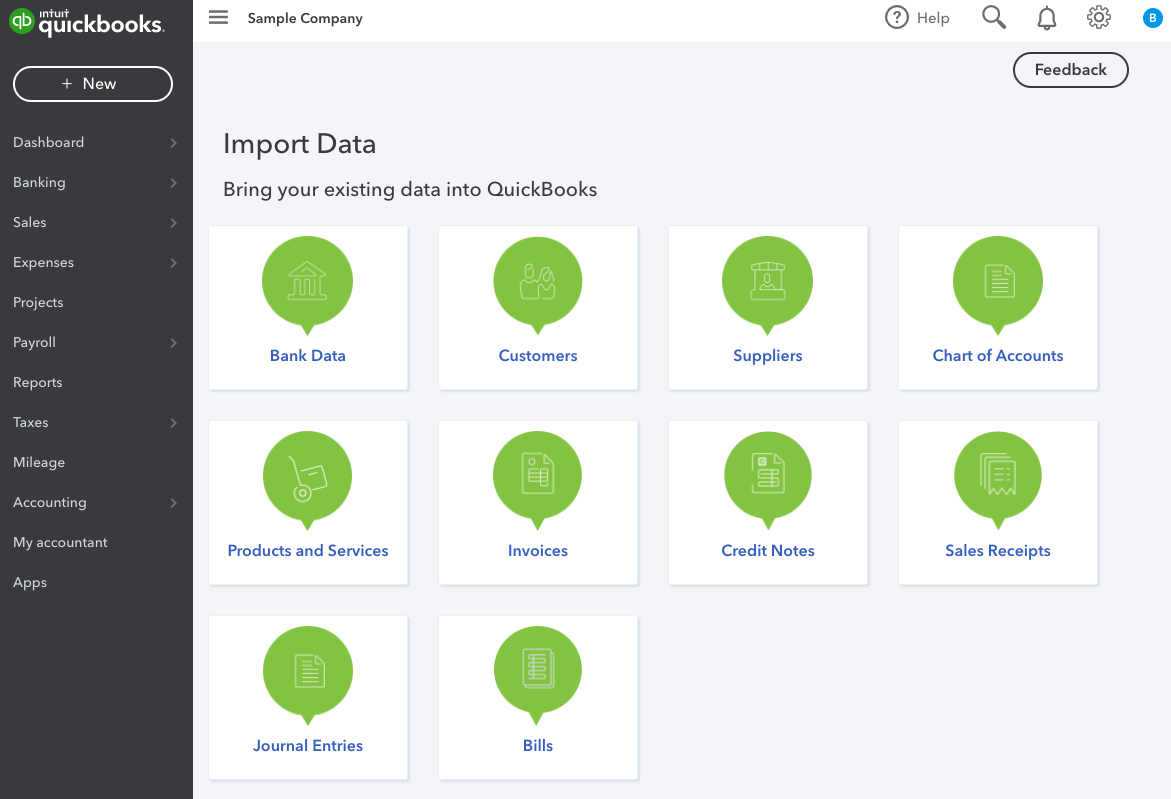

To use QuickBooks Online, first sign up for an account on their website and select a plan that suits your needs. Then, connect your bank accounts, import your data, and customize your settings.

QuickBooks Online is a cloud-based accounting software designed to help individuals and small businesses manage their financial records efficiently. With its user-friendly interface and various features, QuickBooks Online offers an easy way to track income and expenses, create and send invoices, reconcile bank accounts, and generate financial reports.

Whether you are a freelancer, a small business owner, or an accountant, QuickBooks Online can simplify your financial management tasks and save you time and effort. This guide will walk you through the process of using QuickBooks Online, from setting up your account to performing essential tasks. Let’s get started!

Credit: quickbooks.intuit.com

Getting Started With Quickbooks Online

When it comes to managing your small business finances, QuickBooks Online is a powerful tool that can streamline your accounting processes. In this guide, we will walk you through the steps to get you up and running with QuickBooks Online. This will cover creating an account and setting up your business profile to ensure you can make the most of this software.

Creating An Account

Creating an account in QuickBooks Online is the first step toward managing your business finances more efficiently. To get started, visit the QuickBooks Online website and click on the “Sign Up” button. Then, follow the on-screen prompts to enter your personal and business information, including your email, business name, and industry. Once you’ve completed these steps, you’ll have successfully created your QuickBooks Online account and can start setting up your business profile.

