You’re looking to simplify your accounting process, but the choices can be overwhelming. QuickBooks Online and QuickBooks Self-Employed are two popular options that promise to streamline your financial tasks.

But which one is right for you? Imagine saving hours each month and finally ditching the spreadsheet chaos. Choosing the right tool can transform how you handle your business finances, freeing you up to focus on what truly matters. Stay with us, and you’ll discover the strengths and weaknesses of each option, helping you make an informed decision.

Dive in, and let’s find the perfect fit for your financial needs.

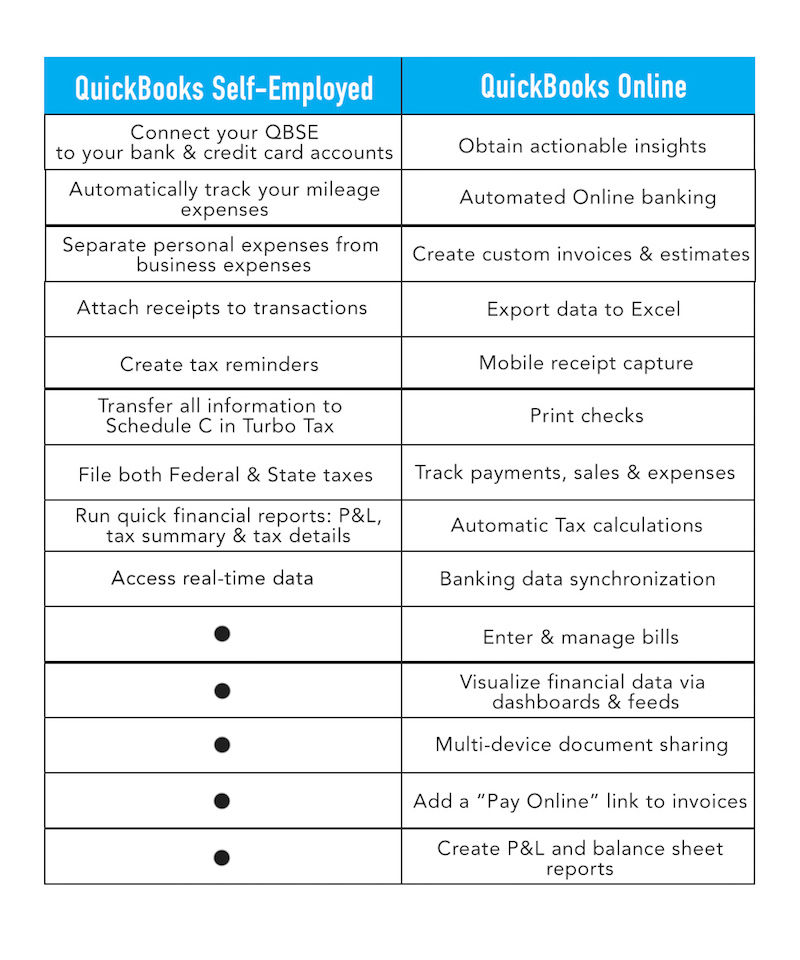

Features Comparison

QuickBooks Online offers extensive accounting features for small businesses, including invoicing and inventory management. QuickBooks Self Employed focuses on freelancers, simplifying expense tracking and tax calculations. Each caters to different financial needs, helping users manage their money effectively.

When deciding between QuickBooks Online and QuickBooks Self-Employed, understanding their features is crucial. Each platform offers unique tools tailored to different needs. Do you need comprehensive financial management or simplified tracking for a solo venture? Let’s delve into the features that set them apart.Invoicing And Billing

QuickBooks Online provides a robust invoicing system. You can customize invoices with your logo and colors, automate billing, and track invoice status. It’s perfect if you manage multiple clients and need detailed records. QuickBooks Self-Employed simplifies invoicing for freelancers. It offers straightforward invoice creation but lacks extensive customization. If your invoicing needs are basic, this might be sufficient.Expense Tracking

With QuickBooks Online, you can categorize expenses, attach receipts, and set up recurring expenses. This feature is invaluable for businesses with varied costs. It allows you to see where your money goes at a glance. QuickBooks Self-Employed offers automatic expense tracking linked to your bank account. It’s designed for simplicity, making it easy to track mileage and other small expenses without much effort.Tax Management

Tax management in QuickBooks Online is comprehensive. It includes tax calculation, filing support, and integration with your accountant. This feature is ideal for businesses handling complex tax scenarios. QuickBooks Self-Employed shines in estimating quarterly taxes for freelancers. It provides reminders, so you never miss a deadline. Does quarterly tax calculation stress you out? This tool might be your relief. The choice between QuickBooks Online and QuickBooks Self-Employed ultimately hinges on your specific needs. Which features resonate most with your business style?User Interface

The user interface plays a crucial role in software usability. QuickBooks Online and QuickBooks Self-Employed offer distinct experiences. Each caters to different user needs. Understanding these differences helps in making an informed choice.

Ease Of Use

QuickBooks Online features a comprehensive interface. It suits users who need multiple functionalities. The design is intuitive but can seem complex for beginners. Yet, it allows for easy navigation through various functions.

