Are you on the hunt for the perfect accounting software for your business? You’re in the right place!

Choosing between Xero, QuickBooks, and FreshBooks can feel overwhelming. Each promises to streamline your financial tasks and save you time. But which one truly delivers the best results for your unique needs? As you dive into this article, you’ll discover the strengths and weaknesses of each platform, helping you make a decision that aligns perfectly with your business goals.

Whether you’re a small business owner, a freelancer, or a seasoned entrepreneur, understanding these tools can transform how you handle your finances. Keep reading to find out which software will be your trusted ally in managing your financial world!

Xero Features

When it comes to managing your business finances, choosing the right accounting software can make a significant difference in efficiency and accuracy. Xero, a popular choice among small business owners, offers a suite of features designed to streamline your accounting processes. Let’s dive into some of the standout features of Xero that might just make it the perfect fit for your business needs.

User Interface

Xero’s user interface is clean and intuitive. As someone who once struggled with cluttered dashboards, I appreciate how Xero keeps everything straightforward. The layout is logical, making it easy to navigate and find what you need without feeling overwhelmed. Imagine opening your accounting software and being greeted by a dashboard that clearly displays your cash flow and financial health at a glance. Wouldn’t that make your day a bit easier?

Invoicing Capabilities

Creating invoices in Xero is a breeze. You can customize templates to reflect your brand, and sending them directly from the platform saves you time. The automatic payment reminders are a lifesaver; they ensure you get paid on time without having to chase clients. When I first started using Xero, I was amazed at how quickly I could set up recurring invoices for my regular clients. How much time would you save if invoicing was no longer a tedious task?

Expense Tracking

Tracking expenses can be a headache, but Xero simplifies this process. You can easily capture receipts with your phone and categorize expenses on the go. This feature is particularly useful for those who travel often or have a lot of small transactions to keep track of. Once, while on a business trip, I was able to snap a photo of my hotel receipt and immediately upload it to Xero, ensuring I didn’t forget about it later. Wouldn’t it be great to have all your expenses organized effortlessly?

Ultimately, Xero’s features are tailored to make managing your finances simpler and more efficient. Whether it’s the user-friendly interface, the seamless invoicing, or the hassle-free expense tracking, each aspect is crafted to meet the needs of business owners like you. Have you considered how these features could improve your financial management?

Credit: www.fundthrough.com

Quickbooks Features

QuickBooks is a popular choice for managing finances and accounting tasks. It provides a range of features that cater to various business needs. In this section, we explore some of its key features. These include ease of use, payroll integration, and reporting tools. Each feature aims to streamline processes and improve efficiency.

Ease Of Use

QuickBooks offers a user-friendly interface. It simplifies navigation for beginners and seasoned users alike. With clear instructions and intuitive design, setting up is straightforward. Users can easily manage invoices, track expenses, and run reports. This simplicity saves time and reduces stress.

Payroll Integration

QuickBooks integrates seamlessly with payroll services. This feature ensures accurate and timely salary processing. Users can automate tax calculations and deductions. It reduces errors and compliance risks. QuickBooks handles complex payroll tasks efficiently.

Reporting Tools

QuickBooks boasts powerful reporting tools. Users can generate detailed financial statements with ease. It helps in analyzing business performance effectively. Customizable reports offer insights into revenue and expenses. This aids in informed decision-making and strategic planning.

Freshbooks Features

FreshBooks offers a range of features tailored for small business owners. These features streamline operations and enhance productivity. Each tool is designed to simplify tasks and improve efficiency. Here’s a closer look at some key features of FreshBooks.

Time Tracking

Efficient time tracking is crucial for billing accuracy. FreshBooks provides intuitive time tracking tools. Users can easily log hours for projects. This ensures precise billing for clients. The feature integrates seamlessly with invoices. Users can convert tracked hours into invoices. Tracking time becomes less of a chore.

