most programs will have an installation wizard that will guide you through the process. After the software is installed, you’ll need to set up your company’s account information, including your business name, address, and contact information.

After your account is set up, you can start entering your financial transactions. Most accounting software will have pre-built templates that you can use to enter common transactions, such as invoices, bills, and expenses. If you have more complex transactions, you may need to create custom entries.

Once you’ve entered your transactions, you can run reports to see how your business is doing. Most accounting software can generate Profit and Loss statements, balance sheets, and other reports.

How do I make a spreadsheet for accounting?

If you need to create a spreadsheet for accounting purposes, there are a few things you’ll need to keep in mind. First, you’ll need to decide what accounting method you’ll be using – cash basis or accrual. Cash basis accounting is more straightforward, and is generally used for personal finances or small businesses.

Accrual accounting is more complex, and is generally used by larger businesses.Once you’ve decided on your accounting method, you’ll need to set up your spreadsheet. You’ll need to create columns for each type of account you’re tracking – assets, liabilities, income, and expenses.

You’ll also need to create rows for each individual transaction. You can either do this manually, or use accounting software to automate the process.Once your spreadsheet is set up, you’ll need to enter your transactions.

Make sure to include the date, account, and amount for each transaction. If you’re using accrual accounting, you’ll also need to include the invoice date and payment date. Once you have all of your transactions entered, you can begin tracking your finances.

Creating a spreadsheet for accounting purposes doesn’t have to be complicated. With a little planning and effort, you can easily track your finances and ensure that your business is running smoothly.

How is Excel used as a accounting system?

Excel can be used as an accounting system in a number of ways. One way is to use it to track expenses by creating a budget. This can be done by setting up a spreadsheet with columns for different categories of expenses, such as food, gas, and entertainment.

Then, you can enter your actual expenses into the appropriate columns and see how much you are spending in each category. This can help you to identify areas where you may be overspending and make adjustments to your budget.Another way to use Excel as an accounting system is to create invoices.

This can be done by setting up a spreadsheet with columns for different items or services that you sell, as well as the prices for each. Then, you can enter customer information and the items or services they have purchased into the spreadsheet. This can help you to keep track of what you have sold and to whom, as well as how much money you are making.

You can also use Excel to track your income and expenses. This can be done by setting up a spreadsheet with columns for different income and expense categories. Then, you can enter your actual income and expenses into the appropriate columns.

This can help you to see where your money is coming from and going to, and can also help you to identify areas where you may be overspending or underspending.Overall, Excel can be a helpful tool for accounting and budgeting.

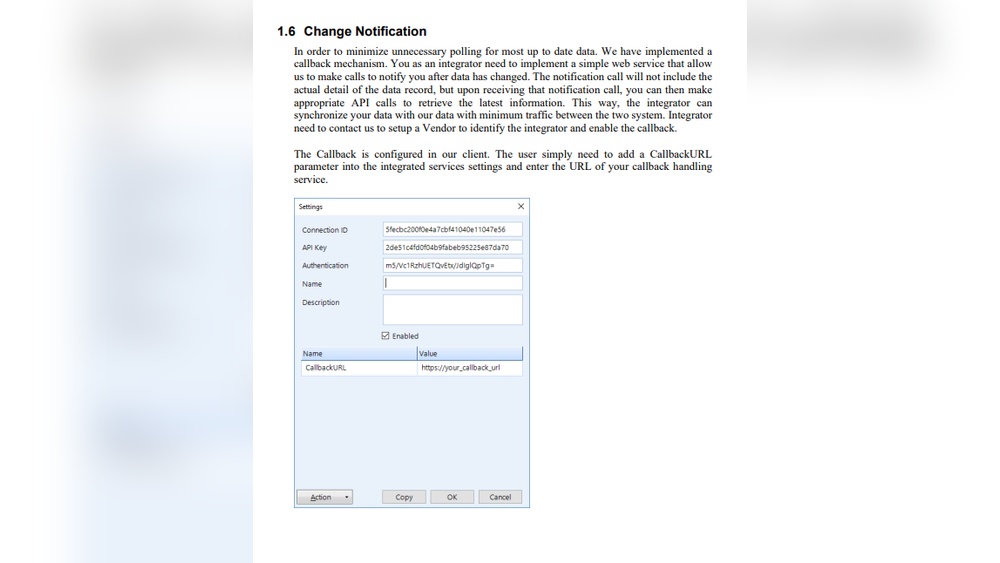

Credit: www.crmdynamics.com

How to create accounting software in excel pdf

Are you looking for a way to create accounting software in Excel? PDF is a great format for this purpose because it is easy to read and print. Plus, you can password protect your PDF files to keep them secure.

Here are the steps to create accounting software in Excel PDF:1. Open Excel and create a new workbook.2. Enter your data into the worksheets.

3. Save your workbook as a PDF file.4. Password protect your PDF file if desired.Now you have accounting software that you can use to track your finances.

PDF is a great format for this purpose because it is easy to read and print. Plus, you can password protect your PDF files to keep them secure.

Full accounting in excel format free download

Excel is a powerful tool that can be used for a variety of purposes, including accounting. While there are many accounting software programs on the market, Excel is a popular choice because it is relatively easy to use and it is a familiar program for many people.There are a number of ways to get started with using Excel for accounting.

One option is to download a free Excel accounting template. This can be a great way to get started, because it will give you a basic framework to work with. There are many different types of accounting templates available, so you can find one that best suits your needs.

Once you have a template, you can begin entering your financial data. You can track income and expenses, create invoices and statements, and more. Excel also makes it easy to generate reports, which can be helpful in making business decisions.

If you are not familiar with Excel, there are a number of resources available to help you learn the program. You can find tutorials, books, and even online courses. Once you have a basic understanding of how to use Excel, you can begin to customize the program to better suit your needs.

With a little time and effort, you can turn Excel into a powerful accounting tool. And, best of all, you can do it for free by downloading a template.

Small business accounting excel template

For small business owners, keeping track of their finances can be a daunting task. There are so many moving parts and things to keep track of, it can be difficult to know where to start. This is where a small business accounting excel template can be a lifesaver.

A small business accounting excel template can help you keep track of your income and expenses, as well as giving you a clear picture of your financial situation at any given time. This can be an invaluable tool for small business owners, as it can help you make informed decisions about where to allocate your resources.There are a number of different small business accounting excel templates available online, so it’s important to find one that’s right for you and your business.

Be sure to choose a template that’s easy to use and understand, and that will give you the information you need to make sound financial decisions.If you’re not sure where to start, there are a number of online resources that can help you find the right small business accounting excel template for your needs. Once you’ve found a template that you’re happy with, be sure to keep it up to date and accurate, as this will be an important tool in helping you run your small business.

Conclusion

If you’re good with Excel, you can create your own accounting software. Here’s how:1. Decide what information you want to track.

This will determine the structure of your spreadsheet.2. Create a separate sheet for each type of information you want to track.3. Use formulas to calculate totals and subtotals.

4. Create charts and graphs to visualize your data.5. Save your workbook as a macro-enabled workbook so you can automate tasks.