Are you struggling to decide between accrual and cash accounting in QuickBooks? You’re not alone.

Many business owners find themselves puzzled when it comes to choosing the right accounting method. The choice can significantly impact your financial reporting and tax obligations. By understanding the differences, you’ll gain better control over your finances and make more informed decisions.

We’ll break down the complexities of QuickBooks accrual vs cash accounting in simple terms. You’ll learn how each method can affect your business, helping you choose the one that best fits your needs. Let’s dive in and clear up the confusion, so you can focus on what you do best—growing your business.

👉👉 Recommended: QuickBooks – The #1 Accounting Software for Small Business Owners

Credit: quickbooks.intuit.com

Basics Of Accounting Methods

Understanding the basics of accounting methods is crucial for managing your finances effectively. These methods determine how you record your income and expenses. They impact your financial statements and tax obligations significantly. Choosing the right method can streamline your financial operations and offer clearer insights into your business performance.

Accrual Method

The accrual method records income and expenses when they are incurred, regardless of when cash is exchanged. If you send an invoice today, the income is recorded now, even if you get paid next month. This method gives a more accurate picture of your financial health.

Imagine you’re running a bakery and have a large order for wedding cakes. You bill the client today but will receive payment after the wedding. With the accrual method, you can track your revenue and expenses in real-time. This helps in planning for future expenses or investments.

However, it requires more detailed record-keeping. You need to monitor accounts receivable and accounts payable closely. This can be challenging but offers a comprehensive view of your business’s financial status.

Cash Method

The cash method records income and expenses when cash is actually received or paid. You get paid for a cake, and you record the income. It’s straightforward and easier for small businesses with simpler transactions.

Think of it like managing your personal budget. You note expenses when you pay bills and income when you receive your paycheck. This method is simple and doesn’t require tracking invoices or accounts payable.

But here’s the catch: it might not reflect your actual financial position. You could have a lot of pending invoices, but your books show less income than accrued. It can skew your understanding of available resources.

Have you ever faced a situation where your bank balance looked healthy, but unpaid bills painted a different picture? The cash method can sometimes lead to this disconnect. It’s essential to consider if this approach suits your business’s complexity and scale.

Choosing between accrual and cash methods is not just an accounting decision. It’s about how you want to see your business. Are you looking for a real-time snapshot or a simpler cash-in, cash-out view? Your choice will shape your financial strategies and, ultimately, your business success.

Credit: www.finoptimal.com

Key Differences

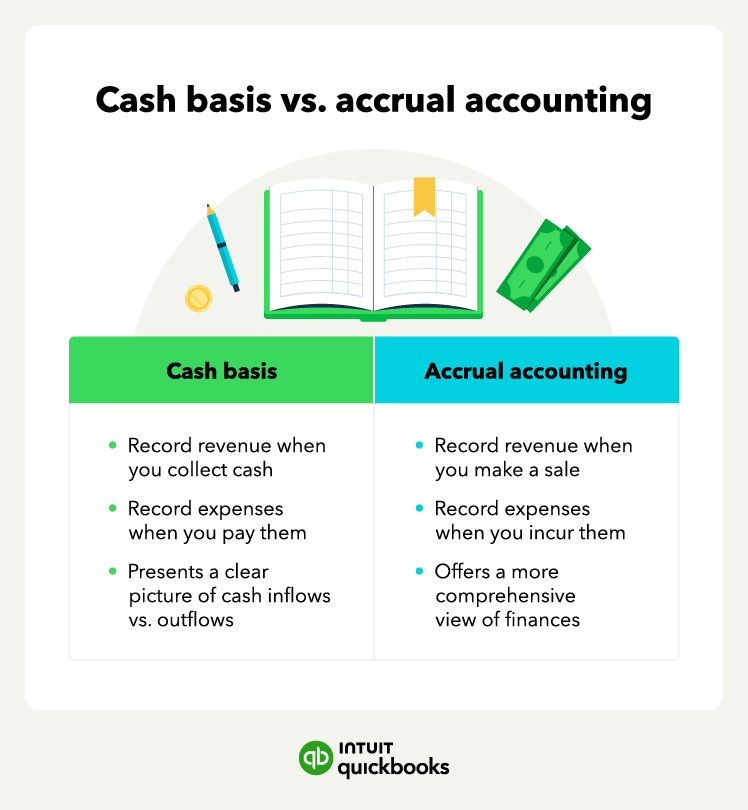

Understanding the difference between accrual and cash accounting is vital. Each method impacts how you record transactions in QuickBooks. This affects the overall view of your business finances.

The choice between accrual and cash can change your financial picture. It’s crucial to know how each method records revenue and expenses. Let’s explore the key differences.

Revenue Recognition

Accrual accounting records revenue when it’s earned. Not when cash is received. This offers a more accurate financial picture. It shows money due to you, even if not yet paid.