Client Portal

FreshBooks includes a user-friendly client portal. This portal enhances client communication and transparency. Clients can view invoices and project updates. They can also approve estimates and make payments. The portal promotes collaboration and trust. It simplifies client interactions and improves satisfaction.

Payment Processing

Payment processing is straightforward with FreshBooks. The platform supports multiple payment methods. Clients can pay via credit cards or bank transfers. FreshBooks ensures secure transactions. Users receive payments faster and with less hassle. The payment system integrates with invoices. This reduces the time spent on financial tasks.

Credit: www.subscriptionflow.com

Pricing Comparison

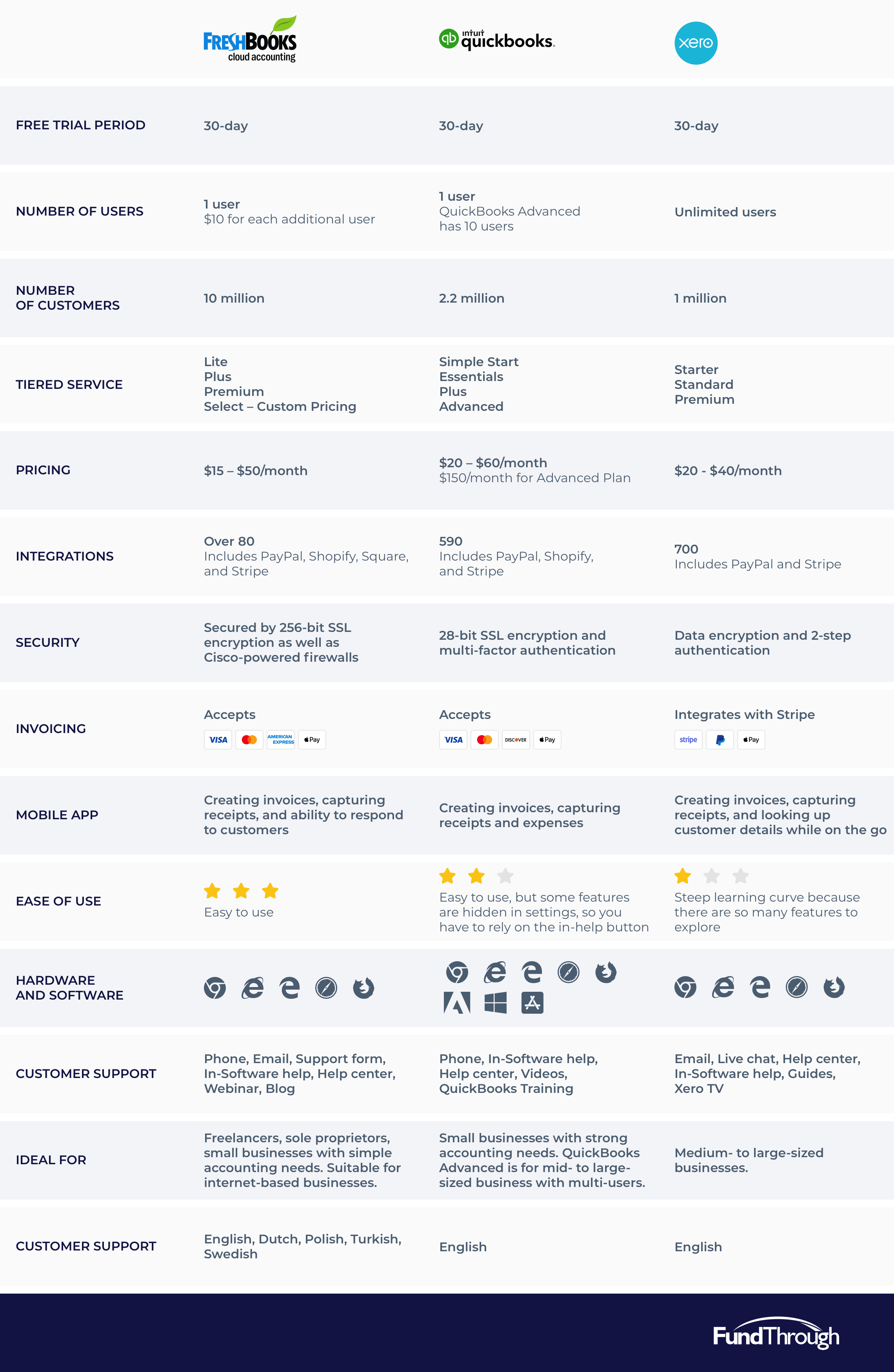

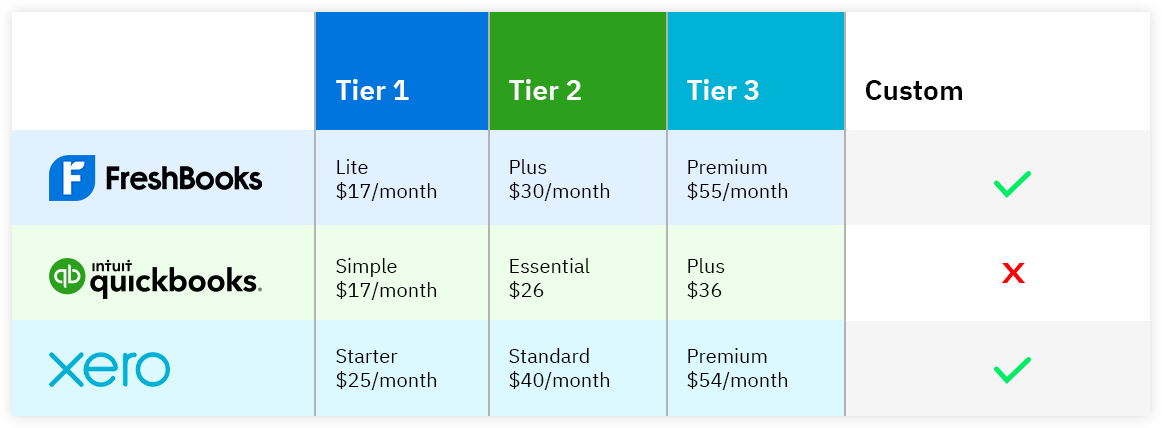

Choosing between Xero, QuickBooks, and FreshBooks involves assessing pricing. Xero offers tiered plans starting at $13 per month. QuickBooks charges $25 monthly for its basic plan. FreshBooks begins at $17 per month, providing essential features for small businesses. Evaluating features alongside costs is crucial for informed decision-making.

When you’re choosing accounting software for your business, pricing is a critical factor. It’s not just about the monthly fee—it’s about getting the best value for your money. Each platform—Xero, QuickBooks, and FreshBooks—has its own pricing structure, and understanding these can help you make a more informed decision. ###Xero Pricing Plans

Xero offers a straightforward pricing model that aims to cater to businesses of different sizes. The Starter plan, priced at $13 per month, is ideal for small businesses needing basic features. As your business grows, you might consider the Standard plan, which costs $37 per month and includes more comprehensive features like bulk reconciliation. For larger businesses, Xero’s Premium plan at $70 per month offers multicurrency support. Xero also provides a free trial period, allowing you to explore its features without any financial commitment. Is your business already expanding into international markets? Then the Premium plan might be worth considering for its added functionalities. ###Quickbooks Pricing Options

QuickBooks provides a versatile range of pricing options to suit varied business needs. The Simple Start plan, at $25 per month, is perfect for single users who need basic tracking. If your team requires more features, the Essentials plan at $50 per month supports three users and adds bill management. For a more robust experience, the Plus plan at $80 per month accommodates five users and includes project tracking. QuickBooks also offers a Self-Employed plan for freelancers at $15 per month, focusing on tax deductions and invoicing. Are you a freelancer or a small business? QuickBooks offers tailored options that might be just right for you. ###Freshbooks Subscription Tiers

