Imagine a world where you can trade assets without needing a broker or an intermediary, where prices adjust automatically based on supply and demand. Sounds intriguing, right?

You’re about to dive into the fascinating realm of Automated Market Makers (AMMs). These innovative tools are reshaping how you engage with financial markets, making them more accessible and efficient. But how do they actually work, and what makes them tick?

Understanding AMMs could be your key to unlocking smarter investment strategies and maximizing returns. Stick around, because this article will unravel the mysteries of AMMs and show you how they can transform your trading experience.

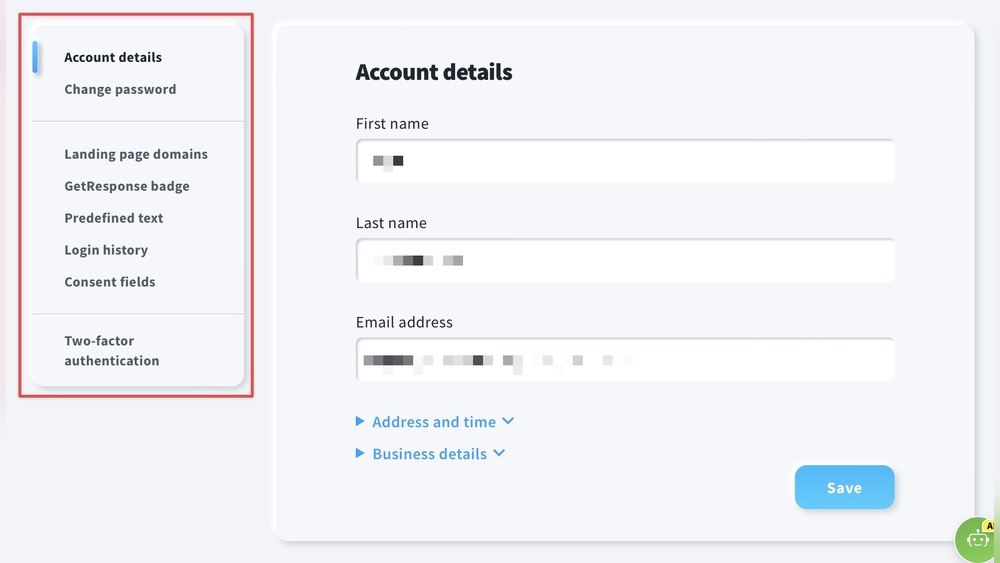

Credit: sdlccorp.com

Automated Market Makers Explained

Automated market makers, or AMMs, help people trade without middlemen. They use special computer programs. These programs create prices for buying and selling. The prices change based on supply and demand. People can trade any time, day or night. It’s like having a shop that’s always open.

AMMs are part of decentralized finance, also called DeFi. In DeFi, there are no banks or brokers. People use AMMs to trade cryptocurrencies easily. They are simple, safe, and fast. Traders love them because they save money on fees.

Liquidity pools are important for AMMs. People add their cryptocurrencies to these pools. The pools help make sure there is always enough to trade. Everyone in the pool earns a small fee when others trade. This keeps the system running smoothly.

Key Components Of Amms

Automated Market Makers (AMMs) operate without a traditional order book. They rely on smart contracts to facilitate trades. Liquidity pools allow users to deposit funds, ensuring seamless transactions.

Liquidity Pools

Liquidity pools are essential for AMMs. They hold tokens for trading. Users add tokens to these pools. They are called liquidity providers. They earn fees for their service. The more tokens in the pool, the better it works. Pools make trading easy and fast.

Smart Contracts

Smart contracts are programs on the blockchain. They run without errors. They ensure trades are safe. No one can change them. They handle trades automatically. No middleman needed. They make trading trustworthy.

Pricing Algorithms

Pricing algorithms set token prices. They use math rules. Prices change with supply and demand. They keep trading fair for all users. Prices are updated quickly. Everyone gets a good deal. No one can cheat the system.

Role Of Liquidity Providers

Liquidity providers play a crucial role in automated market makers by supplying assets to trading pools. They earn fees from transactions, enhancing market efficiency. Their involvement ensures smooth operations and better price stability within the decentralized exchange system.

Benefits For Providers

Liquidity providers play a key role in automated market makers. They add funds to liquidity pools. This helps keep trades smooth. They earn fees from trades in the pool. This is a way to make passive income. The process is simple. Providers just need to deposit their tokens. There is no need for active trading. It’s a hands-off way to earn.

Risks Involved

There are risks for liquidity providers. One risk is impermanent loss. This happens when token prices change. Providers might get back less than they put in. Pools can also be hacked. It’s important to understand these risks. Always do research before joining a pool. Safety is a must.

Incentives And Rewards

Providers get rewards for their service. They earn fees from each trade. Some pools offer extra tokens as rewards. This can increase earnings. Rewards are shared based on the amount added. The more you add, the more you earn. Incentives keep providers engaged. They help ensure enough liquidity in pools.

Credit: www.coinbase.com

How Amms Determine Prices

Automated Market Makers use a simple math formula. This formula helps to set prices. It is called the Constant Product Formula. The formula is: x y = k. Here, x and y are token amounts. K is a constant number. This formula keeps prices balanced. If one token increases, the other decreases. This ensures fair trading in the market.

