To manage your business efficiently with QuickBooks and FreshBooks, you can integrate both software programs for streamlined financial management and invoicing. This article provides a comprehensive guide on how to optimize these tools to effectively track income, expenses, and generate accurate financial reports, enabling you to make informed business decisions.

Additionally, we will discuss the benefits of using QuickBooks and FreshBooks together, their key features, and how to set up the integration process seamlessly. By leveraging the power of these two popular accounting software platforms, you can improve productivity, save time, and enhance the overall financial management of your business.

Understanding The Key Features Of Quickbooks And Freshbooks

Quickbooks and Freshbooks offer essential features for efficient business management. Both platforms provide invoicing, expense tracking, and financial reporting, empowering businesses to streamline their financial processes. With user-friendly interfaces and robust functionalities, Quickbooks and Freshbooks are valuable tools for simplifying business operations.

Understanding the Key Features of Quickbooks and FreshbooksWhen it comes to managing your business finances, two popular platforms, Quickbooks and Freshbooks, stand out among the rest. These cloud-based accounting software solutions offer a range of key features that can streamline your business processes and help you stay on top of your finances. In this section, we will delve into the key features of Quickbooks and Freshbooks, including their user interfaces and navigation, invoicing and payment processing capabilities, expense tracking and reporting functionalities, and integration with other business tools. Let’s explore these features in detail.User Interface And Navigation

One of the first things you’ll notice when using Quickbooks and Freshbooks is their user-friendly interfaces. Both platforms have intuitive designs that make it easy to navigate and find the features you need. With Quickbooks, you’ll find a dashboard that gives you an overview of your company’s financial health at a glance. Its clear and organized menu structure allows for easy access to different sections such as customers, vendors, reports, and more. Freshbooks, on the other hand, offers a simple and modern interface that focuses on the essentials. Its sidebar navigation makes it effortless to move between sections like invoicing, expenses, time tracking, and projects. No matter which platform you choose, you can expect a user interface that is visually appealing, responsive, and efficient.Invoicing And Payment Processing

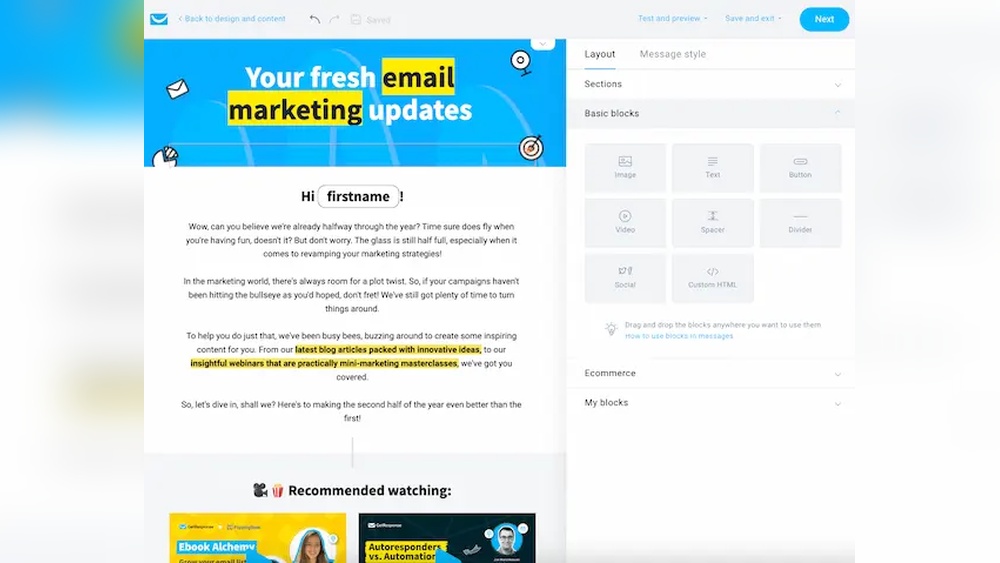

Efficient invoicing and seamless payment processing are vital for any business. Quickbooks and Freshbooks excel in these areas, offering advanced features that simplify the invoicing process and help you get paid faster. With Quickbooks, you can easily create professional-looking invoices with customizable templates. You can also automate recurring invoices and set reminders for overdue payments, ensuring that you never miss out on any revenue. Freshbooks also provides an array of invoicing tools that enable you to customize your invoices, track their status, and send automatic payment reminders. Furthermore, both platforms integrate with popular payment gateways, making it convenient for your clients to pay you online. Whether you’re a freelancer, small business owner, or a large enterprise, Quickbooks and Freshbooks have got you covered when it comes to invoicing and payment processing.Expense Tracking And Reporting