FreshBooks presents a user-friendly pricing structure designed with simplicity in mind. The Lite plan, available at $17 per month, covers basic invoicing and expense tracking for up to five clients. Looking to expand? The Plus plan at $30 per month increases your client cap to 50 and adds additional features like automated recurring invoices. For even larger needs, the Premium plan at $55 per month allows you to manage up to 500 clients and offers advanced reporting tools. FreshBooks also provides a Select plan for businesses with more complex needs, with pricing available upon request. If you manage a large client base, FreshBooks’ Premium plan could offer the flexibility you need. When considering these options, think about your current business requirements and where you see your company in the next few years. Are the additional features worth the extra cost, or are you better off with a more basic plan?Customer Support

Choosing the right accounting software is crucial for your business. But what happens when you need help? Customer support can make or break your experience. Xero, QuickBooks, and FreshBooks offer different support channels. Let’s explore how each one addresses customer needs.

Xero Support Channels

Xero provides multiple support options. Users can access their help center online. It features articles, guides, and videos. For direct help, Xero offers email support. They aim to respond within 24 hours. A community forum is available too. Here, users share tips and solutions. Xero doesn’t offer phone support, which some users miss.

Quickbooks Help Resources

QuickBooks has a robust support system. Their online help center is comprehensive. It includes tutorials, FAQs, and live chat. Users can reach out via phone for immediate assistance. QuickBooks also hosts webinars. These sessions cover various topics. A community forum provides peer-to-peer support. QuickBooks is known for quick responses.

Freshbooks Assistance

FreshBooks offers direct phone support. This is available during business hours. Users appreciate speaking with real people. Email support is another option. FreshBooks aims to respond swiftly. Their help center contains useful articles. Video tutorials guide users through tasks. The FreshBooks community forum connects users. Here, users exchange insights and solutions.

Credit: www.facebook.com

User Experience

Evaluating user experience in accounting software, Xero, QuickBooks, and FreshBooks offer distinct interfaces. Xero provides intuitive navigation, while QuickBooks excels in comprehensive features. FreshBooks impresses with simple design, catering to freelancers. Each platform ensures smooth task management. Choosing the right fit enhances productivity and satisfaction.

When managing your business finances, the user experience of your accounting software is crucial. You want something that not only works efficiently but also feels intuitive and easy to use. Let’s dive into how Xero, QuickBooks, and FreshBooks stack up in terms of user experience.Mobile App Functionality

In today’s fast-paced world, having robust mobile app functionality is a game-changer. QuickBooks offers a comprehensive app that lets you manage invoices, expenses, and even payroll on the go. It’s perfect for when you’re traveling or just away from your desk. Xero’s mobile app is sleek and user-friendly, focusing on tasks like bank reconciliation and tracking expenses. It’s ideal if you prioritize simplicity and effective design. FreshBooks shines with its intuitive time-tracking features, making it a favorite among freelancers who bill by the hour. Its app is straightforward, allowing you to log time, send invoices, and capture expenses effortlessly.Customization Options

Customization can transform your software from a one-size-fits-all solution to a tailored experience. QuickBooks provides a high degree of customization, from creating custom reports to tweaking your dashboard view. This makes it suitable for businesses with specific reporting needs. Xero also offers flexibility with customizable templates and reports, but its strength lies in its simplicity. It strikes a balance between customization and ease of use. FreshBooks focuses on user-friendly customization, especially in invoicing. You can personalize your invoices with logos and color schemes, making them look professional without any hassle.Integration With Other Tools

