Managing your quarterly business expenses can feel overwhelming, but it doesn’t have to be. Imagine having a simple, clear way to track where every dollar goes and plan ahead with confidence.

That’s exactly what a budgeting tool can do for you. By using the right tool, you gain control over your finances, avoid surprises, and make smarter decisions that help your business grow. You’ll learn step-by-step how to use a budgeting tool to organize your quarterly expenses effectively.

Keep reading to discover how this straightforward approach can save you time, reduce stress, and boost your business’s financial health.

Choosing The Right Tool

Choosing the right budgeting tool for your quarterly business expenses sets the foundation for accurate tracking and effective financial planning. The right tool saves time and reduces errors. It should fit your business size and needs. A careful choice helps you control costs and meet financial goals smoothly.

Features To Look For

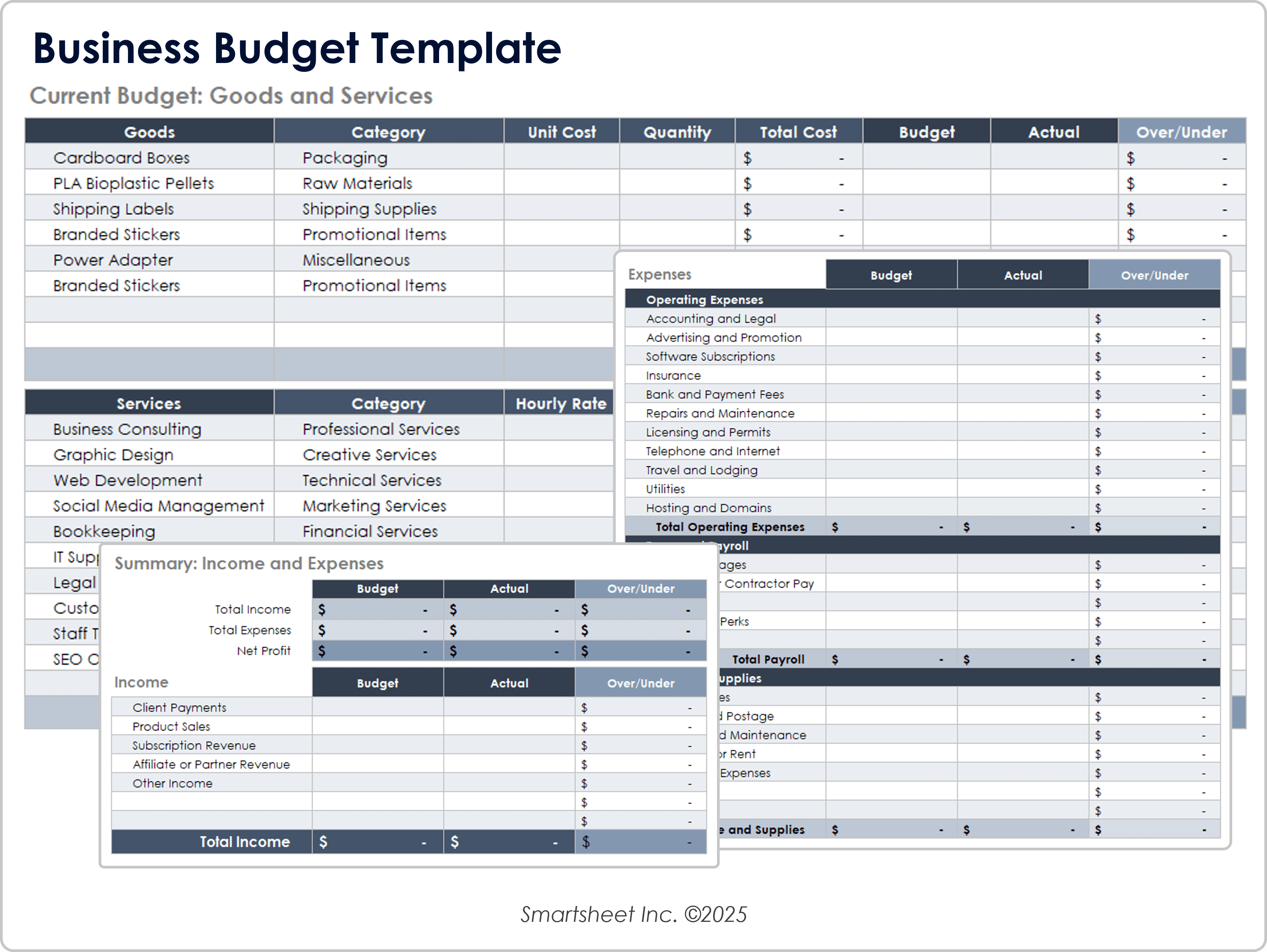

Start with tools that offer clear expense tracking. Look for automatic data import from bank accounts and credit cards. Choose software with customizable categories for your unique business expenses. Real-time reporting helps you see your spending instantly. Alerts and reminders prevent missed payments. Also, check if the tool supports multiple users for team access.