Setting Up Your Business Profile

After creating your account, the next step is to set up your business profile in QuickBooks Online. This involves entering your business details such as company name, address, contact information, and bank account details. You’ll also need to set your fiscal year, tax details, and currency preferences. These details are essential for accurate bookkeeping and financial reporting within the platform.

Navigating The Dashboard

Navigating the Dashboard:

Understanding The Home Page

The Home Page in QuickBooks Online serves as the central hub where you can access key features and tools. It provides an overview of your financial data in a user-friendly layout.

Exploring The Navigation Bar

The Navigation Bar is the primary tool for moving around QuickBooks Online. It is located on the left side of the screen and contains various shortcuts to important functions like invoicing, expenses, and reports.

Managing Your Financial Data

Learn effective financial data management with Quickbooks Online. Simplify tracking expenses, invoicing clients, and monitoring profits effortlessly. Enhance your business’s financial organization and make informed decisions with this user-friendly online tool.

Managing your financial data is crucial for the success of your business. By keeping a close eye on your income, expenses, sales, and tax payments, you can make informed decisions that will contribute to your company’s growth. Quickbooks Online is a powerful tool that can help you easily track and manage all these aspects of your business. In this section, we will explore how to effectively record income and expenses, as well as track sales and tax payments using Quickbooks Online.Recording Income And Expenses

To ensure accurate financial reporting, it’s essential to record all income and expenses correctly. With Quickbooks Online, this task becomes a breeze. Follow these steps to record your income and expenses:- Go to the “Transactions” tab in Quickbooks Online.

- Select “Sales” to record your income or “Expenses” to record your expenses.

- Provide all the necessary details, such as the date, payee, and category.

- Attach any relevant documents, such as invoices or receipts.

- Save your transaction, and it will be automatically recorded in your financial statements.

Tracking Sales And Tax Payments

Keeping track of your sales and tax payments is crucial to meeting your financial obligations and staying compliant. Quickbooks Online simplifies this process by allowing you to easily track your sales and tax payments. Here’s how:- Navigate to the “Sales” tab in Quickbooks Online.

- Under “Customers,” choose “Invoice” to create a sales invoice or “Sales Receipt” to record a sale without an invoice.

- Fill in the necessary details, such as the customer name, product or service sold, and the amount.

- Save your sales transaction, and it will be reflected in your sales reports.

- Go to the “Taxes” tab in Quickbooks Online.

- Select “Manage Tax Payments” to input your tax payment details.

- Enter the information related to your tax payment, such as the tax authority, payment date, and amount.

- Save your payment, and it will be automatically tracked in your tax reports.

Utilizing Reports And Insights

Utilizing Reports and Insights is a critical aspect of managing your business effectively. QuickBooks Online provides robust capabilities for generating financial reports and gaining valuable insights into your business’s performance. By leveraging these features, you can make informed decisions, assess your financial health, and strategize for growth. Let’s explore how you can harness the power of QuickBooks Online’s reporting and insights functionalities.

Generating Financial Reports

Financial reports offer a comprehensive snapshot of your business’s financial position, helping you understand your income, expenses, and overall profitability. QuickBooks Online makes it incredibly easy to generate these reports with just a few clicks.

To generate a financial report, simply navigate to the “Reports” tab in the QuickBooks Online dashboard. From there, you can select the specific report you need, such as the profit and loss statement, balance sheet, cash flow statement, or aged receivables report. These reports provide a clear overview of where your business stands financially, allowing you to identify areas for improvement or areas of strength.

Additionally, QuickBooks Online allows you to customize your financial reports to suit your specific needs. You can filter the data based on date ranges, choose which accounts to include or exclude, and even add your own branding elements. This flexibility empowers you to tailor reports according to your unique business requirements.

Gaining Business Insights

While financial reports offer a retrospective view of your business, gaining insights goes beyond numbers and delves into the underlying factors that drive your success or hinder your growth. QuickBooks Online provides a range of tools and features to help you gain invaluable business insights.

One way to gain insights is by utilizing the “Insights” tab within QuickBooks Online. This feature presents visual representations of your financial data, such as charts and graphs, making it easier to identify trends, patterns, and anomalies. These visualizations can give you a quick understanding of how your business is performing and provide a basis for making data-driven decisions.