QuickBooks Self-Employed offers a simpler interface. Perfect for freelancers and sole proprietors. Its straightforward design makes it easy to use. Users can quickly find the tools they need.

Dashboard Overview

The QuickBooks Online dashboard provides a detailed overview. Users see financial health at a glance. It displays income, expenses, and reports. This helps in making quick business decisions.

QuickBooks Self-Employed features a more basic dashboard. It focuses on essential financial data. Users can track income and expenses easily. This simplicity aids in managing finances without hassle.

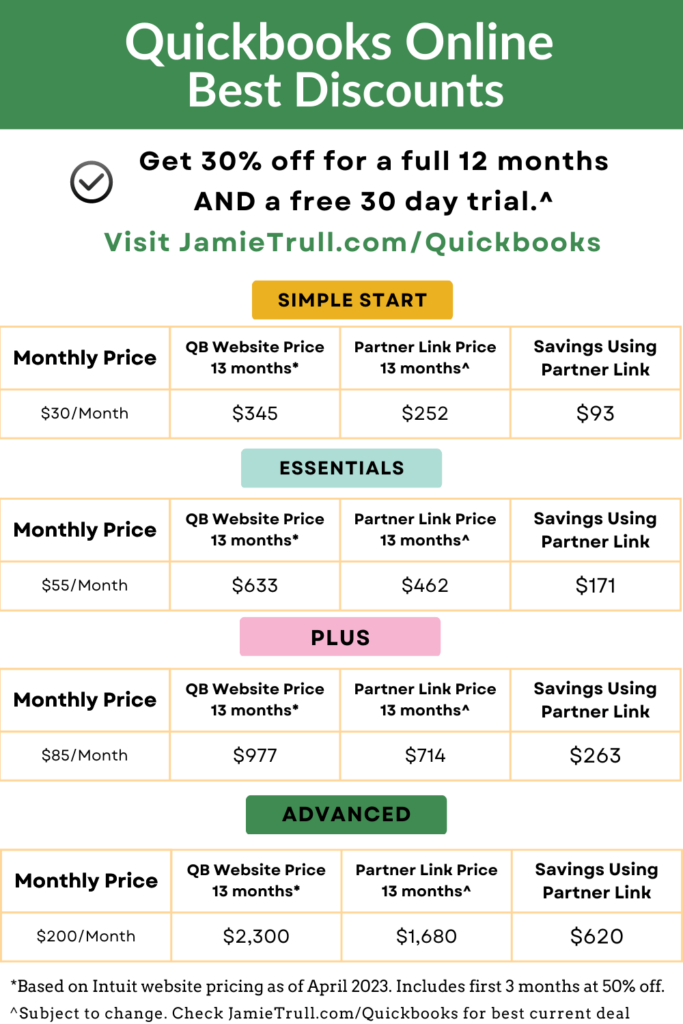

Pricing Structure

Choosing the right accounting software can be crucial for managing finances effectively. If you’re comparing QuickBooks Online and QuickBooks Self-Employed, understanding the pricing structure is essential. Each offers unique plans designed to cater to specific needs. Let’s dive into the details and see which option might be the best fit for you.

Subscription Plans

QuickBooks Online offers a range of subscription plans: Simple Start, Essentials, Plus, and Advanced. Each tier provides progressively more features and flexibility. Simple Start is great if you’re just getting started, while Advanced is tailored for larger businesses.

QuickBooks Self-Employed, on the other hand, has a more straightforward pricing model. It’s designed specifically for freelancers and independent contractors. The plan includes basic features like tracking income and expenses, and calculating quarterly taxes.

Think about your business needs. Are you managing a team or flying solo? Your answer will guide you toward the right subscription plan.

Value For Money

QuickBooks Online’s range of features can offer great value for businesses needing comprehensive accounting solutions. It supports invoicing, inventory management, and project tracking, providing robust tools for growing businesses.

QuickBooks Self-Employed is tailored to those who need to manage their freelance finances without unnecessary complexity. It simplifies tax deductions and expense tracking, making it a practical choice for freelancers.

Reflect on what you truly need. Are you paying for features you won’t use? Consider what brings the most value to your business.

Have you ever felt overwhelmed by accounting choices? I once faced the same dilemma and found clarity by focusing on what I really needed. It’s a liberating feeling to realize you’re investing in tools that genuinely support your business goals.

When deciding between QuickBooks Online and QuickBooks Self-Employed, it’s not just about the price tag. It’s about aligning the features with your business needs. Which option resonates with your financial management style?

Credit: paygration.com

Target Audience

QuickBooks Online and QuickBooks Self-Employed offer unique features. Each version targets different users. Understanding their audience helps you choose the right tool. Let’s explore who benefits most from each platform.

Small Business Owners

Small business owners manage various financial tasks. QuickBooks Online suits their needs best. It supports payroll, invoicing, and inventory tracking. Owners get a comprehensive financial overview. This helps in making informed decisions. The platform also allows multiple users. Team members can access relevant information. QuickBooks Online provides scalability. It grows with the business.

