Are you confused about managing your finances with QuickBooks? You’re not alone.

Many people struggle to understand the difference between “Cash on Hand” and “Bank Account” in this popular accounting software. Imagine feeling more in control of your money, knowing exactly where each dollar is at any given moment. It’s not just a dream—it’s a reality you can achieve with the right knowledge.

By mastering these two vital components in QuickBooks, you’ll unlock the secret to smarter financial management and peace of mind. Let’s dive into the world of QuickBooks and discover how these accounts can transform the way you handle your business or personal finances. Keep reading, because the clarity you seek is just a few scrolls away.

👉👉 Recommended: QuickBooks – The #1 Accounting Software for Small Business Owners

Cash On Hand Basics

Managing finances efficiently is crucial for any business. Understanding the difference between QuickBooks Cash on Hand and a bank account can significantly impact your financial strategy. Let’s dive into the basics of cash on hand and why it matters for your business.

Definition Of Cash On Hand

Cash on hand refers to the physical money your business has readily available. This includes cash in registers, safes, or petty cash. Unlike digital funds in your bank account, cash on hand is tangible and can be used immediately.

Imagine running a cafe. You need cash to give change to customers or handle small expenses. Having cash on hand ensures you can operate smoothly without waiting for bank transactions.

Importance In Business

Why should you care about cash on hand? It’s all about flexibility and preparedness. Having immediate access to cash allows your business to handle unexpected expenses or seize sudden opportunities.

Consider a scenario where a supplier offers you a discount for immediate cash payment. If you have enough cash on hand, you can take advantage of this offer and save money. Ask yourself: Is your business equipped to react swiftly in such situations?

Moreover, maintaining a balance between cash on hand and bank account funds can help you avoid cash flow problems. It’s not just about having money; it’s about having it where you need it, when you need it. Are you optimizing your cash resources for maximum efficiency?

Credit: quickbooks.intuit.com

Bank Account Essentials

When managing finances, understanding the essentials of a bank account can make a significant difference in how you handle QuickBooks Cash on Hand versus your bank account. Bank accounts are more than just a place to store money; they are a tool for managing and optimizing your financial activities. Knowing the intricacies of bank accounts can empower you to make informed decisions and maximize your financial potential.

Understanding Bank Accounts

Bank accounts are financial accounts maintained by a bank or credit union for a customer. They are essential for managing day-to-day transactions and safeguarding your money. You might wonder, what exactly does a bank account do for you?

At its core, a bank account allows you to deposit and withdraw money, pay bills, and even earn interest on your balance. But there’s more. Bank accounts often come with additional features like online banking, mobile apps, and customer service, which enhance your ability to manage your finances efficiently.

Understanding these features can help you choose the right account that aligns with your financial goals. For instance, if you frequently travel, an account with no foreign transaction fees can save you money. Or if you’re just starting to save, finding an account with a high-interest rate can help grow your savings faster.

Types Of Bank Accounts

There are various types of bank accounts, each serving a unique purpose. The most common types include checking accounts, savings accounts, and money market accounts. Each has its benefits and limitations.

Checking accounts are typically used for everyday transactions. They offer features like debit cards and online bill pay, making them ideal for managing regular expenses. Consider it your financial hub for daily activities.

Savings accounts, on the other hand, are designed to help you save money over time. They usually offer higher interest rates than checking accounts. Imagine setting aside money here for a rainy day or a future vacation.

Money market accounts combine features of both checking and savings accounts. They often require a higher minimum balance but offer higher interest rates. If you have a significant amount to store while still needing occasional access, this might be your best option.

Choosing the right type of bank account can significantly impact how you manage your finances. Ask yourself, what are your financial goals, and which type of account aligns with these goals?

Tracking Cash Flow

QuickBooks helps track cash flow by comparing cash on hand with bank account balances. This feature simplifies financial management, showing real-time cash availability for better budgeting decisions. It offers insights into daily spending and helps avoid overdrafts.

Tracking cash flow effectively is crucial for the health of your business. It’s the lifeblood that keeps operations running smoothly. Understanding the difference between QuickBooks Cash on Hand and your Bank Account can help you make smarter decisions.

Role In Financial Management

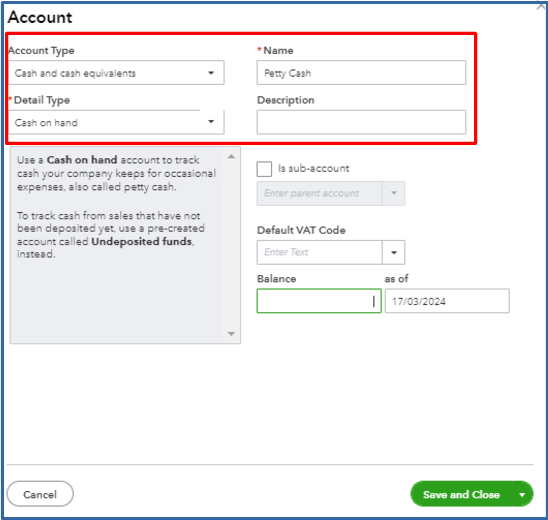

QuickBooks Cash on Hand is your immediate access to funds. It’s like having cash in your wallet, ready for daily expenses. Think of it as your business’s petty cash.