The ability to integrate with other tools can significantly enhance your accounting software’s functionality. QuickBooks integrates seamlessly with a vast array of apps and services, from CRM systems to project management tools. This extensive connectivity makes it ideal for businesses using multiple software solutions. Xero, known for its strong integration capabilities, connects with over 700 apps, including popular tools like Shopify and PayPal. This makes it perfect for businesses that rely heavily on e-commerce. FreshBooks offers integrations with popular payment gateways and productivity tools, but its range is narrower compared to QuickBooks and Xero. However, it covers essentials like Stripe and G Suite, which may be all you need. As you weigh your options, consider your own needs and habits. Do you value mobile accessibility or crave customization? Perhaps seamless integration is your priority. Whatever your choice, ensure it aligns with your business goals and daily operations.Security And Reliability

Choosing between Xero, QuickBooks, and FreshBooks depends on security features and reliability. Each offers robust encryption to protect data. Users find reliable service essential for managing finances smoothly.

When choosing accounting software, security and reliability are crucial factors to consider. You want to ensure that your financial data is safe and that you can access it whenever you need. Xero, QuickBooks, and FreshBooks each offer different features to protect your data and keep your business running smoothly.Data Encryption

Data encryption is the backbone of digital security. Xero uses industry-standard TLS encryption to protect your data as it travels over the internet. QuickBooks employs 128-bit SSL encryption, ensuring your information is secure both in transit and at rest. FreshBooks also offers strong encryption, safeguarding your data with advanced security protocols. These encryption methods mean that your financial information remains confidential and secure from unauthorized access.Backup And Recovery

Accidents happen, and data loss can be devastating. Xero automatically backs up your data daily, ensuring that you can recover your information quickly if needed. QuickBooks offers similar backup solutions, with features that allow you to restore your data in just a few clicks. FreshBooks takes care of backups for you, so you never have to worry about losing important financial information. Knowing that your data is backed up gives you peace of mind and lets you focus on growing your business.Uptime And Performance

Reliability isn’t just about security; it’s also about performance. Xero boasts an impressive uptime record, meaning you can access your financial data whenever you need it. QuickBooks is known for its fast performance and minimal downtime, ensuring your work is never interrupted. FreshBooks also prioritizes uptime, offering a seamless experience with quick loading times and reliable service. Have you ever been frustrated by software that lags? With these tools, you can expect consistent and reliable performance, ensuring your accounting tasks are handled efficiently. In choosing between Xero, QuickBooks, and FreshBooks, consider which security and reliability features align best with your business needs. Is encryption your top priority, or does quick data recovery take precedence? Your choice should reflect what matters most to you in keeping your business secure and running smoothly.Pros And Cons

Xero offers robust invoicing and inventory features, but may overwhelm beginners. QuickBooks provides strong accounting tools, yet has a steeper learning curve. FreshBooks excels in user-friendliness, though lacks some advanced features for large businesses.

Choosing the right accounting software can be a game-changer for managing your business finances. Xero, QuickBooks, and FreshBooks are popular options, each with unique strengths and weaknesses. Understanding the pros and cons of each can help you make an informed decision for your business. Let’s dive into what each has to offer.Xero Advantages And Drawbacks

Xero is known for its user-friendly interface and flexibility. It offers powerful features like automated bank feeds and comprehensive financial reporting. Many users appreciate its seamless integration with over 800 third-party apps. However, there are a few drawbacks. Xero’s mobile app is less robust compared to its desktop version. Additionally, some users find its payroll feature lacking in certain regions. Would these limitations impact your workflow?Quickbooks Strengths And Weaknesses

QuickBooks is a household name in accounting software. Its greatest strength lies in its extensive range of features, from invoicing to expense tracking. It is particularly favored by small to medium-sized businesses for its ease of use. On the downside, QuickBooks can be pricey, especially as your business grows. Some users report that customer support is not always responsive. Consider whether these factors could affect your satisfaction.Freshbooks Benefits And Limitations