Freelancers And Contractors

Freelancers and contractors have specific needs. QuickBooks Self-Employed is designed for them. It tracks income and expenses easily. Users can separate personal and business expenses. This feature simplifies tax filing. The platform also tracks mileage. Freelancers often travel for work. Accurate mileage records save money on taxes. QuickBooks Self-Employed helps manage quarterly tax payments. This prevents end-of-year surprises.

Integration Capabilities

QuickBooks Online and QuickBooks Self-Employed offer unique integration capabilities. These features enhance the user experience and simplify financial management. Understanding these integrations helps users choose the right tool for their needs.

Third-party Apps

QuickBooks Online supports a wide range of third-party apps. This allows users to extend functionality. Popular integrations include PayPal, Shopify, and Square. These apps help streamline payments and sales tracking. Users can automate invoicing and reconcile accounts easily.

QuickBooks Self-Employed integrates with fewer apps. It focuses on essential tools for freelancers. This includes mileage tracking and tax calculations. Users benefit from a simplified setup and interface. It offers essential features without overwhelming choices.

Mobile Access

Both QuickBooks versions provide mobile access. QuickBooks Online offers a robust mobile app. Users can manage their finances on the go. The app includes invoicing, expenses, and reports. It is suitable for small businesses needing flexibility.

QuickBooks Self-Employed also has a mobile app. It is tailored for freelancers and contractors. Users can track mileage and expenses easily. The app helps manage taxes with simple inputs. It offers convenience for those with basic needs.

Credit: www.oneselfclub.com

Customer Support

Choosing the right QuickBooks product depends on your business needs. Customer support is crucial. It ensures smooth operations and quick solutions. QuickBooks Online and QuickBooks Self-Employed offer different support options. Understanding these can help make an informed choice.

Help And Resources

QuickBooks Online provides extensive help resources. Users access guides and tutorials. These are easy to follow. They cover various topics. This includes setup and troubleshooting. QuickBooks Self-Employed offers limited resources. Users find basic guides and articles. These focus on common issues and tasks.

QuickBooks Online has a searchable help database. It is comprehensive and updated regularly. Users find answers quickly. QuickBooks Self-Employed has fewer resources. Its help section is simpler. Users may need extra time to find solutions.

Community Forums

QuickBooks Online boasts active community forums. Users share tips and advice. This fosters a collaborative environment. Users learn from each other’s experiences. QuickBooks Self-Employed forums are less active. Discussions are limited. Users may not find specific solutions easily.

QuickBooks Online forums are moderated. This ensures quality and accurate responses. Experts often participate. QuickBooks Self-Employed forums have fewer moderators. Users rely more on peer advice.

Choosing between these products means considering support options. QuickBooks Online offers more robust resources. QuickBooks Self-Employed caters to simpler needs. Understanding the support landscape is key.

Scalability And Growth

Choosing the right accounting software is vital for business growth. QuickBooks Online and QuickBooks Self-Employed cater to different business needs. Understanding their scalability can guide your decision. Each option offers unique benefits for growth and expansion.

Business Expansion

QuickBooks Online suits businesses aiming for growth. It supports multiple users and extensive features. As your business expands, it adapts to new requirements. Inventory management and customer invoicing features scale with your growth.

QuickBooks Self-Employed fits freelancers and sole proprietors. It’s simple and easy to use. It lacks advanced features for growing businesses. For a business planning to expand, QuickBooks Online offers more flexibility.

Long-term Usability

QuickBooks Online offers long-term solutions for evolving businesses. Its cloud-based nature ensures updates and new features. Businesses benefit from continuous improvements without extra costs. It remains relevant as business needs change.

QuickBooks Self-Employed is ideal for simple, short-term needs. It’s not built for complex, long-term growth. If your business requires more, consider transitioning to QuickBooks Online. Investing in the right software ensures sustainability and growth.

Credit: jamietrull.com

Frequently Asked Questions

What Is The Difference Between Quickbooks Self-employed And Quickbooks Online?

QuickBooks Self-Employed targets freelancers for tracking income, expenses, and taxes. QuickBooks Online suits small businesses, offering invoicing, payroll, and detailed financial reporting.

What Are The Disadvantages Of Quickbooks Self-employed?

QuickBooks Self-Employed lacks robust accounting features. It doesn’t support inventory management or double-entry bookkeeping. Limited integration options can hinder workflow efficiency. Reporting features are basic, impacting detailed analysis. It’s unsuitable for growing businesses needing comprehensive financial management tools. These drawbacks might limit its usefulness for larger operations.

Can I Use Quickbooks Online For Self-employed?

Yes, QuickBooks Online is suitable for self-employed individuals. It helps manage expenses, track mileage, and prepare taxes efficiently.

Conclusion

Choosing between QuickBooks Online and QuickBooks Self-Employed depends on your needs. QuickBooks Online suits small businesses and offers robust features. QuickBooks Self-Employed helps freelancers with simple expense tracking. Both have benefits for different users. Consider your business size and needs.

Also, think about your budget and time for accounting tasks. Compare features closely. Test both options to see which feels right. The best tool supports your financial goals effortlessly. Make a choice that simplifies your accounting journey. Enjoy smoother financial management with the right QuickBooks version.