Are you a freelancer, gig worker, or small business owner trying to keep track of your finances? Managing income and expenses can be a headache, especially when you’re juggling multiple projects.

You need a solution that’s simple, efficient, and tailored just for you. That’s where QuickBooks for Self-Employed comes in. Imagine having a tool that not only saves you time but also helps you maximize your deductions and ultimately keep more money in your pocket.

Intrigued? We’ll explore how QuickBooks for Self-Employed can transform the way you manage your finances, giving you more freedom to focus on what truly matters. Stay with us to learn how this powerful tool can simplify your financial life and empower your business success.

Getting Started With Quickbooks

Starting with QuickBooks for Self Employed can simplify your finances. This tool helps track expenses and manage invoices. Setting it up is straightforward, even for beginners.

Account Setup

Creating an account in QuickBooks is simple. Visit the QuickBooks website and select “Self-Employed” from the options. Fill in your details, including email and password. Once done, you’ll receive a confirmation email. Click the link to verify your account.

Initial Configuration

After setting up your account, configure your settings. First, connect your bank accounts. This allows QuickBooks to track transactions automatically. Next, set your business information. Include your business name and contact details. Adjust your tax settings. This ensures accurate tax calculations.

Explore the dashboard. Familiarize yourself with features like expense tracking and invoice creation. Adjust your preferences to suit your needs. With these simple steps, you’re ready to use QuickBooks.

Tracking Income And Expenses

QuickBooks for Self-Employed simplifies managing finances. It efficiently tracks income and expenses, helping freelancers stay organized. This tool offers easy-to-use features that make financial management straightforward, enhancing productivity.

Tracking income and expenses is vital for anyone self-employed. Without a clear picture of your finances, you might find yourself struggling to make informed business decisions. QuickBooks for Self-Employed offers tools that make this process straightforward and efficient. With features designed to manage invoices and record expenses, you can stay on top of your financial game.

Managing Invoices

Creating and managing invoices can be daunting. QuickBooks simplifies this task by allowing you to generate professional-looking invoices in minutes. You can easily customize them with your logo and preferred colors, giving your business a polished image.

Have you ever forgotten to follow up on unpaid invoices? QuickBooks sends automatic reminders, helping you get paid faster. This feature can save you hours of manual tracking. You can also track invoice statuses—knowing which ones are viewed, paid, or overdue—right from your dashboard.

Recording Expenses

Keeping track of every expense is crucial to understanding your business’s financial health. With QuickBooks, recording expenses is as easy as snapping a photo of your receipts. No more shoeboxes full of paper cluttering your space.

Link your bank account to automatically import expenses. This means you’ll spend less time entering data and more time growing your business. QuickBooks categorizes expenses for you, making tax time less stressful.

Do you often wonder where your money goes each month? The app provides clear, comprehensive reports that break down your spending. This insight helps you make smarter financial decisions and identify areas to cut costs.

QuickBooks for Self-Employed equips you with the tools you need to manage your business finances effectively. By leveraging these features, you can focus more on what you love—running your business—and less on the tedious financial details. Are you ready to take control of your income and expenses?

Tax Preparation Features

Managing taxes can be daunting, especially for self-employed individuals juggling multiple roles. QuickBooks for Self Employed offers robust tax preparation features that simplify this process. Imagine having a tool that not only helps with calculating taxes but also assists in filing them. Let’s dive into how these features can make your tax season less stressful.

Automatic Tax Calculations

QuickBooks for Self Employed provides automatic tax calculations that save you time and reduce errors. You no longer need to spend hours inputting numbers into complicated spreadsheets. The software automatically tracks your income and expenses, calculating your estimated quarterly taxes with precision. It’s like having a virtual accountant that updates your tax liability each time you add a transaction.

Consider how much peace of mind this brings. You can focus on growing your business instead of worrying about tax calculations. Have you ever missed a tax payment because you weren’t sure of your liability? QuickBooks aims to prevent that by keeping you informed and prepared.

Tax Filing Assistance

Filing taxes can be intimidating, but QuickBooks simplifies this with its tax filing assistance feature. You receive guidance tailored to your specific situation, ensuring you understand every step of the process. It’s like having a tax advisor available 24/7, helping you navigate complex tax forms.

QuickBooks also integrates with TurboTax, making e-filing a breeze. Imagine not having to shuffle through heaps of paperwork or stress over missing deadlines. With everything organized and at your fingertips, you can file your taxes confidently and promptly.

How many times have you felt overwhelmed by tax jargon? This tool aims to demystify the process, making tax filing less of a chore and more of a streamlined task. As you leverage these features, think about how much easier your tax season could be.

Integrating Bank Accounts

Integrating bank accounts with QuickBooks for Self Employed simplifies financial tracking. It helps freelancers manage expenses and income efficiently. Automatic transaction updates save time and reduce errors.