Another powerful tool is the “Company Snapshot” feature, which offers a consolidated view of key metrics and performance indicators. This snapshot provides a summary of your business’s financial health, including your current bank balances, income and expense trends, and key ratios like profit margin and inventory turnover. With this information at your fingertips, you can quickly assess your business’s overall performance and identify areas requiring attention or improvement.

Furthermore, QuickBooks Online enables you to track and categorize your expenses and income in real-time. By regularly reviewing these transactions, you can identify patterns and trends, spot areas for cost-cutting, and make informed decisions about budgeting and pricing strategies. This level of granularity ensures you have a comprehensive understanding of your revenue streams and cost structure.

Customizing Settings And Preferences

When using Quickbooks Online, you can tailor the platform to suit your specific needs by adjusting account settings and personalizing user preferences.

Adjusting Account Settings

In Quickbooks Online, navigate to settings and customize your account to align with your business requirements.

- Update company information for accurate reporting.

- Set up sales tax preferences for compliance.

- Configure default accounts for streamlined transactions.

Personalizing User Preferences

Each user can personalize their Quickbooks experience by adjusting individual preferences.

- Modify dashboard settings for a personalized view.

- Customize notifications to stay informed.

- Choose language and date format preferences.

Collaborating With Your Accountant

When it comes to managing your business finances, having a good relationship with your accountant is crucial. QuickBooks Online makes it easy to collaborate with your accountant, allowing you both to access and share financial information in a secure and efficient manner. In this article, we will explore two key aspects of collaborating with your accountant using QuickBooks Online: inviting your accountant and sharing financial information.

Inviting Your Accountant

Inviting your accountant to collaborate with you on QuickBooks Online is a simple process that can be done in just a few steps. Once you have created your QuickBooks Online account, follow these instructions to invite your accountant:

- Login to your QuickBooks Online account.

- Click on the “Gear” icon located on the top right corner of the screen.

- From the drop-down menu, select “Manage Users”.

- Click on the “Accounting firms” tab.

- Click on the “Invite Accountant” button.

- Enter your accountant’s email address and click “Next”.

- Select the access rights you want to grant to your accountant. QuickBooks Online offers different levels of access, such as “Full Access”, “Accounting”, “Reports only”, etc.

- Click “Invite” to send the invitation to your accountant.

Once your accountant accepts the invitation, they will be able to access your QuickBooks Online account and work on your financial records. It’s important to choose an accountant you trust and maintain clear communication throughout your collaboration.

Sharing Financial Information

QuickBooks Online provides various tools that make sharing financial information with your accountant a breeze. By granting appropriate access rights, you can ensure that your accountant has all the necessary information to provide accurate and timely advice. Here are a few ways to efficiently share financial information using QuickBooks Online:

- Reports: QuickBooks Online allows you to generate a wide range of reports that provide valuable insights into your business’s financial health. You can easily share these reports with your accountant by exporting them in common file formats such as PDF or Excel.

- Bank Feeds: With QuickBooks Online’s bank feeds feature, you can automatically import and categorize your bank transactions. This enables your accountant to have real-time access to your financial data, making it easier for them to reconcile accounts and identify any discrepancies.

- Collaboration Tools: QuickBooks Online offers built-in collaboration tools that allow you to communicate and exchange messages with your accountant directly within the platform. This makes it convenient to ask questions, share important updates, and keep track of your conversations.

By leveraging the collaboration features of QuickBooks Online, you can streamline your communication with your accountant and ensure that they have all the necessary information to provide valuable financial insights and support.

Integrating Third-party Apps

QuickBooks Online is a powerful accounting software that offers a range of features to help businesses manage their finances effectively. One of the most valuable aspects of QuickBooks Online is its ability to integrate with third-party apps, allowing users to streamline workflows and optimize productivity. By exploring app integration options, businesses can unlock a world of possibilities to enhance their accounting processes. In this article, we will delve into the benefits of integrating third-party apps with QuickBooks Online and how it can contribute to streamlining workflows.