Keeping track of your business expenses and generating accurate reports is crucial for financial analysis and decision-making. Quickbooks and Freshbooks offer robust expense tracking features that make it easy to record and categorize your expenses. Quickbooks allows you to sync your bank accounts and credit cards, automatically importing transactions and eliminating the need for manual data entry. You can also capture and attach receipts, making it effortless to reconcile your expenses. Freshbooks simplifies expense tracking through their expense management tool, enabling you to photograph receipts, categorize expenses, and import expenses from your bank account. Additionally, both platforms provide reporting functionalities that allow you to generate detailed financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into your business’s financial performance, making it easier to make informed decisions.Integration With Other Business Tools

In today’s interconnected business landscape, integration with other software tools is essential for seamless workflow management. Quickbooks and Freshbooks offer a wide range of integrations with various business tools, allowing you to customize and enhance your accounting processes. Quickbooks integrates with popular applications such as Shopify, PayPal, and TSheets, enabling you to streamline inventory management, payment processing, and employee time tracking. Freshbooks integrates with tools like Gusto, Zapier, and Shopify, offering similar functionalities that can improve your productivity and efficiency. These integrations eliminate the need for manual data entry and duplicate efforts, saving you time and reducing errors. Whether you need to connect your accounting software with an e-commerce platform, project management tool, or payroll system, Quickbooks and Freshbooks have integrations to make it happen.In conclusion, Quickbooks and Freshbooks provide essential features that can help you streamline your business finances. With user-friendly interfaces, efficient invoicing and payment processing capabilities, robust expense tracking and reporting functionalities, and seamless integration with other business tools, these platforms are designed to make your financial management tasks easier and more efficient.Creating And Customizing Invoices

Learn how to efficiently manage your business with Quickbooks and Freshbooks by creating and customizing invoices to streamline the invoicing process. Easily tailor your invoices to reflect your brand and deliver professional-looking documents to your clients.

Creating and Customizing InvoicesIn the world of business management, creating and customizing invoices is an essential part of maintaining a professional image and ensuring timely payments. When it comes to streamlining this process, Quickbooks and Freshbooks are two powerful tools that can help you achieve efficiency and accuracy. In this section, we will explore how you can maximize the potential of these platforms by customizing invoices to align with your brand, setting up payment terms and conditions that suit your business needs, and utilizing automated invoice reminders to enhance your cash flow.Adding Branding And Logo

One of the key factors in establishing a strong brand identity is consistency across all customer touchpoints. By adding your branding elements and logo to your invoices, you can ensure that every interaction with your clients reinforces your professionalism and credibility.Quickbooks and Freshbooks offer easy-to-use features that allow you to effortlessly insert your logo and customize your invoice layout. To begin, navigate to the settings section of the respective platform and look for the option to upload your logo. Make sure that your logo file meets the recommended dimensions and file format specified by the platform.Once you have uploaded your logo, the software will provide you with customization options to align the invoice layout with your brand’s colors, fonts, and overall aesthetic. You can also consider including your company’s tagline, contact information, and social media handles to further enhance your brand presence.Customizing Payment Terms And Conditions

Every business has its unique payment requirements, and being able to communicate these clearly to your clients is crucial for smooth financial transactions. Quickbooks and Freshbooks empower you to customize payment terms and conditions, enabling you to define your expectations in a transparent and professional manner.To customize payment terms and conditions on Quickbooks, go to the settings menu and select the option for invoices. Here, you can add specific payment terms, such as “net 30” or “due on receipt,” as well as any additional information you want to provide to your clients regarding late fees or payment methods accepted.Freshbooks also makes it convenient to customize payment terms and conditions. Navigate to the “Invoice Customization” section in the settings menu and specify your desired terms and conditions. You can outline the due date, late fees, and payment instructions, ensuring that both parties are clear on the agreed-upon terms.Setting Up Automated Invoice Reminders