Comparing Popular Options

Excel remains popular for its flexibility and low cost. Cloud-based tools like QuickBooks and FreshBooks offer strong automation. They include invoicing and payroll features. Wave is a free option suitable for small businesses. Each tool varies in ease of use and support. Test a few with free trials to find your best fit.

Integration With Existing Systems

Ensure the budgeting tool works well with your current software. Look for smooth integration with accounting programs and payment platforms. Tools that sync with your CRM save time on data entry. Integration reduces errors by keeping all data connected. Confirm the tool supports your bank and credit card providers. This keeps your financial data up to date automatically.

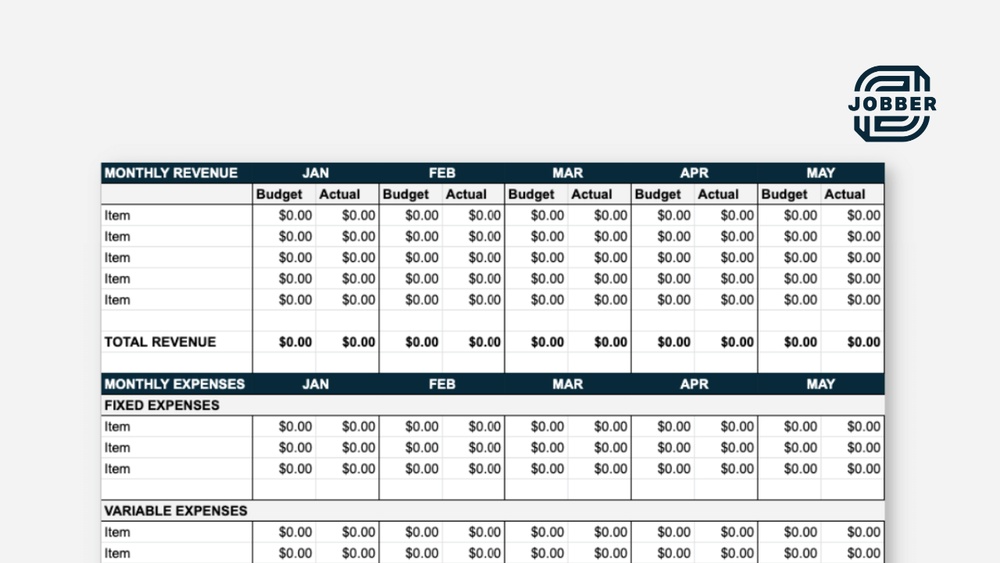

Credit: www.smartsheet.com

Setting Up Your Budget

Setting up your budget is the first step to managing quarterly business expenses effectively. It helps control spending and improves cash flow. A clear budget gives insight into where money goes and where to save.

Using a budgeting tool makes this process easier. The tool organizes data and tracks expenses automatically. Follow these steps to set up a strong budget for your business.

Identifying Quarterly Expenses

Start by listing all expenses you expect each quarter. Include fixed costs like rent and salaries. Add variable costs such as marketing and supplies. Don’t forget occasional expenses like equipment repairs or software upgrades. Knowing all expenses ensures no surprises later.

Categorizing Costs

Group your expenses into clear categories. Examples include operational costs, marketing, payroll, and taxes. This helps to see which areas use most of your budget. It also makes spotting overspending easier. Most budgeting tools let you create custom categories for your needs.

Allocating Income Portions

Divide your income into portions for each expense category. Start with essential costs like rent and salaries. Next, allocate funds for growth areas like marketing. Save a portion for emergencies or unexpected costs. Keep some income aside for taxes and debt payments. This balanced allocation keeps your business stable.

Tracking Spending Effectively

Tracking spending effectively is key to managing quarterly business expenses. It helps you control costs and stay within your budget. Using a budgeting tool simplifies this process by organizing your financial data clearly. You get a real-time view of where your money goes. This clarity prevents overspending and supports better financial decisions.