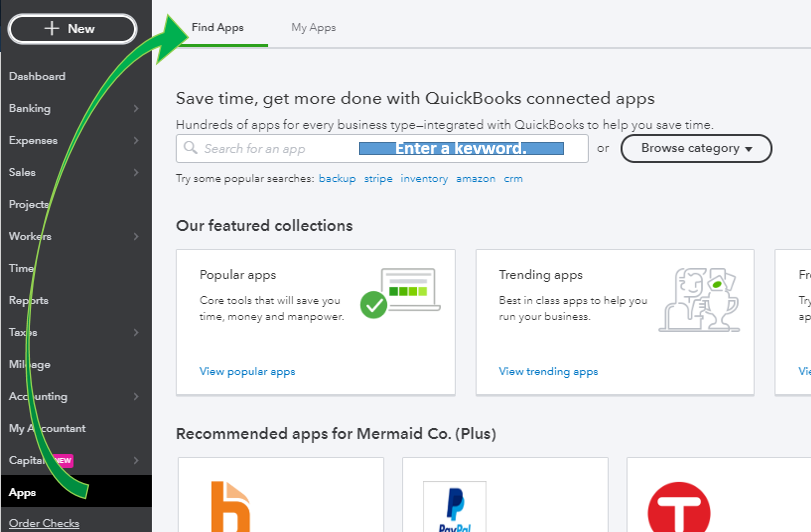

Exploring App Integration Options

QuickBooks Online provides a wide array of options for integrating various third-party apps. Whether you need to connect e-commerce platforms, payment gateways, customer relationship management (CRM) systems, or time-tracking tools, there’s a solution that fits your business needs. Take advantage of QuickBooks Online’s built-in app marketplace, where you can discover and install apps that seamlessly integrate with your accounting software.

When exploring app integration options, consider the specific needs of your business. Are you looking to automate data entry, enhance payment processing, or improve inventory management? Assessing your requirements will help you narrow down the selection of apps that are most suited for your operations.

Streamlining Workflows

Integrating third-party apps with QuickBooks Online can significantly streamline your business workflows, saving you time and reducing human errors. By automating tasks and synchronizing data between different systems, you can eliminate the need for duplicate data entry and manual reconciliations.

For example, integrating your e-commerce platform with QuickBooks Online can automatically transfer sales orders, customer information, and inventory data. This integration ensures that your financial records are always up-to-date, reducing the chances of errors and discrepancies. Similarly, integrating a time-tracking app can accurately capture employee hours and seamlessly import them into QuickBooks Online for payroll processing.

- Automate data entry and synchronize information between systems.

- Eliminate the need for duplicate data entry and manual reconciliations.

- Minimize human errors and ensure data consistency.

- Save time and increase productivity.

By leveraging the power of third-party app integration, businesses can optimize their accounting processes, improve efficiency, and gain a competitive edge. Take the time to explore and implement the right apps that align with your specific needs, and watch as your workflows become more streamlined, accurate, and productive.

Credit: tech.co

Maximizing Efficiency With Shortcuts And Tips

Discover how to streamline your Quickbooks Online experience through effective keyboard shortcuts and time-saving data entry techniques.

Keyboard Shortcuts For Quick Navigation

Quickly navigate through Quickbooks Online with these handy keyboard shortcuts:

- Ctrl + Alt + C: Create a new client profile

- Ctrl + Alt + I: Access your invoices instantly

- Ctrl + Alt + V: View your vendor list with ease

Time-saving Tips For Data Entry

Optimize your data entry process with these effective strategies:

- Use Auto-fill: Let Quickbooks Online predict your entries

- Set Default Settings: Customize default preferences for faster input

- Batch Transactions: Input multiple transactions in one go

Credit: floatapp.com

Frequently Asked Questions Of How To Use Quickbooks Online

What Is The Best Way To Learn Quickbooks Online?

The best way to learn QuickBooks Online is to take advantage of its official tutorials and training resources. Additionally, consider enrolling in online courses or seeking help from certified QuickBooks experts. Practice using the software regularly for hands-on experience.

How Does Quickbooks Online Work?

QuickBooks Online tracks expenses, creates invoices, manages cash flow, and offers financial reports. Users can access it from anywhere with an internet connection. It integrates with other apps, automates tasks, and provides real-time insights for business management.

Why Do Accountants Not Like Quickbooks Online?

Accountants may not like QuickBooks Online due to limited customization options and complex reporting functions.

Is Quickbooks Online Easy To Use?

Yes, QuickBooks Online is easy to use. It offers a user-friendly interface and intuitive features that make managing finances and bookkeeping simple. Users can easily navigate through its functions and perform tasks without any technical expertise.

Conclusion

Streamline your finances with QuickBooks Online for efficient bookkeeping and financial management. Invest in simplicity and accuracy to boost your business success. Take advantage of its user-friendly features and enjoy the benefits of organized data and insightful reporting. Get started today and watch your business thrive.