Price slippage happens when there is a big trade. The trade can change prices quickly. This affects the cost of tokens. Small trades have less slippage. Big trades have more impact. Traders need to be careful. They should plan their trades. Large trades can cost more than expected.

Popular Amm Platforms

Automated Market Makers (AMMs) use smart contracts to facilitate trading on decentralized platforms. Liquidity pools replace traditional order books, allowing users to swap tokens easily. Popular AMM platforms ensure seamless transactions by adjusting prices based on supply and demand, enhancing efficiency and accessibility in crypto trading.

Uniswap

Uniswap is a top platform for trading crypto. It works without middlemen. Traders swap tokens directly. This process is fast and easy. Liquidity providers earn fees. They add tokens to pools. Pools help trades happen smoothly. Uniswap uses Ethereum for transactions. This ensures security. Many users trust Uniswap daily. It supports various tokens.

Sushiswap

SushiSwap is similar to Uniswap. It allows token swaps directly. Users can earn by providing liquidity. SushiSwap has unique features. It offers rewards in its native token, SUSHI. This attracts more users. The platform is open and decentralized. Anyone can participate easily. SushiSwap is part of the DeFi ecosystem. This makes it popular among traders.

Balancer

Balancer offers flexible trading options. Users can create custom pools. Pools can have multiple tokens. This feature is unique. Balancer adjusts automatically. It maintains balance among tokens. Users earn fees by sharing liquidity. Balancer is complex yet user-friendly. Many traders prefer it for diverse options. It supports various crypto assets.

Challenges Facing Amms

Automated Market Makers face challenges like liquidity risks and price slippage. These systems use algorithms to facilitate trading without traditional order books. Understanding their mechanics and limitations is crucial for effective market participation.

Impermanent Loss

Impermanent loss is a big worry for traders. Prices change quickly. This causes loss. It’s not always easy to predict. Traders might lose money instead of gaining. This makes trading risky. AMMs can’t always protect against this loss. Understanding this risk is crucial for traders.

Security Concerns

AMMs can face security problems. Hackers look for weak spots. They can steal funds. Security is vital to keep funds safe. Developers must fix bugs quickly. Users must trust the system to keep their money safe. Vigilance is key to safety.

Regulatory Issues

Rules for AMMs are not clear. Governments are still learning about AMMs. They might make new rules soon. Traders must follow these rules. Breaking rules can lead to fines. It’s important to stay updated with regulations. Compliance helps avoid trouble.

Future Of Automated Market Makers

Automated Market Makers streamline trading by using algorithms instead of traditional order books. They provide liquidity by automatically adjusting prices based on supply and demand, enabling seamless and efficient transactions. Their future promises more innovation, making trading accessible to a broader audience.

Innovation In Amm Technology

Automated Market Makers (AMMs) bring exciting changes. They use smart contracts to set prices. This removes middlemen. It makes trading fast and easy. New algorithms improve accuracy. This helps users get the best prices. Security features are stronger now. This keeps funds safe from hackers. User interfaces are simpler. Everyone can trade easily. More people can join the crypto world.

Integration With Defi Ecosystem

AMMs fit well in the DeFi ecosystem. They connect different financial tools. Users can swap tokens easily. They can also earn interest. Everything is automatic. No need for banks. Liquidity pools are important here. Users add tokens to pools. This helps others trade. Pools give rewards to users. Everyone benefits from these pools. AMMs make DeFi more popular.

Credit: www.coinbase.com

Frequently Asked Questions

How Does Automated Market Making Work?

Automated market making uses algorithms to provide liquidity in markets. It sets prices for buying and selling assets based on supply and demand. Traders interact with smart contracts on decentralized exchanges, ensuring efficient transactions. This system helps maintain balance and reduces price volatility.

What Is The Fee For The Amm Pool?

The fee for an AMM pool varies by platform. Typically, it ranges from 0. 1% to 1% per transaction. Always check specific platform details for precise rates.

What Are The Disadvantages Of Amm?

AMMs face impermanent loss, potentially reducing profits for liquidity providers. They may struggle with low liquidity in some markets. Automated algorithms can be exploited by sophisticated traders, affecting pricing accuracy. Users might experience high slippage during large transactions, impacting trade value.

How Do Market Maker Bots Work?

Market maker bots automate buying and selling to provide liquidity. They place orders on both sides of the order book. These bots profit from the spread between buy and sell prices. They help stabilize markets by reducing volatility and improving trading efficiency.

Conclusion

Automated Market Makers (AMMs) simplify trading in decentralized finance. They use smart contracts to manage trades efficiently. AMMs help users trade without needing a traditional order book. This makes trading faster and easier for everyone. Liquidity pools are crucial in this process.

They provide the funds needed for trading activities. AMMs also allow anyone to provide liquidity and earn fees. This democratizes access to trading and investing. Understanding AMMs can open new opportunities in the crypto market. As technology evolves, AMMs will play a vital role in digital finance.

Stay informed and explore their potential.