Recording Transactions

Start by entering every expense into your budgeting tool. Record transactions as soon as they happen. Include details like date, amount, and category. Accurate records keep your budget up to date. Avoid delays to prevent missing any expenses. Consistent recording builds a clear spending history. This history helps spot patterns and plan future budgets.

Monitoring Category Limits

Set spending limits for each expense category in your tool. Watch these limits closely throughout the quarter. Compare your actual spending to the set limits regularly. This shows if you are on track or overspending. Adjust your spending habits if you approach a limit. Staying within limits keeps your budget balanced. It ensures you do not run out of funds unexpectedly.

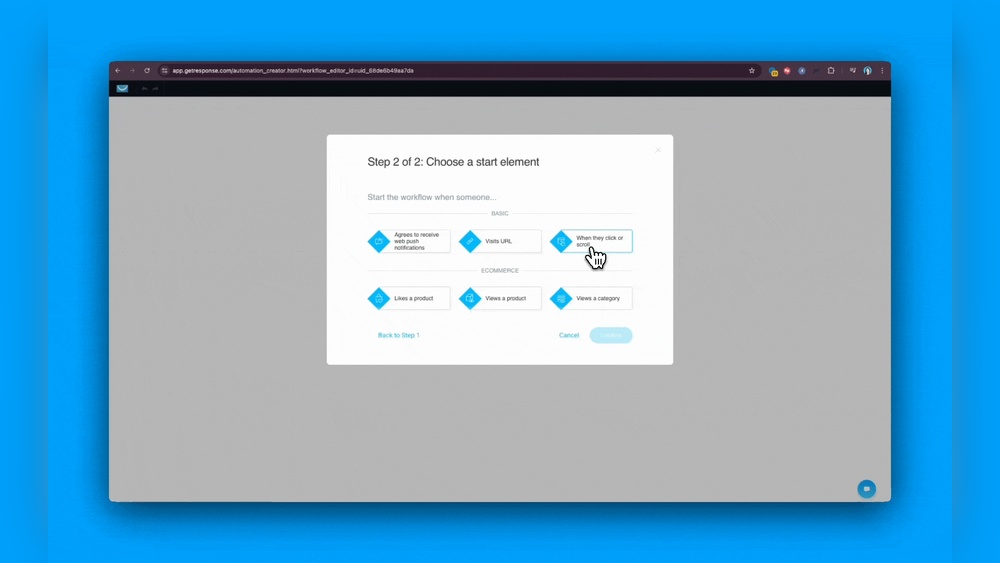

Using Alerts And Notifications

Enable alerts and notifications in your budgeting tool. These reminders warn you when spending nears a limit. They can also notify you of unusual transactions. Alerts help you act quickly to control costs. Notifications keep your budget management proactive. They reduce the risk of overspending and financial surprises. Use these features to maintain smooth expense tracking.