Late payments can have a significant impact on your cash flow and business operations. To avoid the inconvenience of chasing down payments, Quickbooks and Freshbooks offer the option to set up automated invoice reminders that gently nudge your clients to make timely payments.Quickbooks allows you to automate reminders through the settings area of the platform. Here, you can determine how many days before or after the due date you want the reminders to be sent. You can also customize the message content to strike the right balance between professionalism and friendliness.On Freshbooks, go to the “Late Payment Fees” menu in the settings section, and select the option to enable automated reminders. Specify the frequency and the content of the reminders, ensuring that they convey a friendly yet assertive tone.By utilizing the automation features of Quickbooks and Freshbooks, you can save valuable time and resources while maintaining a healthy cash flow. These automated invoice reminders serve as gentle prompts to your clients, minimizing the risk of delayed payments and fostering a positive client-business relationship.In conclusion, creating and customizing invoices with Quickbooks and Freshbooks can enhance your brand identity, streamline your payment processes, and improve your overall business management. By adding your branding and logo, customizing payment terms and conditions, and setting up automated invoice reminders, you can establish professionalism, communicate your expectations clearly, and expedite payment collection. These features allow you to focus on what matters most – growing your business and delivering exceptional products or services.Managing Expenses And Receipts

When it comes to managing your business finances efficiently, two popular accounting software options that can simplify your life are QuickBooks and FreshBooks. These platforms offer a range of features to help you stay on top of your expenses and receipts, making it easier to track and analyze your financial data.

Uploading And Categorizing Receipts

One of the key tasks in managing expenses is keeping track of receipts. QuickBooks and FreshBooks allow you to easily upload and categorize your receipts, ensuring that you have a clear record of your business expenses.

With QuickBooks, you can simply take a photo of your receipt using the mobile app and upload it directly to your account. FreshBooks offers a similar feature, allowing you to snap a photo and attach it to an expense entry. Both platforms also allow you to manually upload receipts from your computer.

Once your receipts are uploaded, you can categorize them within the software. This step is crucial as it helps you track expenses by category, making it easier to analyze your spending and allocate resources effectively. You can create customized categories that align with your business needs, such as office supplies, travel expenses, or advertising costs.

Tracking Bill Payments And Recurring Expenses

In addition to managing receipts, QuickBooks and FreshBooks also provide features to help you track bill payments and recurring expenses. By entering details about your recurring expenses and bill due dates, you can ensure that important payments are never missed.

QuickBooks allows you to set up recurring bills, such as monthly rent or utilities, and track their payment status. You can customize the frequency, start and end dates, and payment method for each recurring expense. FreshBooks also offers a similar feature, enabling you to set up recurring invoices for your clients.

By utilizing these tools, you can save time and streamline your financial management processes, ultimately improving cash flow and reducing the risk of late payment penalties or missed opportunities.

Generating Expense Reports For Tax Purposes

One of the many benefits of using QuickBooks and FreshBooks is the ability to generate detailed expense reports. These reports come in handy when it’s time to file your taxes or analyze your spending patterns.

QuickBooks allows you to easily generate expense reports by selecting the desired time period and expense categories. The software automatically compiles all relevant transactions and presents them in a clear and concise format. FreshBooks offers similar functionality, allowing you to generate expense reports based on different criteria, such as client or project.

With these reports at your fingertips, you can gain valuable insight into your business expenses, identify potential areas for cost savings, and provide accurate documentation for tax purposes.

Generating Financial Statements And Reports

Generating financial statements and reports is a crucial aspect of managing your business with QuickBooks and FreshBooks. These reports provide you with valuable insights into your company’s financial health and performance. In this section, we will delve into the three key types of financial statements and reports that can help you make informed business decisions: Profit and Loss Statements, Cash Flow Analysis, and Balance Sheets and Tax Reports.