Your bank account is more structured, offering a bigger picture of your financial standing. It’s where you manage larger transactions and track long-term financial health.

Both play distinct roles. Cash on Hand helps you manage daily cash flow needs efficiently. Your bank account aids in strategic planning and long-term financial management.

Impact On Business Decisions

Consider the impact these accounts have on your decisions. Cash on Hand allows you to react quickly to unexpected expenses. It’s your buffer for immediate needs.

On the other hand, your bank account affects bigger decisions. It provides insights into trends and potential for investments or expansions.

Balance between these two ensures you aren’t caught off guard. Are you leveraging both accounts effectively to steer your business toward success?

Keeping track of these accounts can shift your perspective. It can reveal areas for improvement and opportunities for growth. Are you ready to refine your cash flow strategy?

Recording Transactions

Distinguish between QuickBooks Cash on Hand and Bank Account for accurate transaction recording. Cash on Hand tracks immediate cash accessible for expenses. Bank Account reflects funds deposited in the bank, useful for managing larger financial commitments. Understanding both ensures better financial management and clarity.

Recording transactions accurately is essential when managing your finances in QuickBooks, whether you’re dealing with cash on hand or a bank account. Proper recording ensures that your financial statements reflect the true state of your business. But how do you ensure you’re doing it correctly? Let’s dive into the methods and accuracy needed for efficient transaction recording.

Methods Of Recording

You have several methods at your disposal for recording transactions in QuickBooks. One common method is manual entry, where you input each transaction by hand. This can be time-consuming but offers you a high degree of control over each entry.

Another option is to connect your bank account directly to QuickBooks. This method allows for automatic transaction imports, saving you time and reducing human error. However, it requires vigilance to ensure that all transactions are correctly categorized.

For cash transactions, you might use the QuickBooks cash account feature. This involves recording each cash movement manually, which can be tedious but is necessary for accurate cash management.

Accuracy In Financial Statements

Accuracy is crucial for financial statements to provide a clear picture of your business’s health. Misrecorded transactions can lead to incorrect profit and loss statements, affecting your decision-making.

Consider using the reconciliation feature in QuickBooks. Reconcile your accounts regularly to ensure that your recorded transactions match your bank statements. This practice helps identify any discrepancies early on, ensuring your books are always accurate.

Think about the last time you were surprised by an unexpected bank fee or discrepancy. Regular reconciliation could have flagged that issue sooner, saving you both time and money.

Are you confident in the accuracy of your current financial statements? If not, reviewing your recording practices might be the key to more reliable financial insights.

Liquidity Comparison

Liquidity is crucial for any business aiming to maintain smooth operations. QuickBooks offers a unique perspective on liquidity by comparing cash on hand with bank account balances. Understanding this distinction can help businesses manage their finances more effectively.

Access To Funds

Cash on hand provides immediate access to funds. Businesses can use it for urgent payments or unforeseen expenses. Bank accounts, while secure, may have restrictions. Transfers might take time, limiting immediate access. This affects how quickly a business can respond to financial needs.

Implications For Business Operations

Having cash on hand ensures operational flexibility. It supports daily expenses without delay. On the other hand, relying solely on a bank account may require planning. Businesses need to consider transaction times and potential fees. This can impact budgeting and financial planning.

Credit: quickbooks.intuit.com

Security Considerations

Security considerations play a vital role in managing finances. Choosing between cash on hand and a bank account involves assessing security risks. Understanding these risks helps in making informed decisions. Let’s explore the security aspects of cash on hand versus bank accounts.

Risks Of Cash On Hand

Cash on hand poses several risks. Theft is a major concern. Keeping large amounts of cash increases vulnerability to theft. Cash lacks formal tracking. Loss of cash means permanent loss. There’s no way to recover stolen cash. Fire or other disasters can destroy cash. Insurance for cash is often limited or costly. Cash management demands vigilance. Organizing cash securely requires careful planning. It also requires constant monitoring.

Bank Account Protections

Banks offer significant security features. Accounts are protected against theft. Banks provide insurance for deposits. FDIC insures deposits up to certain limits. Electronic records ensure tracking of funds. Banks use encryption to protect data. Unauthorized access is monitored and prevented. Banks offer fraud detection services. Financial institutions constantly update security protocols. Bank accounts reduce physical risks. Funds remain safe from physical disasters. Managing funds in a bank is generally safer.