In contrast, cash accounting records revenue only when cash is in hand. This can delay recognizing income. It reflects only the actual cash flow, not future receivables.

Expense Recording

Accrual accounting records expenses when they occur. Even if not yet paid. This method matches expenses with related revenues.

Cash accounting records expenses only when paid. This can delay recognizing some costs. It may not match expenses with revenue timing.

Impact On Financial Statements

Accrual accounting provides a comprehensive view. It shows both revenues and expenses as they happen. This method gives a better picture of long-term financial health.

Cash accounting offers a simpler view. It shows real-time cash flow. But it might not reveal future liabilities or earnings.

Advantages Of Accrual Method

Accrual accounting in QuickBooks provides a clearer financial picture by recording revenues and expenses when they occur, not when cash is exchanged. This method offers better long-term financial planning and helps businesses track outstanding debts and credits, ensuring accurate financial statements and improved decision-making capabilities.

Choosing the right accounting method can significantly impact how you see your business’s financial health. The accrual method offers distinct advantages that can provide a clearer, more accurate picture of your finances. Understanding these benefits might change how you approach your bookkeeping, potentially leading to smarter business decisions.

Accurate Financial Picture

The accrual method records income and expenses when they are incurred, not when money actually changes hands. This approach ensures that you see your business’s true financial state at any given moment.

Imagine you’re waiting on several large invoices to be paid. Under the cash method, your books might show a bleak picture until payments arrive. With accrual accounting, those invoices are recorded as soon as they are issued, reflecting a more accurate financial status.

Are you capturing the real story of your business finances, or just waiting for payments to clear?

Better Matching Principle

The accrual method allows you to match revenues with related expenses within the same period. This principle is crucial for understanding profitability.

Think about a scenario where you launch a marketing campaign. The expenses occur immediately, but the revenue might flow in over several months. Accrual accounting ensures these expenses are matched with the revenue they generate, providing a clear picture of the campaign’s success.

Does your current method help you see the true impact of your investments?

Compliance With Gaap

Accrual accounting is compliant with Generally Accepted Accounting Principles (GAAP), which is essential for businesses seeking external financing or preparing for audits. GAAP compliance indicates that your financial statements are reliable and standardized.

If you plan to grow your business, seek investors, or consider going public, aligning with GAAP through accrual accounting can ease these transitions. It shows that you are serious about your financial reporting.

Is your accounting method preparing your business for future opportunities?

Embracing the accrual method may seem daunting initially, but its advantages can position your business for success. Accurate financial insights, better matching of income and expenses, and GAAP compliance could be the key to unlocking your business’s potential.

Credit: quickbooks.intuit.com

Advantages Of Cash Method

The cash method in QuickBooks simplifies accounting. It records transactions only when money changes hands. This approach helps small businesses manage finances easily, offering clear insights into cash flow.

Are you considering the best accounting method for your business? The cash method might be your answer. While the accrual method has its merits, the cash method offers unique advantages that can simplify your financial life. Let’s dive into how this approach can benefit you.

Simplified Record Keeping

The cash method is straightforward. You record income when money is actually received, and expenses when they’re paid. This simplicity means fewer headaches when tracking transactions.

Imagine having less paperwork and fewer chances for errors. Wouldn’t that make your life easier?

A friend once shared how switching to the cash method freed up time and resources. Instead of getting bogged down in accounting details, she focused on growing her business.

Improved Cash Flow Management

Knowing your exact cash position is crucial. With the cash method, you have a clear view of what’s available to spend. This knowledge helps you make informed decisions.

Think about how less stress over cash flow can positively impact your daily operations. You can plan better and avoid financial surprises.

Consider the advantage of seeing immediate results from your sales efforts. It’s like having a financial mirror reflecting the reality of your business.

Tax Timing Benefits

The cash method can offer flexibility in tax timing. You can control when you report income and expenses. This can help you manage tax liabilities more effectively.

Imagine being able to defer income to the next tax year or accelerate expenses to reduce your current tax burden. That’s smart tax planning.

Does your business need a break on taxes in a challenging year? The cash method could provide that breathing room.

In choosing the cash method, you embrace simplicity and flexibility. How might these advantages change your business landscape? The choice is yours, but remember to weigh the benefits carefully.

Choosing The Suitable Method

Choosing the suitable accounting method for your business can impact financial insights. QuickBooks offers two primary methods: accrual and cash basis. Each has unique benefits and considerations that can affect your business operations. Understanding which method aligns with your business needs ensures accurate financial management.

Business Size Considerations

Business size plays a crucial role in selecting the right accounting method. Smaller businesses often prefer cash basis due to its simplicity. This method records transactions when money exchanges hands. It provides a straightforward view of cash flow. Larger businesses may benefit from accrual accounting. It records transactions when they occur, regardless of payment. This method offers a detailed financial picture.