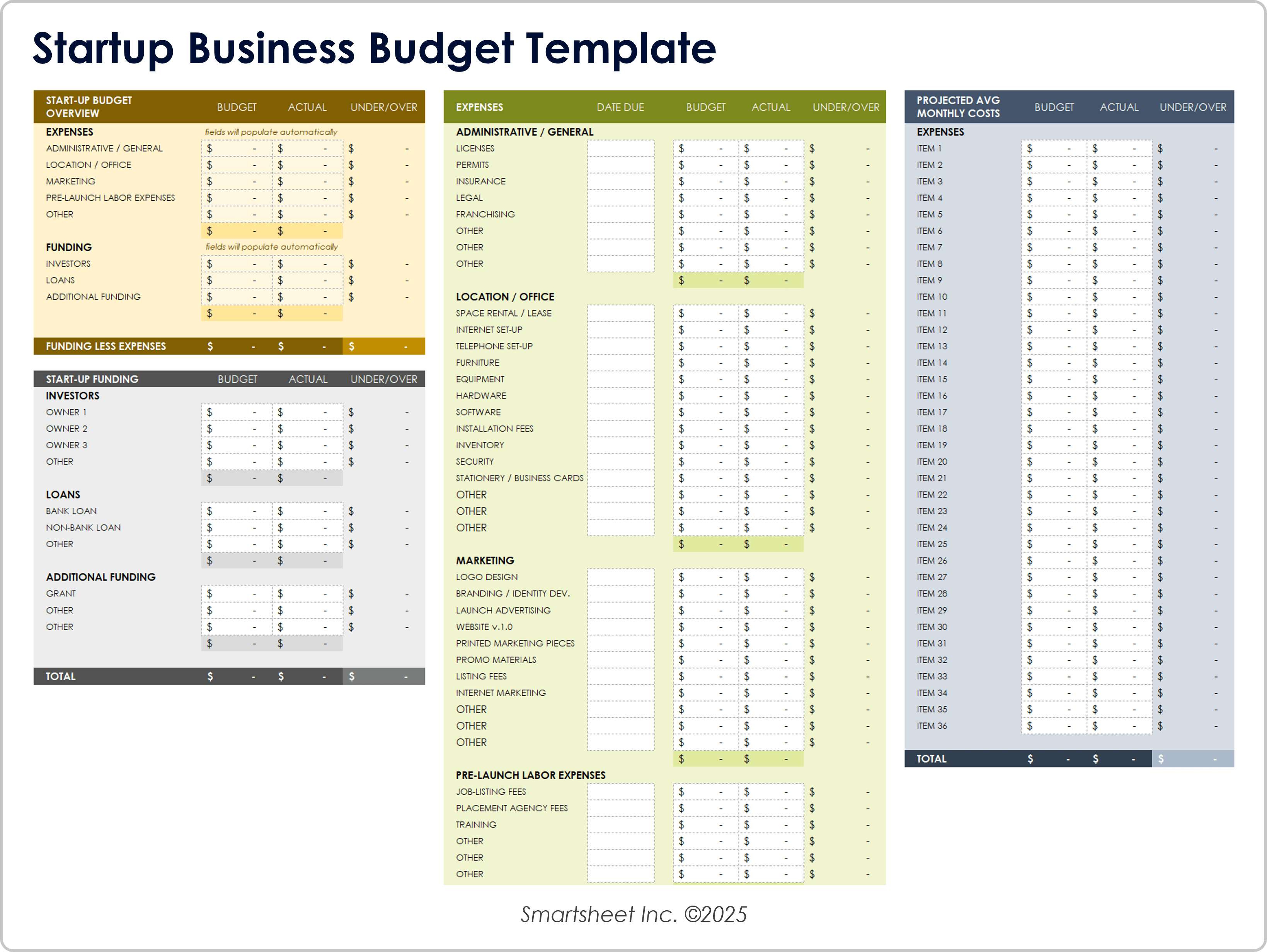

Credit: www.smartsheet.com

Automating Savings And Payments

Automating savings and payments streamlines your quarterly business expense management. It reduces manual work and prevents missed deadlines. Automation helps maintain steady cash flow and keeps your financial goals on track.

Scheduling Automatic Transfers

Set up automatic transfers to move funds regularly. Choose specific dates to transfer money from your checking to savings accounts. This ensures you save consistently without thinking about it. Scheduling transfers aligns with your quarterly budget plan.