Tax Implications

Understanding tax implications of QuickBooks cash on hand and bank accounts is crucial. Cash on hand may require careful tracking for tax reporting. Bank accounts often provide clearer documentation, simplifying tax preparation.

Understanding the tax implications of managing QuickBooks Cash on Hand versus a Bank Account can save you time and money. It’s not just about keeping track of cash flow; it’s about preparing for tax season with confidence. Let’s dive into what you need to know to stay compliant and maximize your potential deductions.

Reporting Requirements

Tracking your cash on hand requires meticulous attention to detail. You need to record every transaction accurately to ensure your financial statements reflect reality. If you fail to report your cash on hand properly, you might face penalties or audits, which can be stressful and costly.

On the other hand, bank accounts provide a more structured way of tracking income and expenses. Banks automatically keep records for you, which can simplify your reporting process. However, you still need to ensure that all transactions align with your records in QuickBooks for accurate reporting.

Potential Deductions

Cash on hand can offer unique deduction opportunities, but only if you document everything properly. For example, petty cash expenses for small business purchases can be deducted, but you need receipts and proper documentation. Missing out on these deductions means you might be leaving money on the table.

Bank accounts also present deduction opportunities, often in the form of transaction fees or interest charges. These can add up over time, and keeping track of them can lead to significant savings. Always look for expenses that can be legitimately deducted to reduce your taxable income.

Have you ever considered how overlooking small expenses could impact your tax return? Ensuring every dollar is accounted for might seem tedious, but it can lead to substantial tax savings.

By maintaining accurate records and understanding the distinctions between cash on hand and bank accounts, you can better manage your finances. This knowledge not only helps you comply with tax regulations but also ensures you’re not missing out on valuable deductions. Stay proactive, and your efforts will pay off when tax season rolls around.

Credit: quickbooks.intuit.com

Choosing The Right Option

Deciding between QuickBooks Cash on Hand and a bank account? QuickBooks offers instant tracking for cash transactions. In contrast, a bank account provides security and interest on deposits.

Choosing the right option between QuickBooks Cash on Hand and a Bank Account can be a pivotal decision for your business. Both have their advantages, but understanding which one aligns best with your needs is essential. Whether you’re managing a startup or an established business, the choice you make can impact your financial flexibility and control.

Factors To Consider

When deciding, consider how each option will affect your day-to-day operations. Do you need immediate access to cash for small, frequent transactions, or are you looking for a way to manage larger sums securely?

Think about the level of record-keeping required. QuickBooks Cash on Hand allows you to track cash transactions easily, but it might lack the stringent controls and reporting features of a bank account.

Additionally, consider transaction fees and interest rates. A bank account might offer interest on deposits, while cash on hand won’t. Are these potential savings or earnings significant for your business?

Balancing Cash And Bank Accounts

Finding the right balance between cash on hand and bank accounts can optimize your financial management. You might decide to keep a certain amount of cash available for daily expenses while depositing larger sums in the bank to take advantage of interest rates.

This approach can also reduce the risk of theft or loss, as excess cash isn’t kept on-site. However, maintaining this balance requires diligent monitoring and management.

A practical tip is to set a cash threshold—an amount you feel comfortable keeping on hand. If you exceed this, consider depositing the excess into your bank account. This strategy ensures you have the liquidity you need without compromising security.

Have you ever experienced an unexpected cash shortfall or had too much idle cash sitting around? Reflect on those experiences to guide your decision. By carefully weighing these factors, you’ll be better equipped to choose the financial option that supports your business’s growth and stability.

Frequently Asked Questions

Is It Better To Have Cash On Hand Or In The Bank?

Keep some cash for emergencies, but store the majority in the bank for security and interest benefits. Balancing both provides liquidity and financial growth. Evaluate your needs and risk tolerance to decide the best distribution. Remember, banks offer safety and potential interest earnings, unlike cash.

What Does Cash On Hand Mean In Quickbooks?

Cash on hand in QuickBooks refers to physical cash available for business expenses. It tracks cash transactions separately from bank accounts, ensuring accurate financial records. This helps manage liquidity and monitor cash flow effectively. Regular updates maintain precise financial health insights, facilitating informed decision-making for business operations.

Why Is The Amount In Quickbooks Different From Bank Balance?

QuickBooks and bank balances can differ due to pending transactions, reconciliation issues, or data entry errors. Regularly updating QuickBooks and checking for discrepancies helps ensure accurate alignment with your bank.

Conclusion

Choosing between QuickBooks Cash on Hand and Bank Account matters. Each option offers unique benefits. QuickBooks Cash on Hand helps track immediate cash flow. This is useful for daily business needs. Bank Accounts provide security and detailed transaction records. They are great for long-term financial planning.

Understand your needs before deciding. This will help you manage money wisely. QuickBooks can simplify this process. It offers tools to manage finances easily. Remember, smart financial choices lead to business success. Make informed decisions to ensure your business thrives.

Stay organized and efficient with QuickBooks.