Industry Standards

Different industries may favor one accounting method over another. Service-based industries often use cash basis. They need to track immediate cash flow for services rendered. Manufacturing or retail industries might lean towards accrual accounting. They require detailed insights into inventory and future sales. Following industry standards can enhance financial reporting accuracy.

Regulatory Requirements

Regulatory requirements can dictate the choice between accrual and cash basis. Some jurisdictions mandate accrual accounting for specific business types. This ensures compliance with tax laws and financial reporting standards. Understanding local regulations is crucial. It helps avoid legal pitfalls and ensures smooth operations.

Switching Between Methods

Choosing between accrual and cash methods in QuickBooks simplifies financial tracking. Accrual records transactions when they occur, while cash records them upon payment. Understanding these methods helps businesses maintain accurate financial records.

Switching between cash and accrual accounting methods in QuickBooks can feel like navigating a maze. Each method has its benefits, and choosing the right one can significantly impact your business’s financial health. You might find yourself wondering if a switch is necessary, and how it might affect your business operations. Let’s dig into the details and see what it takes to make this transition smoothly.

###

Irs Guidelines

Before making a switch, it’s crucial to understand the IRS guidelines regarding accounting methods. The IRS allows businesses to choose their accounting method, but switching requires approval. You may need to file Form 3115, Application for Change in Accounting Method.

Certain businesses, like those with gross receipts over $25 million, are required to use the accrual method. If your business doesn’t meet these requirements, you may still switch, but ensure compliance to avoid potential penalties. Always consult a tax professional before making major changes.

###

Impact On Financial Reporting

Switching your accounting method can change how your financial health is reported. The cash method records transactions when money changes hands. This can make your books look healthier during periods of slow cash flow.

The accrual method, however, records income and expenses when they are incurred, regardless of cash flow. This provides a more accurate picture of your business’s financial status. Consider how this change might affect your financial analysis and decision-making processes.

###

Steps For Transition

Making the transition involves a few key steps. First, analyze your current accounting needs and determine if a switch aligns with your business goals.

Next, consult with an accountant or a financial advisor to understand the implications and ensure compliance with IRS regulations. Then, update your QuickBooks settings to reflect the new method, ensuring accuracy in your financial reporting.

Finally, monitor your financial statements closely after the switch. This will help you adjust and optimize your accounting practices moving forward.

Have you considered what benefits this switch might bring to your business? Could it offer a clearer financial picture, or improve cash flow management? Your decision could be transformative, offering new insights into your financial operations.

Common Mistakes To Avoid

Understanding the differences between accrual and cash accounting in QuickBooks is crucial. Many users make common mistakes that can impact financial accuracy. These errors can lead to significant issues if not addressed. This section highlights some common pitfalls to avoid, ensuring smoother bookkeeping.

Misclassification Of Transactions

Misclassifying transactions is a frequent error in QuickBooks. Users often confuse income with expenses. Assign each transaction to the correct account to maintain accuracy. Incorrect classification can distort financial reports. It may affect decision-making and financial health assessments.

Inconsistent Application

Consistency in accounting methods is vital. Switching between accrual and cash methods can cause confusion. QuickBooks users should stick to one method for consistency. This practice helps in maintaining clear financial records. Inconsistency can lead to errors and misleading financial statements.

Neglecting Tax Implications

Tax implications vary between accrual and cash accounting. Many users overlook these differences in QuickBooks. This oversight can result in incorrect tax filings. Understanding each method’s tax impact is crucial. It ensures compliance and avoids potential penalties.

Frequently Asked Questions

What Is The Difference Between Accrual And Cash In Quickbooks?

QuickBooks uses accrual accounting to record income and expenses when they occur, regardless of payment timing. Cash accounting records transactions only when money changes hands. Accrual provides a more accurate financial picture, while cash offers simpler tracking for immediate cash flow.

Both methods suit different business needs.

Should I Choose Cash Or Accrual?

Choose cash basis for simplicity and immediate expense recognition. Opt for accrual for a comprehensive financial picture. Consider business size, complexity, and tax implications. Consult an accountant for personalized advice.

Can You Switch Between Cash And Accrual In Quickbooks?

Yes, you can switch between cash and accrual accounting in QuickBooks. Go to “Reports” and select “Customize Report” to change the accounting method. This flexibility allows you to view financials in both formats.

Conclusion

Choosing between accrual and cash methods in QuickBooks depends on your needs. Accrual offers a detailed view of finances. Cash shows actual cash flow. Each method has its benefits. Consider your business size and complexity. Small businesses might prefer cash.

Larger ones may need accrual. Always consult with an accountant for guidance. They can help make the best decision for your situation. Understand the impact on your financial statements. Make an informed choice. Accurate records lead to better business decisions.

Keep your financial health in check. Choose wisely.