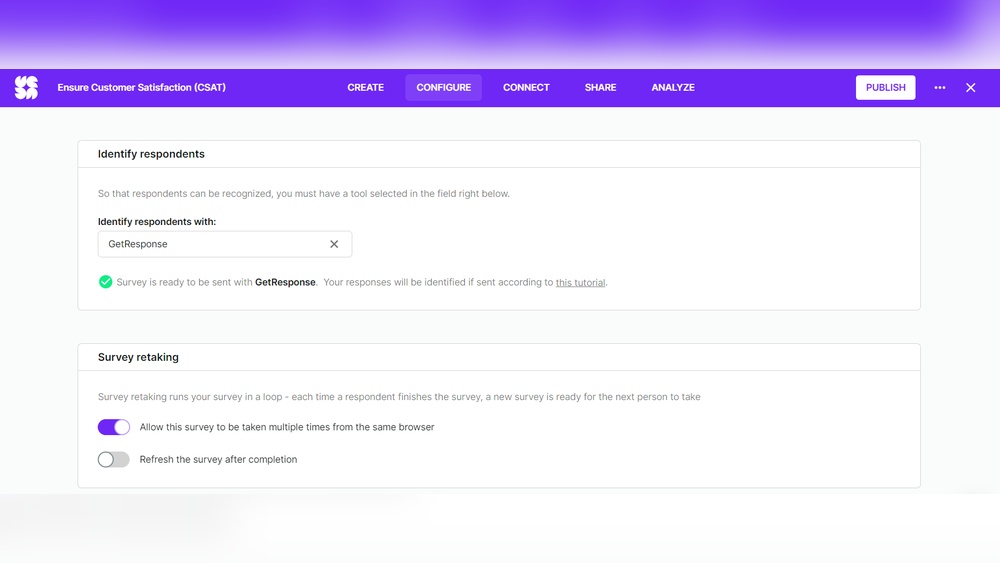

Linking To Savings And Investment Accounts

Connect your budgeting tool to your savings and investment accounts. This link allows automatic updates of your balances and transactions. It helps track your progress toward financial goals. Linking accounts saves time and improves accuracy.

Automating Bill Payments

Use your budgeting tool to automate bill payments. Schedule payments for recurring expenses like rent, utilities, and subscriptions. Automation avoids late fees and keeps your credit rating healthy. It also frees you from remembering each due date.

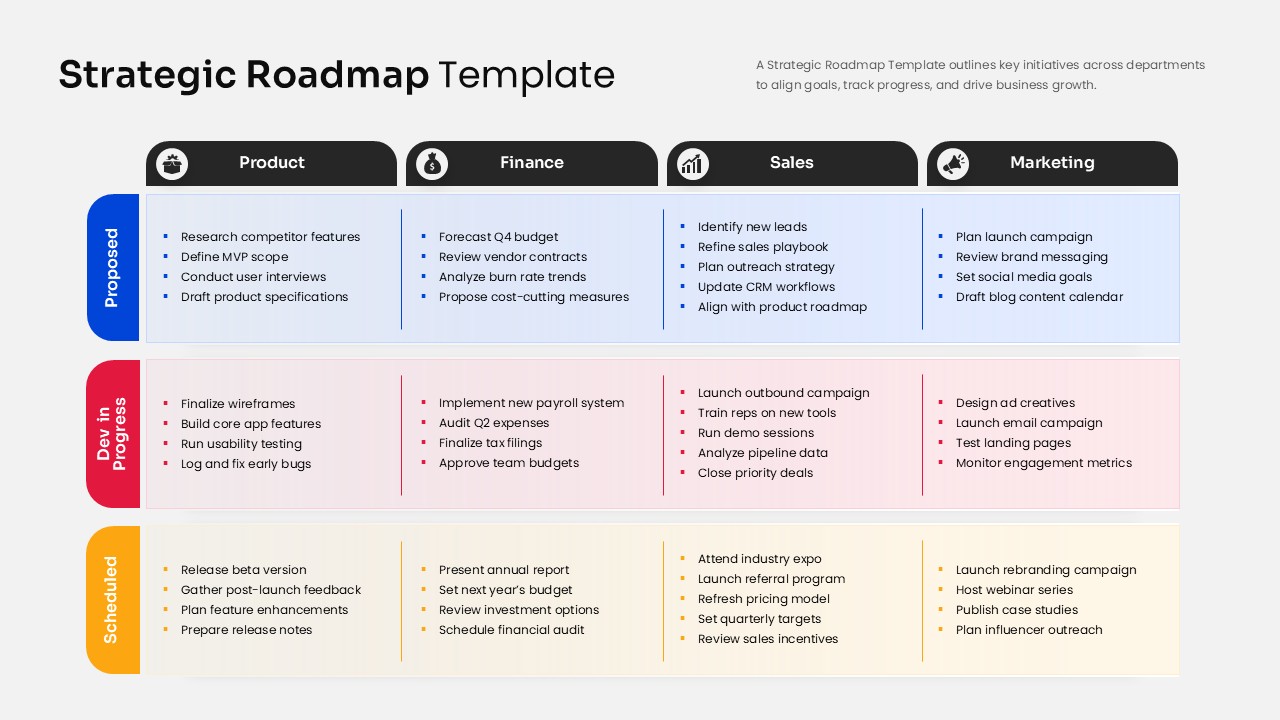

Analyzing And Adjusting Your Budget

Analyzing and adjusting your budget is key to managing quarterly business expenses effectively. It helps track spending and improves financial planning. Regular analysis reveals trends and areas needing change. Adjusting the budget ensures it stays realistic and useful.

This section guides you through reviewing reports, spotting savings, and tweaking categories for better results in future quarters.