FreshBooks shines in invoicing and time-tracking capabilities. It’s ideal for freelancers and small business owners who need to manage client billing efficiently. The platform is praised for its intuitive design and exceptional customer service. However, FreshBooks may not be as feature-rich as its competitors in areas like inventory management. Some users find its reporting capabilities limited. Is FreshBooks too simplified for your business needs? When weighing the pros and cons, think about which features align best with your business goals. Would you prioritize comprehensive reporting, seamless integrations, or superior invoicing? The right choice can streamline your financial tasks and enhance productivity.Best Use Cases

Comparing Xero, QuickBooks, and FreshBooks reveals distinct strengths. Xero excels in robust integrations for growing businesses. QuickBooks is ideal for detailed financial reporting and complex accounting needs. FreshBooks simplifies invoicing and expense tracking for freelancers and small businesses. Each offers unique features catering to different business sizes and needs.

Deciding between Xero, QuickBooks, and FreshBooks can be challenging. Each platform offers unique strengths suited to different business needs. Understanding the best use cases can guide you in selecting the right software for your business’s accounting needs.Small Businesses

Small businesses need efficient and cost-effective solutions. QuickBooks stands out for its comprehensive features tailored to small business needs. With its simple interface, it’s easy to track expenses, send invoices, and run payroll. Xero is also a strong contender, especially for those who prefer cloud-based solutions. It integrates seamlessly with various third-party apps. This is useful for businesses that rely on multiple software tools. FreshBooks, though less feature-rich, shines in simplicity. It’s perfect for businesses that primarily need invoicing and expense tracking.Freelancers And Contractors

Freelancers often juggle multiple clients and projects. FreshBooks is designed with this in mind, offering simple invoicing and time-tracking features. You can easily customize invoices and keep track of billable hours. QuickBooks can be beneficial if you need more comprehensive financial management. It provides features like tax estimation, which can be a lifesaver during tax season. Xero, while less focused on freelancers, offers a great ecosystem of apps. This can be useful if you need specific tools beyond basic accounting.Medium-sized Enterprises

Medium-sized enterprises require robust accounting systems. QuickBooks offers advanced reporting and multi-user access, which is perfect for larger teams. Its scalability can support your growth without needing a platform switch. Xero excels with its unlimited users feature, making it ideal for collaborative work environments. It also offers powerful reporting and project management tools. FreshBooks may not be the first choice here, but it can still serve specific needs. If your enterprise values user-friendliness over complex features, FreshBooks can be a viable option. Which platform resonates with your business needs? It’s crucial to weigh the strengths of each against your specific requirements. Your choice can streamline your accounting processes and save you valuable time.Frequently Asked Questions

Is Xero Better Than Freshbooks?

Xero suits larger businesses with complex needs. FreshBooks is ideal for small businesses and freelancers. Xero offers robust accounting features. FreshBooks excels in invoicing and expense tracking. Choose Xero for comprehensive accounting. Opt for FreshBooks for simplicity and ease of use.

Evaluate based on business size and accounting requirements.

Is Quickbooks Or Freshbooks Better?

QuickBooks suits larger businesses needing advanced features, while FreshBooks is ideal for freelancers and small businesses. Both offer invoicing and financial management, but QuickBooks excels in comprehensive accounting capabilities. FreshBooks focuses on ease of use and simplicity. Evaluate your business needs to determine the best fit.

What Are The Disadvantages Of Xero?

Xero can be costly for small businesses. Limited inventory management features exist. Offline access is unavailable. Advanced reporting tools may be lacking. Integration with some apps might be challenging.

Conclusion

Choosing between Xero, QuickBooks, and FreshBooks depends on your needs. Each offers unique features suitable for different businesses. Xero excels in automation, saving time on manual tasks. QuickBooks is ideal for comprehensive financial reporting. FreshBooks simplifies invoicing, great for freelancers.

Consider your budget and business size. Think about the features you value most. Research and trial can help make your decision easier. All three are solid choices. Make sure to weigh pros and cons carefully. Find the right fit for your business.

Your accounting software should support your growth and simplify your financial tasks.