Integrating your bank accounts with QuickBooks for Self-Employed can transform the way you manage your finances. Imagine having all your transactions automatically synced and categorized, saving hours of tedious data entry. By connecting your bank accounts, you can focus more on growing your business and less on bookkeeping.

Connecting Accounts

Start by navigating to the banking section within QuickBooks. It’s a simple process that guides you through adding your accounts. QuickBooks supports most major banks, making it easy to connect securely.

Think about the time you spend manually entering transactions. Wouldn’t it be nice to eliminate that task altogether? With QuickBooks, once your accounts are linked, your transactions flow into the system automatically.

Security is crucial, and QuickBooks uses encryption to protect your data. You can rest easy knowing your information is safe.

Transaction Sync

Once your bank accounts are connected, QuickBooks begins syncing your transactions. This means every purchase, deposit, and expense is recorded without you lifting a finger.

Have you ever missed an expense during tax season? Automatic syncing ensures no transaction is overlooked, helping you stay organized and prepared.

QuickBooks categorizes transactions for you, but you have the power to adjust these categories. This flexibility helps tailor your financial records to suit your business needs.

What would you do with the extra time saved from syncing transactions? Perhaps you could focus on strategizing your next big business move. Integrating your bank accounts with QuickBooks for Self-Employed isn’t just a feature—it’s a game-changer for your financial management.

Budgeting Tools

QuickBooks for Self-Employed offers an easy way to track expenses and manage income efficiently. Ideal for freelancers, it helps simplify tax calculations. This tool provides clear financial insights, aiding in better budgeting decisions.

When managing your finances as a freelancer or small business owner, QuickBooks for Self-Employed offers a suite of Budgeting Tools that can be game-changers. These tools aren’t just about crunching numbers; they’re about empowering you to make smarter financial decisions. You’ll find yourself more in control of your money, leading to better business outcomes.

Setting Financial Goals

Setting financial goals is crucial for any entrepreneur. QuickBooks for Self-Employed makes this task less daunting by providing intuitive features that help outline your objectives. Start by asking yourself what you want to achieve financially in the next six months or year.

Use these goals as a roadmap. QuickBooks allows you to track your progress and adjust your strategies as needed. Perhaps you’re aiming to save a specific amount or reduce unnecessary expenses—these tools keep you accountable.

Having clear goals not only helps in planning but also in building confidence. You might be surprised how motivating it is to see your progress in real time. How would reaching these goals change your business or personal life?

Monitoring Cash Flow

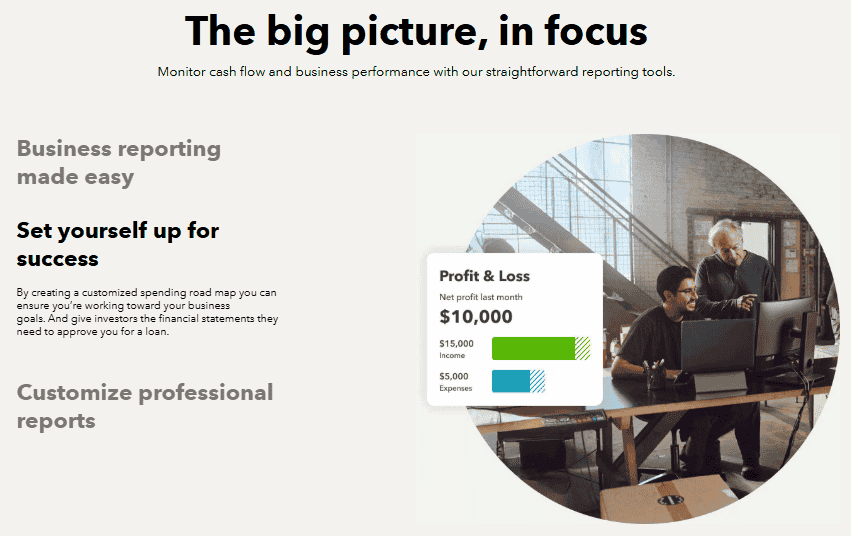

Monitoring cash flow is essential for keeping your business running smoothly. QuickBooks simplifies this by offering real-time insights into your income and expenses. This feature lets you see exactly where your money is going and where it’s coming from.

You can set up alerts for when your cash flow dips below a certain level. This proactive approach helps you avoid potential financial pitfalls. Imagine avoiding overdraft fees simply because you had the foresight to monitor your cash flow.

QuickBooks also allows you to create detailed reports. These reports can be pivotal during tax season or when seeking financial advice. With cash flow information at your fingertips, you can make informed decisions that positively impact your bottom line. How might better cash flow management improve your stress levels and work-life balance?

By leveraging QuickBooks for Self-Employed’s budgeting tools, you not only set and achieve your financial goals but also gain peace of mind knowing your cash flow is under control. Consider how these budgeting tools can transform your approach to business finances.