Reviewing Quarterly Reports

Start by examining your quarterly reports carefully. Look at all income and expenses recorded in your budgeting tool. Check if actual spending matches your planned budget. Note any big differences or unexpected costs. Use graphs or charts to visualize spending patterns. This step helps you understand where your money went.

Identifying Cost-saving Opportunities

After reviewing reports, find areas to cut costs. Look for recurring expenses that seem too high. Consider cheaper alternatives for supplies or services. Eliminate unnecessary spending that does not add value. Small savings in many areas add up over time. Keep your business goals in mind while choosing what to reduce.

Adjusting Categories For Future Quarters

Use your findings to update budget categories. Increase or decrease amounts based on past spending. Add new categories if new expenses appear. Remove categories that are no longer relevant. Make your budget flexible to adapt to changes. This keeps your budget accurate and practical for future use.

Credit: www.slidekit.com

Maximizing Tax Benefits

Maximizing tax benefits is essential for managing quarterly business expenses. A budgeting tool helps identify and organize expenses that qualify for tax deductions. Keeping accurate records can reduce tax liability and improve financial health.

Using a budgeting tool to track expenses simplifies tax preparation. It ensures no deductible costs are overlooked. This process also helps avoid surprises during tax season.

Tracking Deductible Expenses

Track all business-related expenses carefully. Common deductible costs include office supplies, travel, and utilities. Use the budgeting tool to categorize these expenses accurately. Regular updates prevent missing any deductible items. This practice helps lower your taxable income.

Understanding Irs Limitations

Know the IRS rules for deductions. Some expenses have limits or specific criteria. For example, meals and entertainment may only be partially deductible. The budgeting tool can flag expenses that exceed IRS limits. Staying within these rules avoids audits and penalties.

Preparing Documentation For Tax Filing

Keep all receipts and invoices organized in one place. The budgeting tool can store digital copies of documents. This makes tax filing faster and more accurate. Clear documentation supports your deductions during an IRS review. Always back up your records regularly.

Tips For Long-term Financial Health

Maintaining long-term financial health is essential for any business. Using a budgeting tool for quarterly expenses helps manage money wisely. It allows you to focus on key areas that support stability and growth.

Here are practical tips to keep your business finances strong over time. These tips help balance daily needs with future goals.

Balancing Savings And Debt Repayment

Set clear priorities between saving money and paying off debt. Allocate funds to both areas based on your business situation. Avoid putting all money into one and neglecting the other. Paying debt reduces interest costs. Saving builds a safety net for opportunities and challenges.

Use your budgeting tool to track these payments each quarter. Adjust amounts depending on cash flow and upcoming expenses. This balance keeps your business financially healthy.

Building Emergency Funds

Emergency funds protect your business from unexpected costs. Aim to save at least three to six months of operating expenses. Use your budgeting tool to set aside a fixed amount each quarter. Treat this as a non-negotiable expense.

Having cash ready prevents business disruptions. It offers peace of mind during tough times. Regular contributions build this fund steadily without affecting daily operations.

Planning For Business Growth

Budgeting for growth means investing in new products, marketing, or staff. Use your tool to forecast costs and expected returns. Set aside part of your quarterly budget specifically for growth initiatives.

Tracking these investments helps measure success and adjust plans. Growth planning keeps your business competitive and ready for future demands.

Frequently Asked Questions

What Is The 70/20/10 Budget Rule?

The 70/20/10 budget rule divides income into 70% for essentials, 20% for savings, and 10% for debt repayment or donations.

How To Prepare A Quarterly Budget?

To prepare a quarterly budget, list expected income and expenses for three months. Allocate funds to categories like operations, savings, and debt. Track actual spending weekly. Adjust estimates as needed to stay on target. Use budgeting tools for accuracy and efficiency.

Can You Write Off 100% Of Business Expenses?

You can write off 100% of ordinary and necessary business expenses. Some categories, like meals or vehicles, have IRS limits. Always keep detailed records to support deductions.

What Are The 4 A’s Of Budgeting?

The 4 A’s of budgeting are Assess, Allocate, Adjust, and Analyze. Assess income and expenses, allocate funds wisely, adjust as needed, and analyze results regularly.

Conclusion

Using a budgeting tool helps control your quarterly business expenses. It keeps spending organized and clear. Track your costs regularly to avoid surprises. Adjust your budget as your business needs change. Consistency in using the tool improves financial planning. This simple habit supports better cash flow and savings.

Start small and build your budgeting skills over time. Managing expenses well leads to stronger business growth.