Profit And Loss Statements

A Profit and Loss Statement, also known as an Income Statement, is a summary of your company’s revenues, expenses, and net income or loss over a specific period of time. It helps you understand how well your business is performing financially.

By generating a Profit and Loss Statement regularly, you can:

- Monitor your revenue streams and identify areas for growth.

- Analyze your expenses and identify areas for cost-saving or resource optimization.

- Evaluate the profitability of different product lines or services.

- Identify trends and patterns in your business’s financial performance.

Cash Flow Analysis

A Cash Flow Analysis allows you to track the movement of cash in and out of your business over a specific period, usually a month or a year. It helps you manage your cash flow effectively and ensure that you have enough funds to cover your expenses, investments, and other financial obligations.

By generating a Cash Flow Analysis, you can:

- Identify any cash flow gaps and address them promptly.

- Analyze the timing of your cash inflows and outflows.

- Monitor and manage your working capital.

- Plan for investments, expansion, or financial contingencies.

Balance Sheets And Tax Reports

A Balance Sheet provides a snapshot of your company’s financial position at a specific point in time. It lists your assets, liabilities, and equity, giving you an overview of what your business owns and owes.

- Assess your business’s solvency and liquidity.

- Evaluate your company’s financial stability and long-term viability.

- Monitor your debt-to-equity ratio and leverage.

Tax reports are essential for compliance and reporting purposes. They help you calculate and report your business’s tax liabilities accurately. With QuickBooks and FreshBooks, you can generate various tax reports, such as Profit and Loss reports for tax purposes or general sales tax reports.

- Ensure compliance with tax regulations.

- Minimize the risk of errors or penalties in tax filing.

- Keep track of deductible expenses and credits.

Managing your business with QuickBooks and FreshBooks allows you to generate these financial statements and reports effortlessly. By regularly reviewing and analyzing these reports, you can gain valuable insights into your business’s financial performance and make informed decisions to drive growth and profitability.

Syncing With Bank Accounts And Payment Gateways

Syncing with bank accounts and payment gateways is crucial for effectively managing your business finances. QuickBooks and FreshBooks are powerful accounting software that offer seamless integration with various banks and payment gateways, streamlining the process of tracking and managing financial transactions.

Integrating With Crm And Project Management Systems

Integrating QuickBooks and FreshBooks with CRM and project management systems allows for a more comprehensive view of your business operations. By connecting these platforms, you can streamline the flow of data, enhance collaboration, and gain valuable insights into customer relationships and project progress.

Collaborating With Team Members And Accountants

Effective collaboration with team members and accountants is simplified through QuickBooks and FreshBooks. These tools enable real-time access to financial data, facilitating better communication and coordination. Seamless collaboration ensures that all stakeholders are informed and aligned, leading to more informed decision-making and improved efficiency.

Credit: www.smallbusinesscomputing.com

Frequently Asked Questions Of How To Manage Business With Quickbooks And Freshbooks

What Is The Difference Between Quickbooks And Freshbooks?

QuickBooks is tailored for larger businesses needing comprehensive financial tools, whereas FreshBooks is designed for freelancers and small businesses focused on invoicing and time tracking. Both can be valuable, but the best choice depends on your business’s specific needs.

How Can Quickbooks And Freshbooks Improve Business Efficiency?

By automating tasks, organizing financial data, and streamlining invoicing, QuickBooks and FreshBooks help save time, reduce errors, and provide valuable insights to make informed business decisions. These tools can optimize processes and enhance productivity for your business.

Can Quickbooks And Freshbooks Integrate With Other Business Tools?

Yes, both QuickBooks and FreshBooks offer integration options with various third-party apps and tools, allowing you to streamline workflows, simplify data management, and enhance the overall efficiency and functionality of your business operations. Integrations can help achieve a seamless operational environment.

Conclusion

QuickBooks and FreshBooks are powerful tools for efficiently managing business finances. Both platforms offer user-friendly interfaces and robust features for invoicing, expense tracking, and financial reporting. By utilizing these tools, businesses can streamline their accounting processes and gain valuable insights into their financial health.

With the right approach, these software solutions can greatly benefit businesses of all sizes.