Mobile App Capabilities

Managing finances can be daunting, especially for self-employed individuals constantly on the move. With QuickBooks for Self Employed, the mobile app capabilities are designed to simplify your financial tasks anytime, anywhere. Whether you’re in a coffee shop or traveling for business, this app ensures you stay on top of your financial game effortlessly.

On-the-go Access

Imagine being able to access your financial data while waiting for your coffee order. The QuickBooks mobile app provides you with the flexibility to check your income and expenses on-the-go. You can quickly view your transactions, ensuring that you never miss a beat in your business operations.

Have you ever been caught off guard by unexpected expenses while traveling? With QuickBooks, you’re empowered to handle such surprises. The app lets you update your records instantly, reducing the stress of remembering details for later.

Mobile Features

QuickBooks mobile app isn’t just a portable financial tracker; it brings a suite of features to your fingertips. Need to snap a photo of a receipt? The app’s receipt capture function allows you to store and organize receipts seamlessly.

Are you traveling and need to track mileage? The app automates mileage tracking with GPS, ensuring you can claim every mile for tax deductions. This practical tool saves you time and boosts your efficiency.

Do you struggle with categorizing expenses? The app automatically categorizes transactions, helping you understand your spending habits better. This insight can aid in making informed business decisions.

Have you ever wondered how much time you could save by managing your finances on your phone? With QuickBooks, your mobile device becomes a powerful ally in financial management. Are you ready to take control of your finances from anywhere?

Security Measures

Security is a top priority for QuickBooks for Self Employed. Keeping financial data safe is crucial for freelancers and small business owners. QuickBooks implements robust security measures to protect users’ sensitive information.

Data Protection

QuickBooks uses advanced encryption to secure user data. This ensures that all financial transactions remain private. The software employs industry-standard SSL technology. This protects data during transmission. Regular security updates also help guard against threats. Users can feel confident knowing their information is safe.

User Permissions

QuickBooks allows users to manage permissions effectively. This feature helps control who can access sensitive information. Users can assign roles based on necessity. This minimizes the risk of unauthorized access. It ensures that only trusted individuals handle financial data. This level of control boosts overall security.

Customer Support Options

QuickBooks for Self Employed offers various customer support options to assist users effectively. Access live chat, phone support, and helpful articles for quick solutions. Find answers to common questions through an extensive online community.

Managing your finances as a self-employed individual can be overwhelming, and QuickBooks for Self-Employed is here to help. But what happens when you hit a roadblock? That’s where their robust customer support options come in handy. Whether you’re a seasoned entrepreneur or just starting out, having access to reliable support can make a world of difference.

Help Center Resources

QuickBooks offers a comprehensive Help Center packed with resources tailored for self-employed users. You can find step-by-step guides, FAQs, and video tutorials to walk you through common issues. Imagine encountering a problem with categorizing expenses—simply search the Help Center, and you’ll likely find a straightforward solution.

The resources are designed to be user-friendly, even for those who aren’t tech-savvy. You can bookmark helpful articles for easy reference later. The best part? It’s available 24/7, so you can find answers on your own schedule.

Contacting Support

Sometimes, you need a human touch. QuickBooks offers various ways to contact their support team for more personalized assistance. You can reach them via phone or chat, depending on your preference.

Have you ever felt stuck with a technical issue that a guide just couldn’t resolve? Speaking directly with an expert can provide the clarity you need. Before contacting support, make sure you have your account details handy to speed up the process.

QuickBooks also offers a community forum where you can interact with other users. You might find that someone else has faced the same issue and already has a solution. It’s like having a team of fellow entrepreneurs at your fingertips.

Have you used QuickBooks support before? What was your experience? Sharing your story could help others who might be hesitant to reach out for help.

Frequently Asked Questions

How Much Do Quickbooks Cost For Self-employed?

QuickBooks Self-Employed costs $15 per month. It offers invoicing, expense tracking, and tax calculations tailored for freelancers. You can also opt for an annual plan at a discounted rate. Always check QuickBooks’ website for current pricing and promotions.

Is Quickbooks Good For Self-employment?

QuickBooks is excellent for self-employment. It offers easy invoicing, expense tracking, and tax calculations. The user-friendly interface simplifies financial management. QuickBooks helps manage income and expenses efficiently. It is a valuable tool for freelancers and small business owners seeking streamlined accounting solutions.

What Is The Difference Between Quickbooks Self-employed And Quickbooks Solopreneur?

QuickBooks Self-Employed targets freelancers with basic accounting needs. QuickBooks Solopreneur isn’t an official product but refers to solo business owners using QuickBooks for more comprehensive features.

Conclusion

QuickBooks for Self Employed can simplify your financial tasks. It offers easy tracking of expenses and income. This tool helps manage taxes efficiently. Freelancers and small business owners benefit greatly. It saves time and reduces stress. Stay organized without hassle.

QuickBooks makes bookkeeping less daunting. It keeps your records tidy and accessible. Try it for better financial control. Your business will thank you. Embrace this user-friendly solution for peace of mind.